Missouri Lien and Tax Search Checklist

Description

How to fill out Lien And Tax Search Checklist?

If you need to comprehensive, down load, or produce legitimate papers web templates, use US Legal Forms, the greatest selection of legitimate forms, which can be found online. Make use of the site`s simple and practical lookup to obtain the paperwork you want. A variety of web templates for business and personal reasons are categorized by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Missouri Lien and Tax Search Checklist in just a handful of clicks.

Should you be currently a US Legal Forms consumer, log in to your bank account and click the Acquire option to find the Missouri Lien and Tax Search Checklist. You can also entry forms you formerly delivered electronically within the My Forms tab of the bank account.

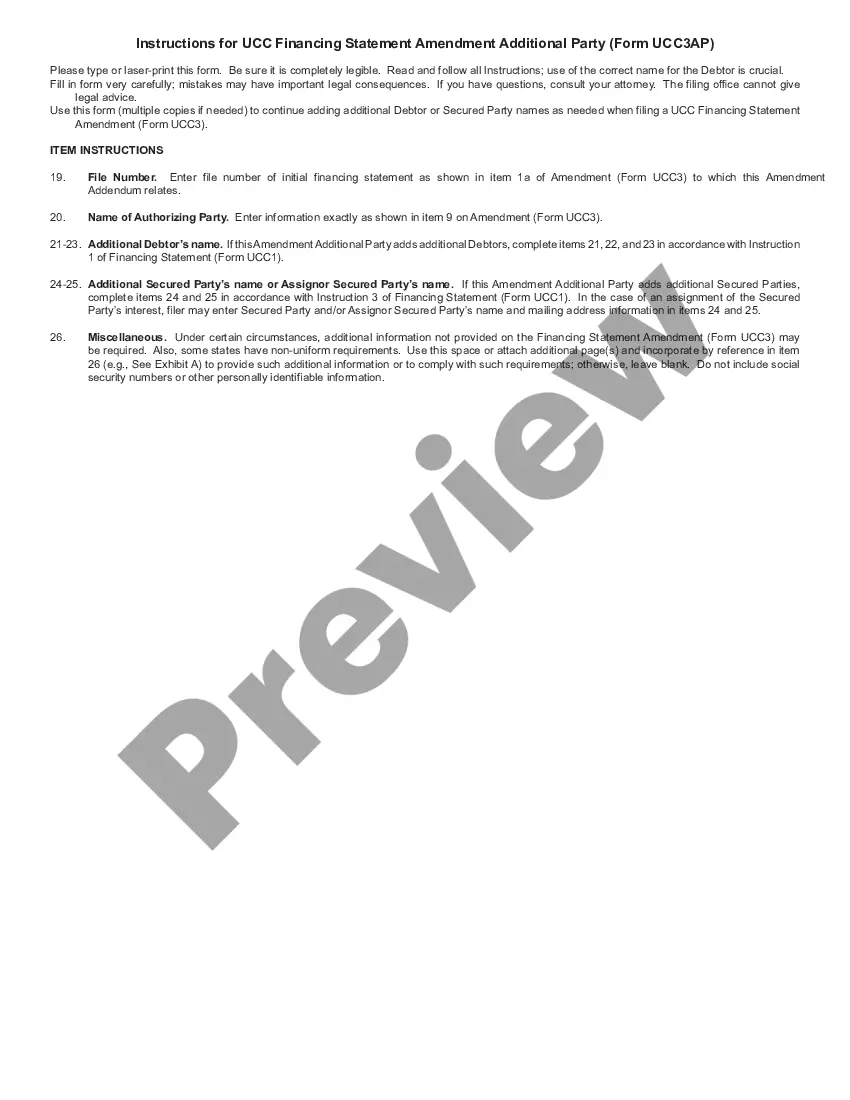

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for that right town/land.

- Step 2. Take advantage of the Review solution to look through the form`s information. Don`t forget about to see the explanation.

- Step 3. Should you be not satisfied with the form, take advantage of the Research field at the top of the display to get other versions of the legitimate form design.

- Step 4. Upon having found the form you want, go through the Buy now option. Opt for the pricing strategy you prefer and put your qualifications to sign up to have an bank account.

- Step 5. Approach the deal. You may use your credit card or PayPal bank account to perform the deal.

- Step 6. Select the structure of the legitimate form and down load it in your gadget.

- Step 7. Total, revise and produce or sign the Missouri Lien and Tax Search Checklist.

Each legitimate papers design you buy is the one you have permanently. You may have acces to each and every form you delivered electronically with your acccount. Select the My Forms area and select a form to produce or down load yet again.

Be competitive and down load, and produce the Missouri Lien and Tax Search Checklist with US Legal Forms. There are many specialist and status-specific forms you can use for the business or personal demands.

Form popularity

FAQ

Liens. Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years total).

O If the lienholder is an individual, a notice of release (lien release section of DOR-4809) must be completed, signed, and notarized. An estate executor may release the lien by submitting the above with an original or certified copy of the probate court order. information is legible.

Notice of Intent to Lien 10 days prior to filing lien. Written consent from residential owner before work. Lien must be filed within 6 months of last work. An action to enforce a Missouri mechanics lien must be initiated within 6 months from filing.

Unless sooner released or discharged, the lien shall expire ten years after the certificate of lien was filed, unless within such ten-year period, the certificate of lien has been refiled by the director of revenue with the recorder.

Almost all Missouri counties, other than Jackson County and St. Louis City, sell tax liens.

Please contact the circuit clerk or the recorder of deeds in the county in which the lien was filed to receive official information concerning the lien.

To search for a lien filed by the Missouri Department of Revenue you may access or contact your county Record of Deeds office. If you are inquiring about motor vehicle tax liens Ask Motor Vehicle!