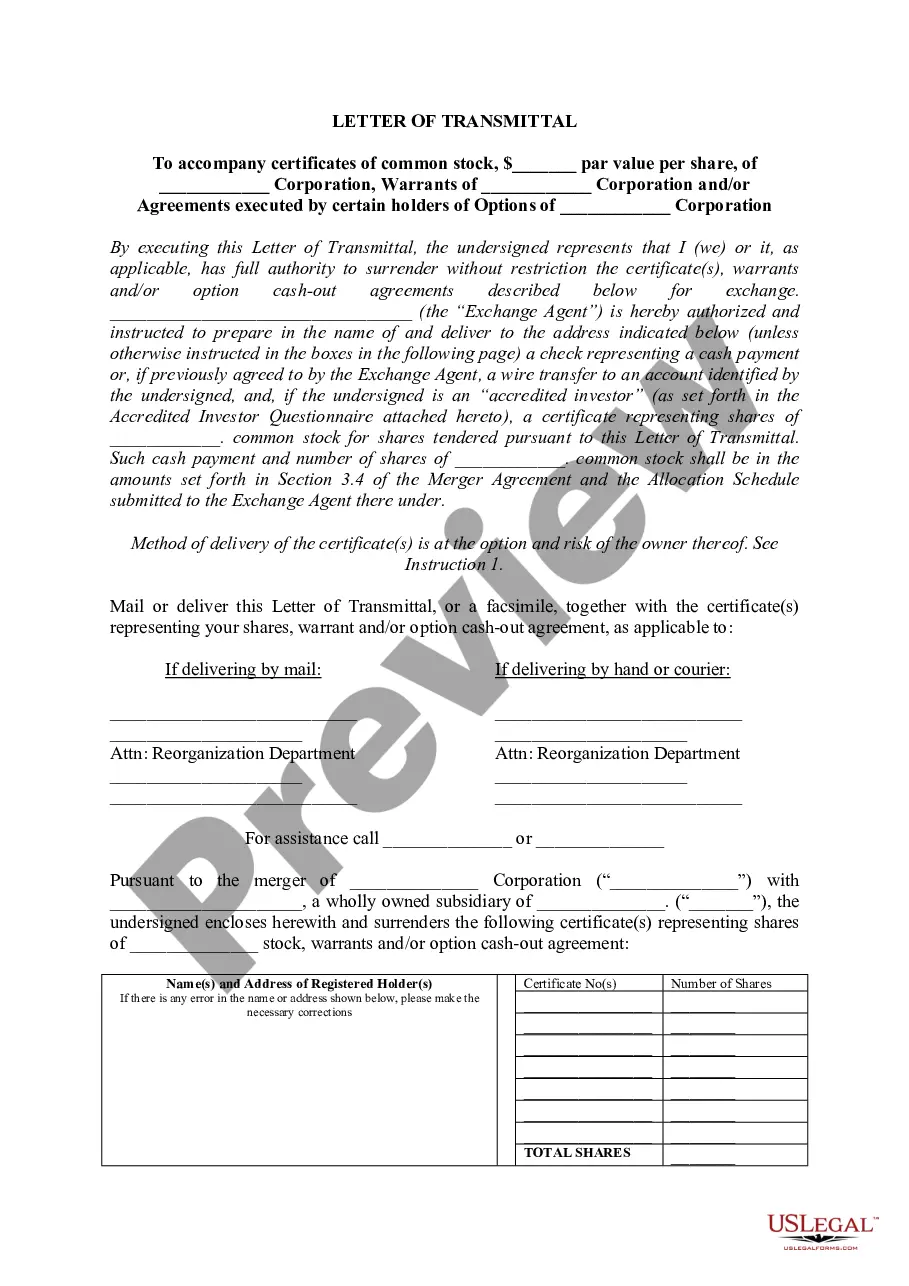

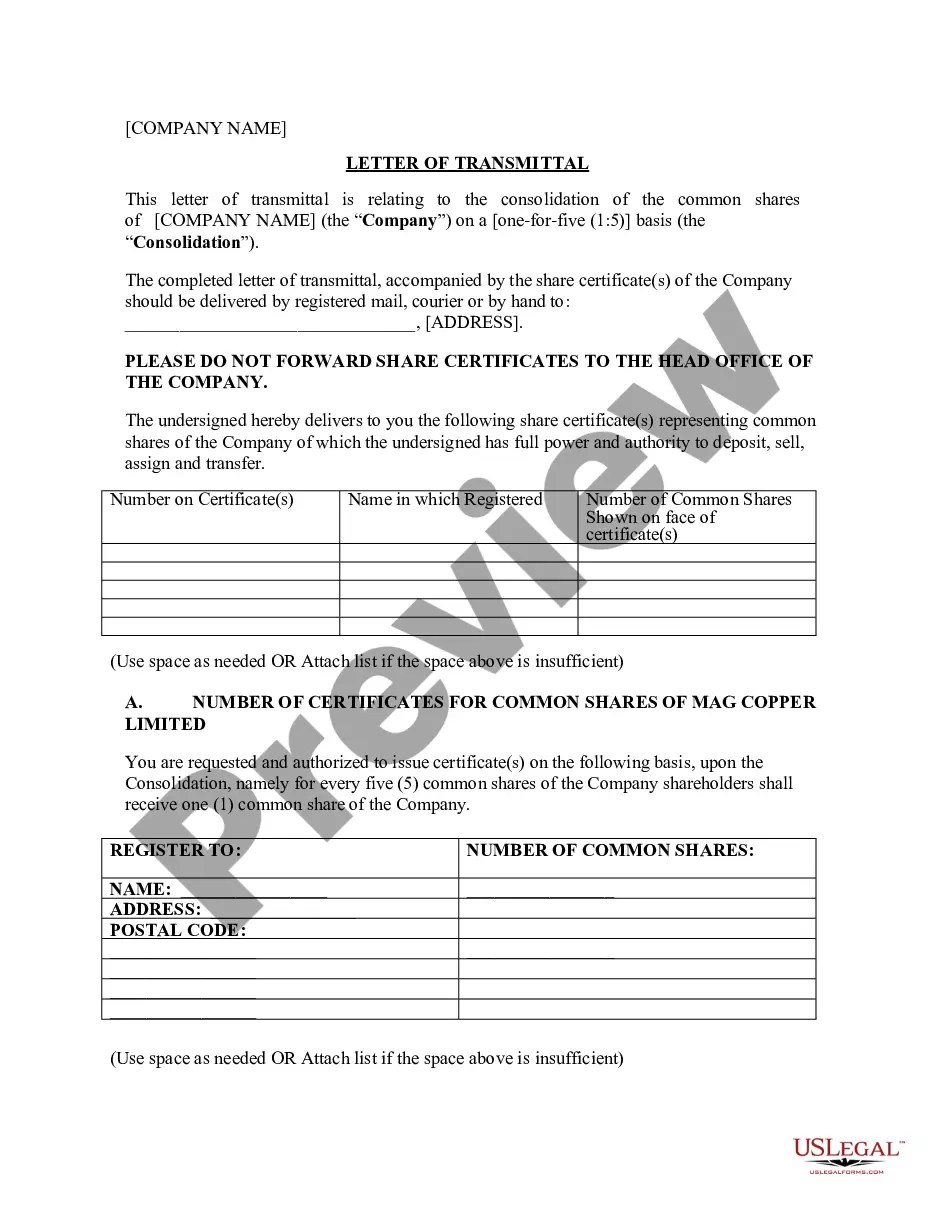

Missouri Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

You may devote hours on-line trying to find the legitimate record format which fits the state and federal specifications you need. US Legal Forms gives a huge number of legitimate types which are examined by professionals. You can easily down load or print the Missouri Letter of Transmittal from my services.

If you have a US Legal Forms bank account, it is possible to log in and then click the Acquire button. Following that, it is possible to full, revise, print, or sign the Missouri Letter of Transmittal. Each and every legitimate record format you acquire is your own property eternally. To acquire one more copy for any acquired type, check out the My Forms tab and then click the related button.

If you use the US Legal Forms site the very first time, stick to the simple guidelines beneath:

- Initial, make sure that you have selected the right record format for that region/town of your choosing. Look at the type explanation to make sure you have picked out the correct type. If available, take advantage of the Review button to look throughout the record format also.

- In order to discover one more version of your type, take advantage of the Look for area to discover the format that suits you and specifications.

- Once you have located the format you would like, just click Buy now to move forward.

- Select the costs prepare you would like, enter your credentials, and register for an account on US Legal Forms.

- Complete the financial transaction. You should use your Visa or Mastercard or PayPal bank account to purchase the legitimate type.

- Select the structure of your record and down load it for your gadget.

- Make changes for your record if needed. You may full, revise and sign and print Missouri Letter of Transmittal.

Acquire and print a huge number of record layouts utilizing the US Legal Forms Internet site, which provides the most important collection of legitimate types. Use expert and express-distinct layouts to handle your business or personal needs.

Form popularity

FAQ

However, if you have no employer to withhold federal taxes, then you will need to do this by making estimated tax payments. Step 1: Determine if estimated tax payments are necessary. ... Step 2: Calculate the minimum estimated tax payment to make. ... Step 3: Make your payments on time. ... Step 4: Avoid late-payment penalties.

