Missouri Self-Employed Animal Exercise Services Contract

Description

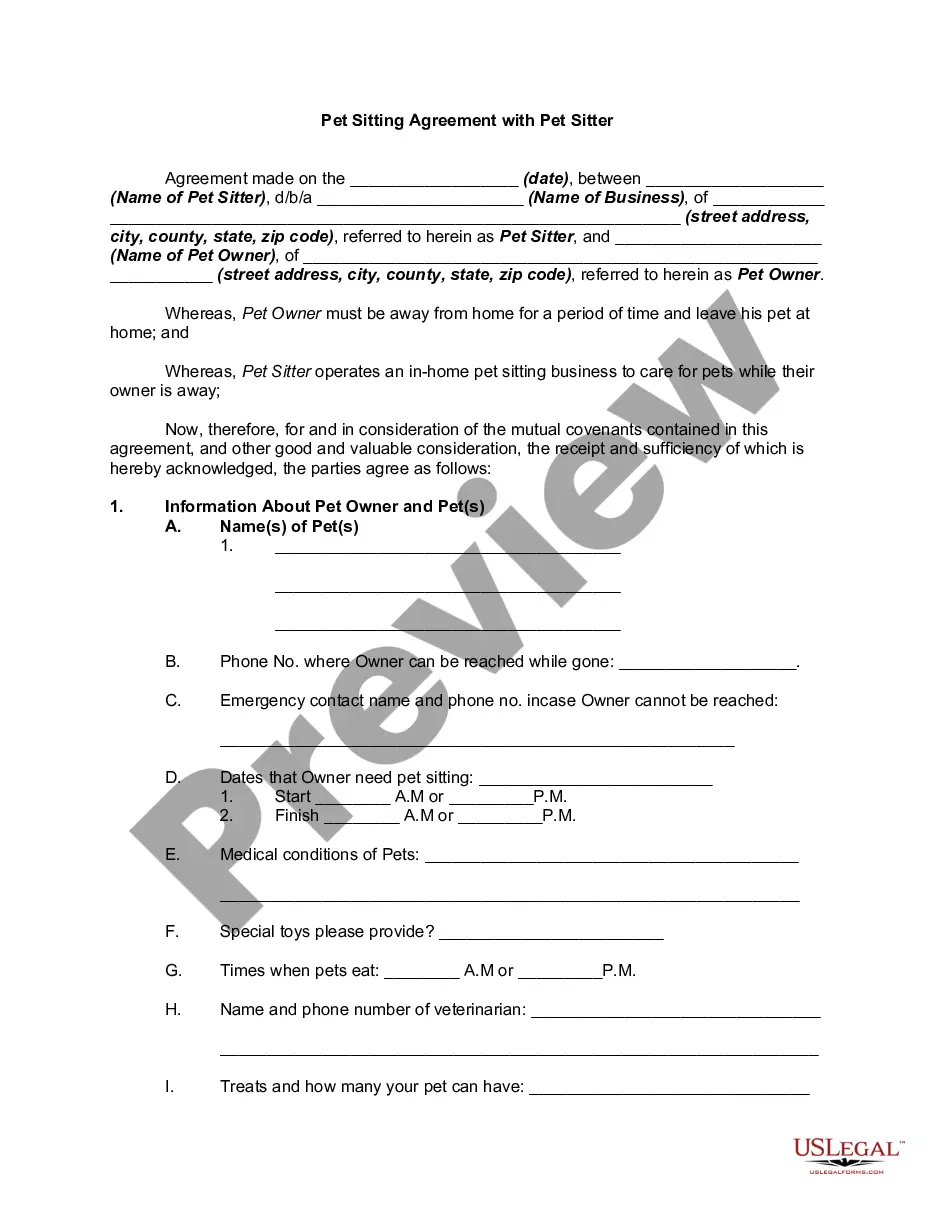

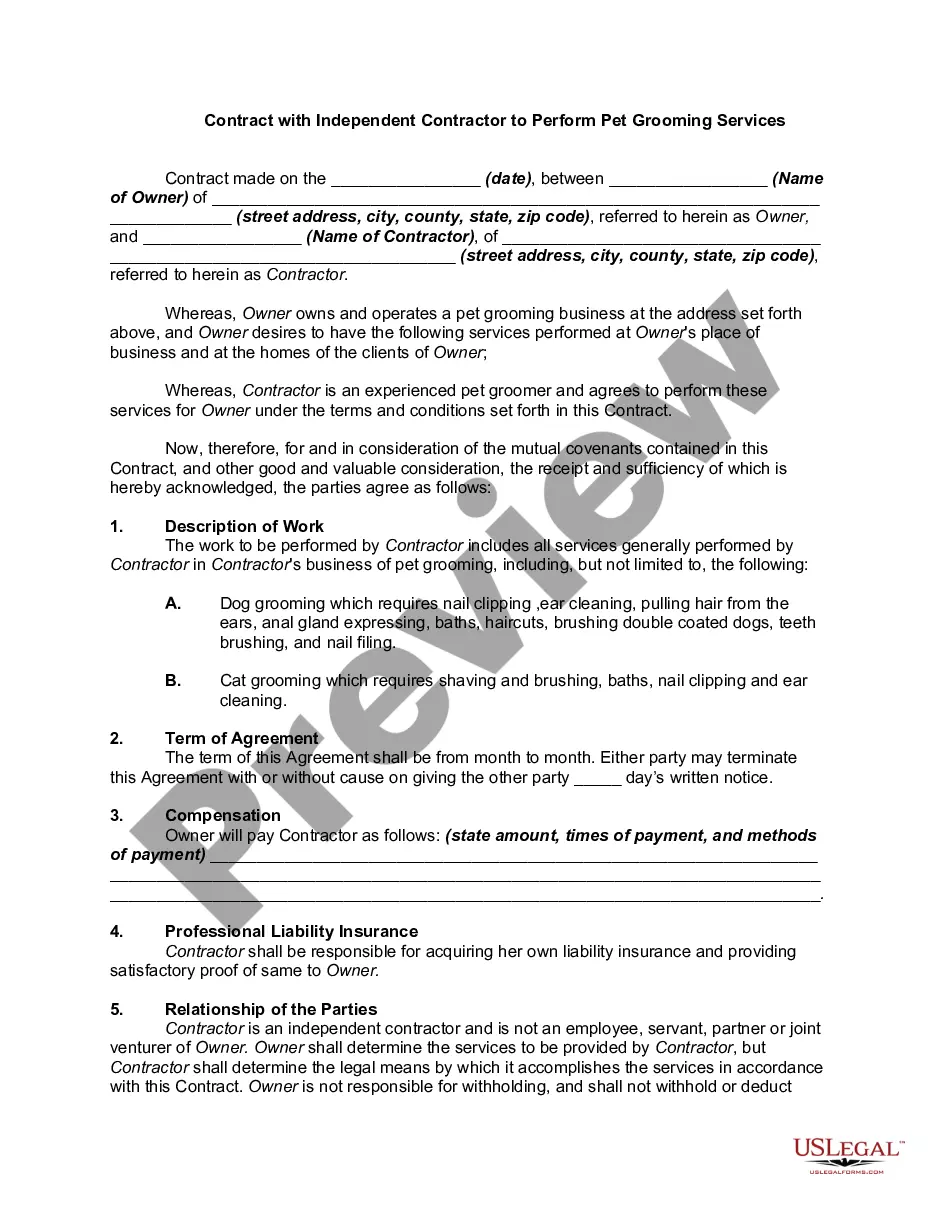

How to fill out Self-Employed Animal Exercise Services Contract?

If you wish to total, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are available online.

Employ the site’s user-friendly and straightforward search to locate the documents you require. A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Use US Legal Forms to find the Missouri Self-Employed Animal Exercise Services Contract within a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Missouri Self-Employed Animal Exercise Services Contract with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Missouri Self-Employed Animal Exercise Services Contract.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of your legal document template.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Missouri Self-Employed Animal Exercise Services Contract.

Form popularity

FAQ

The Animal Care Facilities Act in Missouri sets standards for the care and treatment of animals in various facilities. This act ensures that animals receive adequate food, water, and shelter. For those involved in animal-related services, understanding the Missouri Self-Employed Animal Exercise Services Contract can provide insight into compliance with this act.

A landlord in Missouri can deny an ESA if the request violates specific regulations or if the animal poses a direct threat. However, they must have a valid reason and cannot deny an ESA based solely on breed or size. The Missouri Self-Employed Animal Exercise Services Contract can clarify your rights and help you advocate for your ESA.

Starting an animal rescue in Missouri generally requires specific licenses and permits. Regulations vary depending on your location and the scale of your operation. Consulting the Missouri Self-Employed Animal Exercise Services Contract can help you understand the necessary legal requirements for establishing an animal rescue.

Landlords may verify ESA letters, but they must be careful to respect your privacy and rights. Typically, they can only request to see documentation that confirms your need for an ESA. The Missouri Self-Employed Animal Exercise Services Contract provides guidance on ensuring your ESA is recognized appropriately.

