Missouri Campaign Worker Agreement - Self-Employed Independent Contractor

Description

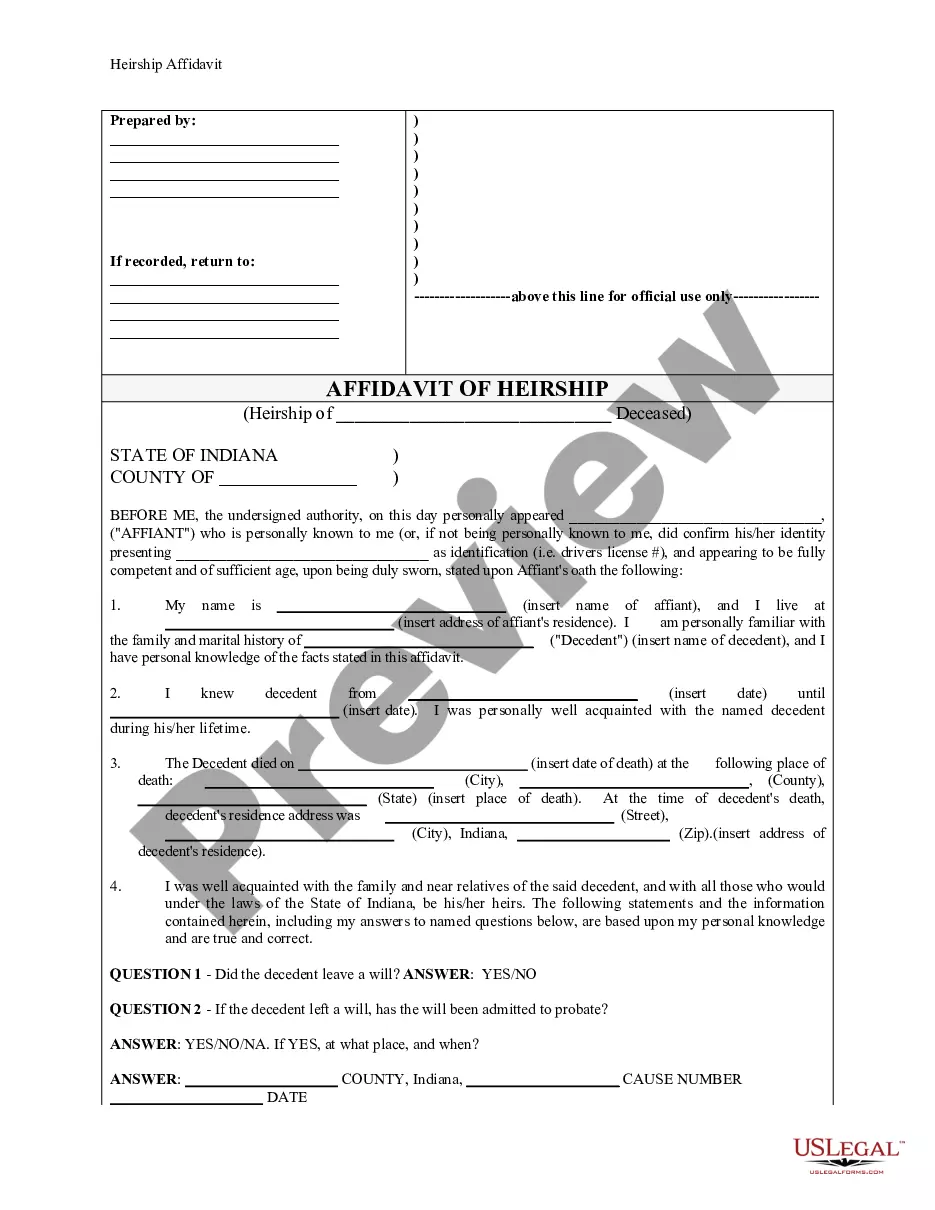

How to fill out Campaign Worker Agreement - Self-Employed Independent Contractor?

If you desire to be thorough, acquire, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms, which can be accessed online.

Take advantage of the site's straightforward and convenient search to find the documents you require. Numerous templates for business and personal uses are organized by categories and states, or keywords.

Use US Legal Forms to access the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to each form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download and print the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Indeed, an independent contractor is classified as self-employed. This arrangement allows you to manage your business independently and establish your own terms of work. Therefore, when you enter into agreements like the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor, you affirm your role as self-employed, benefiting from greater control and freedom.

To prove your status as an independent contractor, you can use various documents like contracts, invoices, and tax returns. These items demonstrate your work arrangements and income flow. Services like USLegalForms can help you easily create the necessary documentation for your Missouri Campaign Worker Agreement - Self-Employed Independent Contractor.

Being self-employed means you run your own business and do not work as an employee for someone else. It typically includes freelancers, independent contractors, and business owners. Therefore, if you are engaging in a Missouri Campaign Worker Agreement - Self-Employed Independent Contractor, you automatically qualify as self-employed.

Yes, an independent contractor is considered self-employed. When you work as an independent contractor, you operate your own business and hire your own clients. This status gives you greater flexibility in your work arrangements, which can be particularly beneficial when entering agreements like the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form requires clear and accurate information about the work arrangement. Begin with your personal details, including name and address, and then describe the services you will provide. Provide payment details, including rates and methods of payment. Using a form specifically designed for the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor can guide you in ensuring all necessary information is included.

Writing an independent contractor agreement involves several key components. Start with the title and date, followed by details about the parties, scope of work, payment terms, and duration of the contract. Finally, ensure that both parties sign and date the agreement. For added convenience, consider using a pre-prepared template like the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor available on USLegalForms.

The terms 'self-employed' and 'independent contractor' can often be used interchangeably, but there are subtle differences. An independent contractor typically works under a specific agreement for a client, while self-employed individuals may run their own businesses. It’s essential to use the term that best describes your work arrangement, especially when filling out a Missouri Campaign Worker Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, you should start by clearly stating the names and contact information of both parties involved. Next, outline the scope of work and include any specific deadlines or deliverables. Don’t forget to include payment terms, such as how and when the contractor will be compensated. Using the Missouri Campaign Worker Agreement - Self-Employed Independent Contractor template from USLegalForms can simplify this process.

The new federal rule on independent contractors focuses on clarifying the classification criteria. Under this rule, the distinction between employees and self-employed independent contractors is significant, affecting benefits and rights. A Missouri Campaign Worker Agreement - Self-Employed Independent Contractor can assist you in defining your status and ensuring compliance with the updated regulations. Staying informed about these changes is crucial for your business operations.

Creating a Missouri Campaign Worker Agreement - Self-Employed Independent Contractor is straightforward when you follow a structured approach. First, identify the key elements such as the scope of work, payment terms, and deadlines. You can use templates or services like uslegalforms to customize your agreement to suit your specific needs. Ensuring a clear and thorough agreement helps establish a professional relationship with your clients.