Missouri Cosmetologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

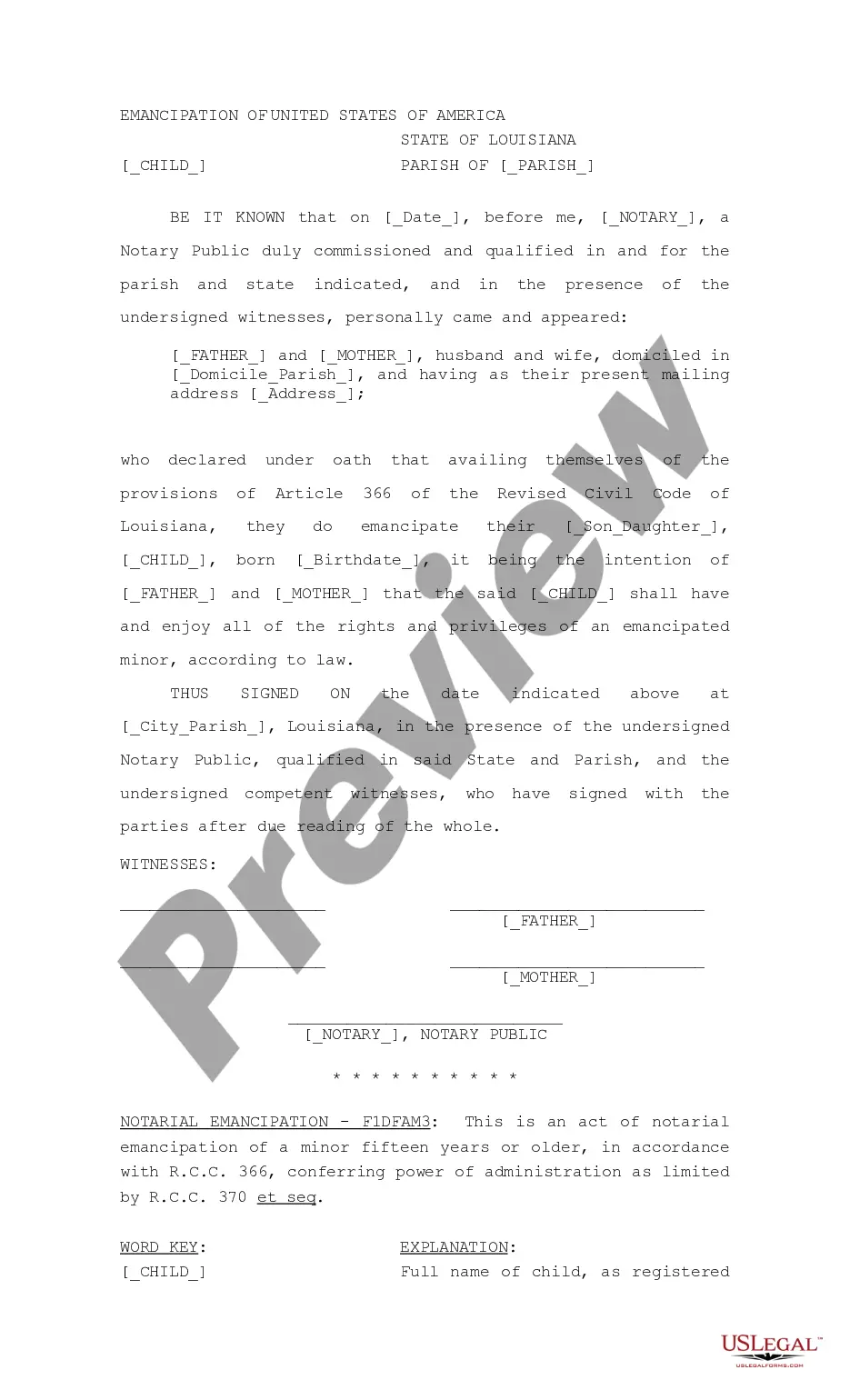

Finding the appropriate legal document format can be a challenge. Of course, there are numerous templates available online, but how can you locate the legal form you need? Visit the US Legal Forms website. The platform provides thousands of templates, such as the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor, that you can utilize for business and personal purposes. All of the documents are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to access the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor. Use your account to search for the legal documents you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps that you can follow: First, ensure you have selected the correct form for your city/state. You can browse the form using the Review button and examine the form description to confirm it is suitable for you. If the form does not fulfill your requirements, utilize the Search field to find the right form. Once you are sure the form is appropriate, click the Get now button to retrieve the form. Choose the payment plan you prefer and provide the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document to your system. Finally, complete, modify, print, and sign the obtained Missouri Cosmetologist Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal documents where you can find various file templates.

- Utilize the service to acquire professionally crafted documents that meet state regulations.

Form popularity

FAQ

An independent contractor in cosmetology is a professional who offers services such as hair styling, makeup application, or nail care independently, rather than working as an employee. They have the freedom to set their own hours and manage their client relationships. A well-structured Missouri Cosmetologist Agreement - Self-Employed Independent Contractor outlines these terms, helping to clarify the expectations and responsibilities of both parties.

Yes, an independent contractor is considered self-employed. This means they operate their own business and are responsible for managing their taxes and income. In the context of cosmetology, a Missouri Cosmetologist Agreement - Self-Employed Independent Contractor can formalize this relationship, making it clear that the contractor is not an employee of a salon or spa.

Writing an independent contractor agreement requires clarity and precision. Start by outlining the roles and responsibilities of each party involved. Next, include payment terms, project timelines, and any specific conditions regarding the work. You can find helpful resources and templates for a Missouri Cosmetologist Agreement - Self-Employed Independent Contractor on uslegalforms to ensure you cover all essential aspects.