Missouri recognizes emotional support animals under the Fair Housing Act, allowing individuals to have ESAs in housing situations. This recognition includes the right to request reasonable accommodations from landlords. Understanding the Missouri Self-Employed Animal Exercise Services Contract will help you navigate these legal aspects effectively.

Yes, a landlord can deny an ESA if they have legitimate reasons. However, they must comply with the Fair Housing Act when handling ESA requests. Utilizing the Missouri Self-Employed Animal Exercise Services Contract can clarify your position and ensure that your rights are protected.

In Missouri, Emotional Support Animals (ESAs) provide comfort and support to individuals with mental health conditions. Under the Fair Housing Act, individuals with a valid ESA letter can request reasonable accommodations in housing. The Missouri Self-Employed Animal Exercise Services Contract may help you understand your rights and responsibilities regarding ESAs.

Yes, you can sell meat from your farm in Missouri, but there are specific regulations you must follow. You will need to ensure that your farm complies with state and federal guidelines for meat processing and sales. Additionally, having a Missouri Self-Employed Animal Exercise Services Contract can help clarify your responsibilities and rights in these transactions. For further assistance, consider using the US Legal Forms platform to access the right contracts and resources.

The main points of the Animal Welfare Act include provisions for humane care, treatment, and transportation of animals. It mandates regular inspections and establishes penalties for violations. For anyone providing animal exercise services, familiarizing yourself with these key points can enhance your Missouri Self-Employed Animal Exercise Services Contract, ensuring you uphold the highest standards of care.

An animal care facility is any establishment that houses, cares for, or provides services to animals. These facilities can include shelters, veterinary clinics, and boarding kennels. When creating a Missouri Self-Employed Animal Exercise Services Contract, it is important to understand how these facilities operate and the standards they must meet to ensure animal welfare.