Missouri Survey Assistant Contract - Self-Employed

Description

How to fill out Survey Assistant Contract - Self-Employed?

If you wish to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the foremost collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the Missouri Survey Assistant Contract - Self-Employed in just a few clicks.

Every legal document template you acquire is yours indefinitely. You can access every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

Compete and acquire, and print the Missouri Survey Assistant Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to download the Missouri Survey Assistant Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

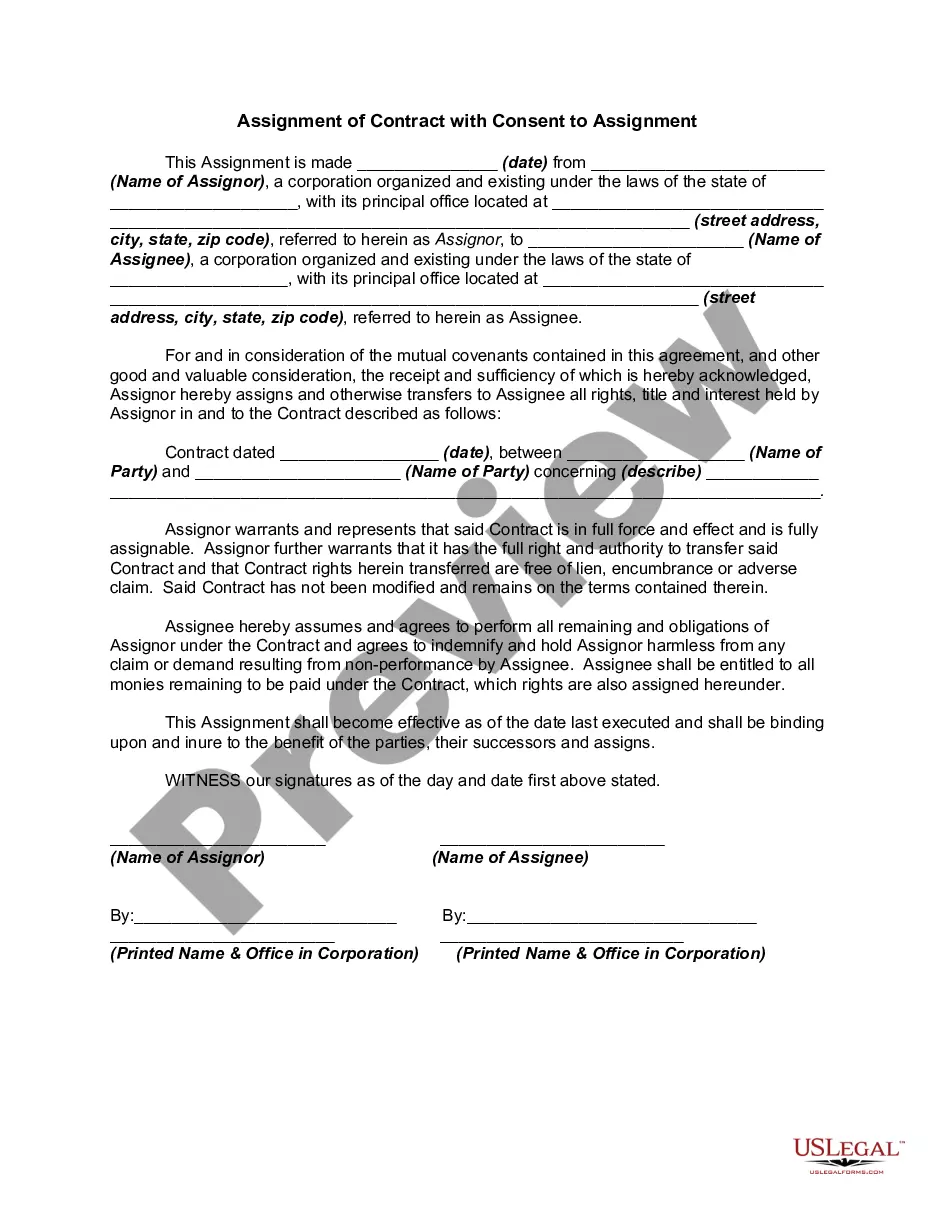

- Step 2. Use the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Missouri Survey Assistant Contract - Self-Employed.

Form popularity

FAQ

The Missouri Department of Revenue is overseen by the Director of Revenue, who reports directly to the Governor of Missouri. This leadership plays a crucial role in shaping tax policy and revenue generation strategies. For self-employed professionals using the Missouri Survey Assistant Contract - Self-Employed, understanding this oversight can provide insights into regulatory changes and compliance practices.

To file a complaint with the Missouri Department of Revenue, visit their website and fill out the designated complaint form. Make sure you include all relevant details for a prompt review. Also, if you are operating under the Missouri Survey Assistant Contract - Self-Employed, you will want to ensure your legal rights are protected during this process.

If you feel the Missouri Department of Revenue has acted unfairly, you can file a complaint through their official channels. Start by gathering necessary documentation and clearly outlining your issue. For assistance, users of the Missouri Survey Assistant Contract - Self-Employed can benefit from legal forms that help structure their complaints effectively.

The Missouri Department of Revenue manages the collection of taxes and revenue for the state. It oversees vehicle registration, licensing, and tax assessments to ensure compliance with state laws. For those engaged with services like the Missouri Survey Assistant Contract - Self-Employed, understanding these responsibilities is key for accurate reporting and compliance.

A virtual assistant is an independent contractor who provides administrative services to clients while operating outside of the client's office. A virtual assistant typically operates from a home office but can access the necessary planning documents, such as shared calendars, remotely.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.

To qualify, individuals must 1) have earned at least $5,000 in self-employment income in the most recent taxable year before they applied for regular unemployment, 2) submit documentation substantiating their self-employment income, and 3) must be receiving benefits from regular unemployment, Pandemic Emergency

Recently, one client inquired, Can my assistant be an independent contractor? The short answer is NO. Under current law, there are no circumstances under which someone who is an assistant should be classified as an independent contractor.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Unemployment compensation under the PUA program provides for up to 39 weeks of benefits for individuals who are self-employed (including independent contractors). Unemployment compensation benefits are available for individuals for weeks of unemployment beginning on or after Jan. 27, 2020 through Dec. 31, 2020.