Missouri Self-Employed Seasonal Picker Services Contract

Description

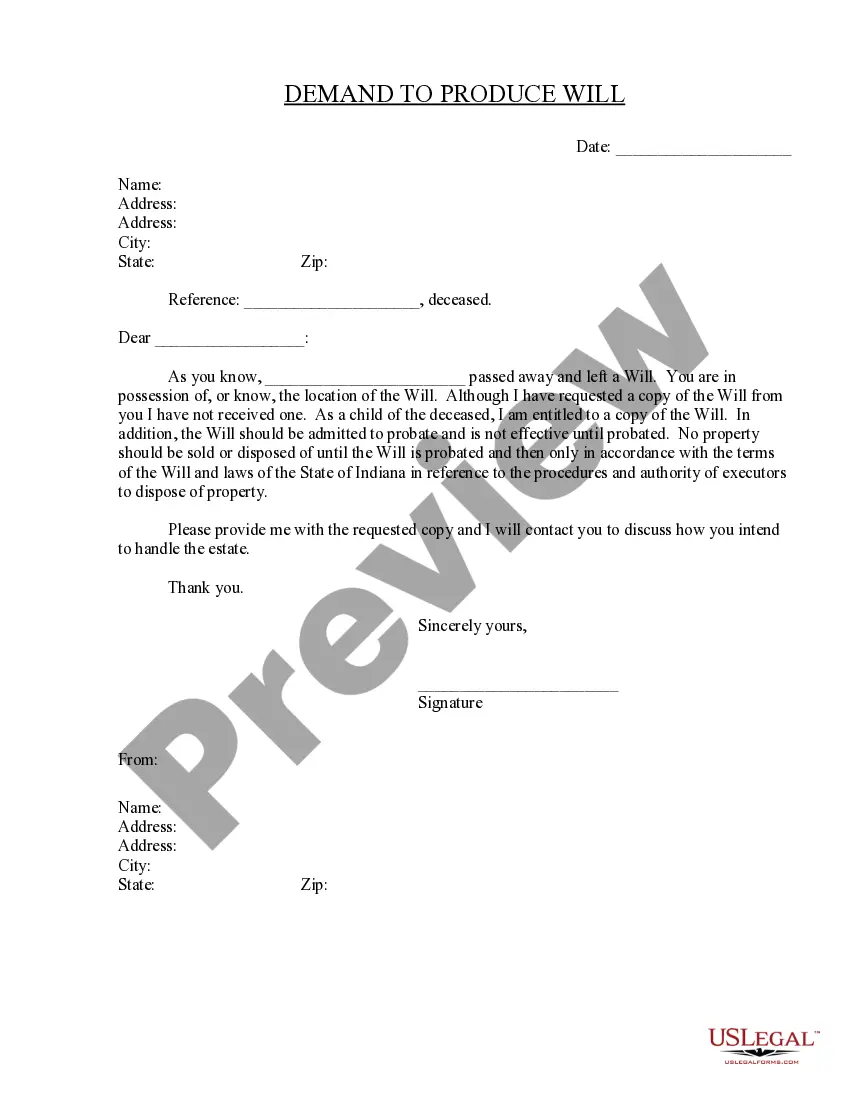

How to fill out Self-Employed Seasonal Picker Services Contract?

You might spend numerous hours online trying to locate the legal document template that fulfills the state and federal requirements you desire.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

It is easy to obtain or print the Missouri Self-Employed Seasonal Picker Services Contract from your account.

If available, use the Preview button to view the document template as well. If you wish to obtain an additional version of your form, use the Search field to find the template that meets your needs and requirements. Once you have located the template you need, click Get now to proceed. Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Select the format of your document and download it to your device. Make adjustments to your document if necessary. You can fill out, modify, and sign and print the Missouri Self-Employed Seasonal Picker Services Contract. Download and print numerous document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Missouri Self-Employed Seasonal Picker Services Contract.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the document details to confirm you have chosen the right form.

Form popularity

FAQ

To write a self-employment contract, start by detailing the services you will provide and the payment structure. Include terms related to duration, confidentiality, and termination. Utilizing the Missouri Self-Employed Seasonal Picker Services Contract can streamline this process and ensure compliance with state laws.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. Ensure that it includes essential elements such as an offer, acceptance, consideration, and the signatures of both parties. The Missouri Self-Employed Seasonal Picker Services Contract can serve as a great template for your self-employment agreements.

To find government contracts to bid on, check websites like FedBizOpps and local government procurement sites. These platforms list various contracting opportunities across different sectors. If you're interested in seasonal work, look for options that align with the Missouri Self-Employed Seasonal Picker Services Contract.

Writing a contract for a 1099 employee involves outlining the job responsibilities, payment terms, and any specific deadlines. It is crucial to specify that the worker is an independent contractor and not an employee. Using the Missouri Self-Employed Seasonal Picker Services Contract can help clarify these terms and uphold legal standards.

To write a simple employment contract, start with the names of both parties and the date. Clearly state the job title, responsibilities, and payment details. Including terms for termination and confidentiality can also be beneficial, especially in a Missouri Self-Employed Seasonal Picker Services Contract.

The Missouri employment contract outlines the terms and conditions between an employer and employee. This document details the job responsibilities, compensation, and duration of employment. If you are a self-employed seasonal picker, consider using the Missouri Self-Employed Seasonal Picker Services Contract for clarity and legal protection.

To write a self-employed contract, start by clearly defining the scope of work, including specific tasks and deliverables. Include details such as payment terms, deadlines, and any necessary permits or licenses. Finally, ensure both parties sign the Missouri Self-Employed Seasonal Picker Services Contract to make it legally binding.

Writing a contract agreement for services involves outlining the scope of work, payment terms, and duration of the contract. For a Missouri Self-Employed Seasonal Picker Services Contract, you should include specific details relevant to the seasonal work. Utilizing platforms like uslegalforms can simplify this process, providing templates and guidance to ensure your contract is comprehensive and legally sound.

Seasonal contracts function by establishing a specific timeframe for employment, typically aligned with peak business periods. For the Missouri Self-Employed Seasonal Picker Services Contract, this means defining project timelines, deliverables, and payment terms. Such contracts help both employers and employees understand their roles and expectations, ensuring clarity throughout the season.

Seasonal employees may have the opportunity to transition into permanent roles, but this is not guaranteed. The Missouri Self-Employed Seasonal Picker Services Contract typically focuses on temporary needs, so it's essential for workers to demonstrate their value during the season. If a business sees a consistent need for their skills, they may consider offering a permanent position.