Missouri Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Are you presently in a location where you require paperwork for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding forms you can rely on isn’t straightforward.

US Legal Forms provides thousands of document templates, such as the Missouri Account Executive Agreement - Self-Employed Independent Contractor, which are designed to meet state and federal requirements.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Missouri Account Executive Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and confirm it is for your specific city/state.

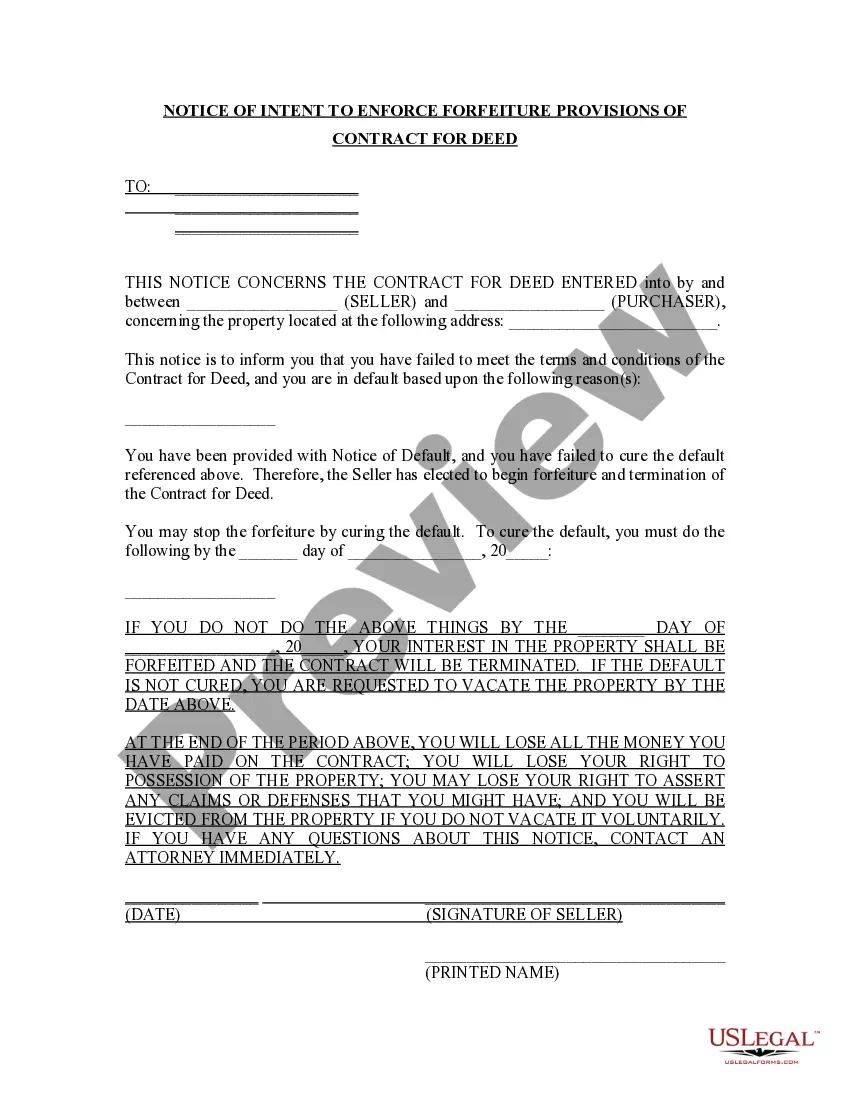

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the correct document.

- If the document isn’t what you’re looking for, use the Search box to find the form that meets your needs and specifications.

- Once you find the appropriate document, click Get now.

- Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the Missouri Account Executive Agreement - Self-Employed Independent Contractor at any time if necessary. Simply select the required document to download or print the template.

Form popularity

FAQ

In Missouri, an operating agreement is not legally required for an LLC, but it is highly recommended. Having a clear operating agreement can outline the roles, responsibilities, and rights of LLC members, which is crucial for preventing disputes. When you work as a Self-Employed Independent Contractor under a Missouri Account Executive Agreement, a well-drafted operating agreement adds clarity to your business relationships. For more assistance, consider using US Legal Forms to find templates that suit your specific needs.

Filling out an independent contractor form requires basic information, including your name, business address, and services offered. Be sure to provide tax identification details and sign the form to validate it. If you're unsure about what specific information to include, using a designated template like the Missouri Account Executive Agreement - Self-Employed Independent Contractor can provide clarity and help you complete it correctly.

To write an effective independent contractor agreement, start by specifying the contracting parties and the legal framework governing the agreement. Include clear sections on work scope, payment details, and responsibilities of both parties. It’s also beneficial to outline confidentiality and termination clauses to protect both sides. You can find templates like the Missouri Account Executive Agreement - Self-Employed Independent Contractor to simplify this process.

An independent contractor should fill out several forms, including the independent contractor agreement and tax forms such as the W-9. Additionally, any specific forms related to the work being performed might be necessary. It's essential to keep all documentation organized. For a comprehensive overview, consider the Missouri Account Executive Agreement - Self-Employed Independent Contractor forms provided by uslegalforms.

Filling out a declaration of independent contractor status form involves providing your personal information, business details, and any relevant tax information. You should accurately describe the nature of your work and the relationship with the company. This declaration confirms your status as a self-employed independent contractor. For a clear guide, refer to resources available through uslegalforms.

To fill out an independent contractor agreement, start by defining the roles and responsibilities of both parties. Clearly outline payment terms, including how and when compensation will be issued. Specify the project duration and any specific deliverables that need to be completed. Utilizing the Missouri Account Executive Agreement - Self-Employed Independent Contractor template can streamline this process.

The main difference between an independent contractor and an employee in Missouri lies in the level of control and independence each has. Employees typically have set hours, benefit packages, and are subject to company policies. In contrast, independent contractors, including those entering a Missouri Account Executive Agreement - Self-Employed Independent Contractor, enjoy greater flexibility and autonomy over their work processes, but they also assume more responsibility for their taxes and liabilities.

Creating an independent contractor agreement involves several important steps. Begin by clearly outlining the scope of work, payment terms, and deadlines. Additionally, include clauses that specify the relationship dynamics, confidentiality, and dispute resolution. Platforms like USLegalForms can facilitate this process, ensuring that your Missouri Account Executive Agreement - Self-Employed Independent Contractor meets legal standards and protects both parties involved.

In Missouri, having an operating agreement for an LLC is not a legal requirement, but it is highly recommended. This document outlines the management structure and operating procedures, which can prevent disputes among members. Moreover, a well-drafted operating agreement can help establish your intentions and provide clarity for business operations, especially for any Missouri Account Executive Agreement - Self-Employed Independent Contractor you might have.