This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

Missouri Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms that is accessible online.

Take advantage of the site's user-friendly and efficient search feature to discover the documents you need.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Every legal document template you purchase is yours for an extended period. You will have access to all forms you downloaded in your account. Visit the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Missouri Form of Accounting Index with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to find the Missouri Form of Accounting Index in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to locate the Missouri Form of Accounting Index.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

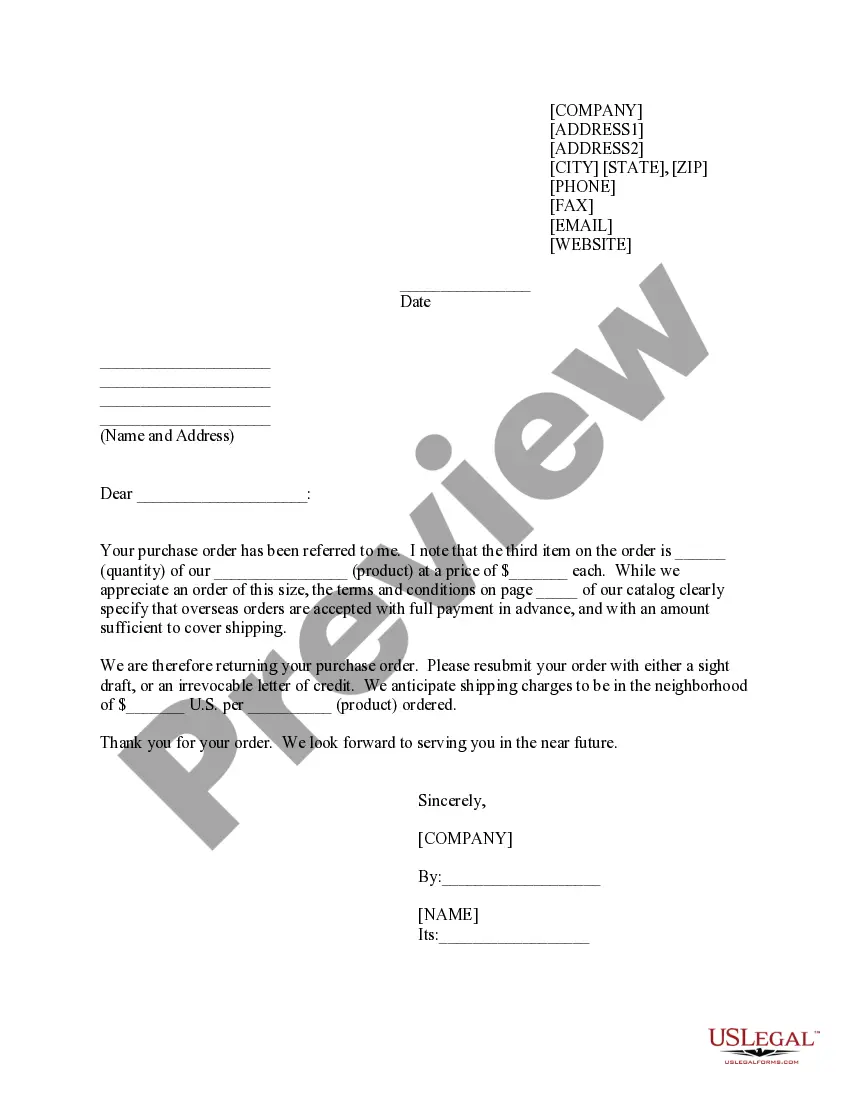

- Step 2. Utilize the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you want, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Missouri Form of Accounting Index.

Form popularity

FAQ

The three golden rules of accounting are crucial for maintaining accurate records. First, debit what comes in, credit what goes out; second, debit all expenses and losses, credit all income and gains; and third, in the case of personal accounts, debit the receiver and credit the giver. Following these rules will enhance your understanding of your Missouri Form of Accounting Index.

Structuring your chart of accounts requires careful planning to reflect your business's operational flow. Start with broad categories, then break them down into sub-accounts for detailed tracking. This hierarchical structure helps you manage finances effectively and allows for a more precise Missouri Form of Accounting Index representation.

You can find your Missouri tax employer account number in several ways. Check your business registration documents or any correspondence from the Missouri Department of Revenue. Alternatively, you can call their office for assistance. Having this number is important for tax reporting and is linked to your Missouri Form of Accounting Index.

Filling out a chart of accounts involves entering each account with its unique number and name. Ensure that you categorize each account under the correct type, such as assets or expenses. Use clear, descriptive names to avoid confusion. An effective chart of accounts will streamline your accounting processes and enhance the accuracy of your Missouri Form of Accounting Index.

To prepare your chart of accounts, start by listing all the categories of your business transactions. Consider the different areas like assets, liabilities, equity, income, and expenses. Once you outline these categories, assign unique numbers to each account for easy identification. This well-prepared chart of accounts is essential for maintaining an organized Missouri Form of Accounting Index.

To claim the Missouri Pass-Through Entity (PTE) credit, you need to fill out the appropriate forms when filing your tax return. Attach the PTE certificate to your return, detailing your share of credit from the entity. The Missouri Form of Accounting Index can be a key tool in helping you understand the steps and forms needed to ensure a successful claim. Make sure you check the latest regulations regarding the credit.

You should file your Missouri PTE form with the Missouri Department of Revenue. The mailing address typically appears on the form itself. By using the Missouri Form of Accounting Index, you can confirm the current filing location and related requirements. This resource provides the necessary guidance to keep your submission on track.

The Missouri Pass-Through Entity (PTE) form is used by partnerships and S corporations to report income, gains, and losses to the state. This form helps ensure proper tax handling between individual partners or shareholders. For additional clarity and ease of use, consult the Missouri Form of Accounting Index. It contains detailed information on how to fill out the form correctly.

Yes, you can file the Missouri Pass-Through Entity (PTE) forms electronically. The Missouri Department of Revenue allows e-filing for PTE forms to streamline tax filing. Using the Missouri Form of Accounting Index can direct you to the exact forms and procedures needed for electronic submission. This method ensures a faster and more secure filing process.

Yes, you can file your Missouri state taxes online through various e-filing services approved by the Missouri Department of Revenue. Make sure to use recognized platforms, as they often guide you through the entire filing process. By leveraging the Missouri Form of Accounting Index, you can easily find the appropriate resources and relevant forms to complete your filing accurately and efficiently.