Companies who pay employees in Missouri must register with the MO Department of Revenue for a Withholding Account Number and the MO Department of Labor and Industrial Relations for an Employer Account Number. Apply for both online at the MO Online Business Registration Portal.

Companies who pay employees in Missouri must register with the MO Department of Revenue for a Withholding Account Number and the MO Department of Labor and Industrial Relations for an Employer Account Number. Apply for both online at the MO Online Business Registration Portal.

A Notice of Balance Due has been issued because of an outstanding tax delinquency. Failure to resolve the tax issue, within the stated time limits on the notice, will result in the suspension of your professional license or the loss of employment with the State of Missouri.

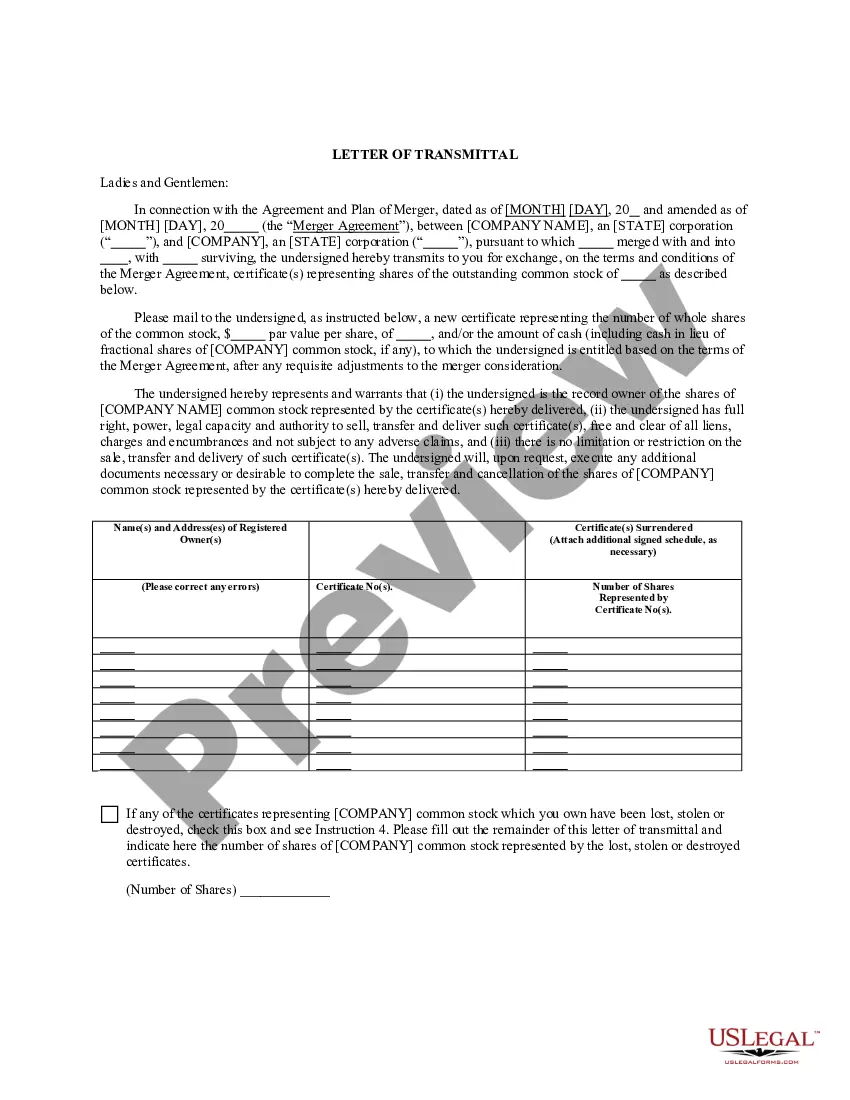

Signature. Mail to: Taxation Division. Phone: (573) 751-8750. P.O. Box 3330. Fax: (573) 522-6816. Jefferson City, MO 65105-3330. E-mail: withholding@dor.mo.gov. Instructions. MO W-3. Missouri Department of Revenue. Transmittal of Tax Statements.

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

A Satisfaction/Discharge of Tax Lien will be issued within 45-60 days from the date that the debt was resolved. You may resolve the debt by either making payment in full or submitting documentation showing you do not owe the debt.

If the employee elects to have withholding tax withheld on their wages, complete the Tax Registration Application (Form 2643) found on our website at in order to report the taxes withheld on the Employer's Return of Income Taxes Withheld (Form MO-941).