Yes, independent contractors do file as self-employed individuals. This means you will report your income and expenses on your tax returns, utilizing the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor as a reference. Make sure to keep track of your earnings and any applicable deductions, as this is essential for accurate tax filing. Understanding this process ensures you stay compliant and benefit financially.

Filling out an independent contractor agreement requires attention to detail. Start by including both your and your client’s information, followed by the services to be rendered as per the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor. Be sure to fill in the payment structure, any deadlines, and signature lines to finalize the document. This meticulousness ensures all bases are covered, benefiting both parties.

Writing an independent contractor agreement involves outlining the responsibilities and terms clearly. Begin with an introduction that identifies the parties and the purpose of the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor. Include sections detailing payment terms, service expectations, and termination conditions. This clarity helps protect you and your client and ensures a smooth working relationship.

To fill out an independent contractor form, start by gathering necessary information such as your contact details and tax identification number. Ensure you include the specific services you will provide under the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor. Remember to carefully review the terms and conditions to establish a clear understanding with your client, which helps both parties stay aligned.

Typically, the business owner or the contractor will draft the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor. However, it’s advisable to consult with an attorney or use established templates to ensure the agreement meets legal standards. Utilizing a reliable platform like US Legal Forms can help you access professionally drafted agreements tailored to your needs, ensuring all essential elements are covered.

Creating a Missouri Cosmetologist Agreement - Self-Employed Independent Contractor involves a few crucial steps. Begin by defining the services offered and payment terms clearly. You should include the duration of the agreement and termination clauses. Utilizing platforms like US Legal Forms can simplify this process, providing templates designed for Missouri cosmetologists to ensure compliance and clarity.

Independent hairstylists must file their taxes as self-employed individuals, which means they need to report their income and expenses accurately. They typically use IRS Schedule C to document their earnings and deductible expenses related to their work under the Missouri Cosmetologist Agreement - Self-Employed Independent Contractor. It's essential to keep meticulous records of all transactions to simplify the filing process and to ensure compliance with tax regulations. Platforms like uslegalforms can provide essential resources and templates to help you navigate this process smoothly.