Missouri Letter of Transmittal

Description

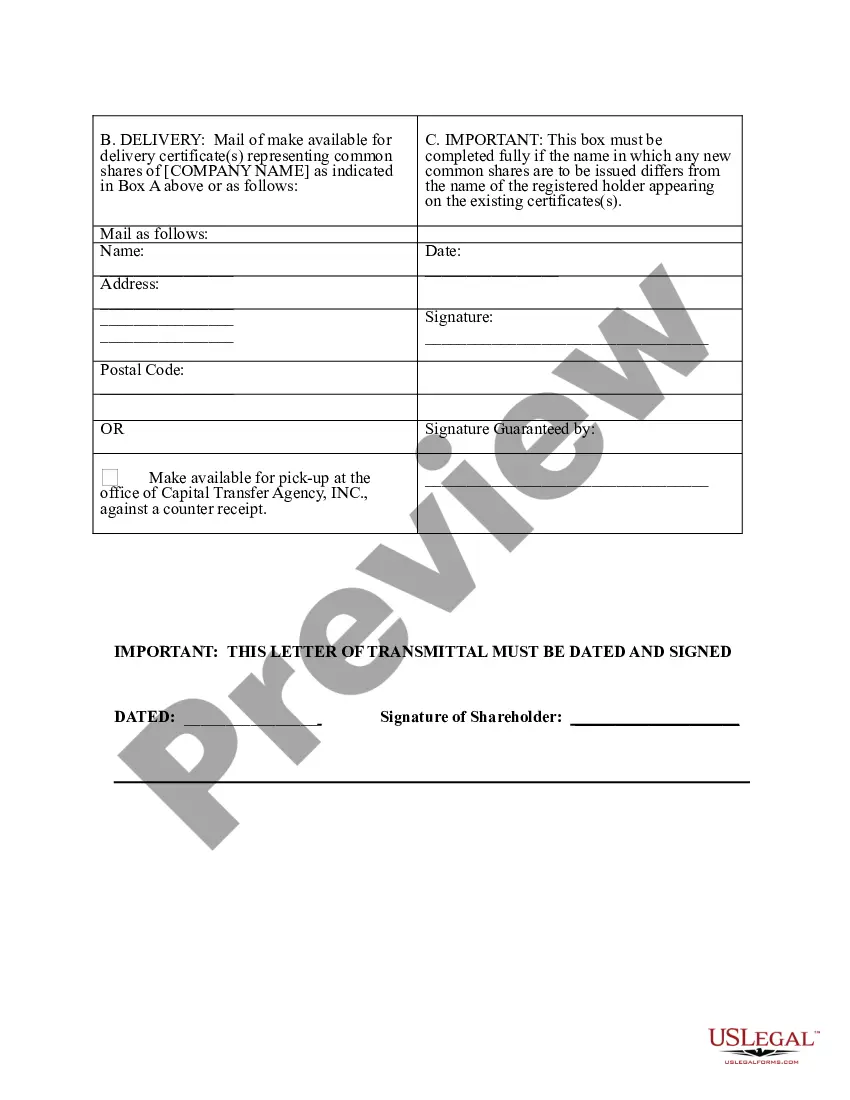

How to fill out Letter Of Transmittal?

Choosing the right lawful document template can be a battle. Of course, there are tons of templates available on the net, but how can you obtain the lawful type you need? Make use of the US Legal Forms site. The service delivers a huge number of templates, such as the Missouri Letter of Transmittal, that you can use for organization and personal requirements. Every one of the forms are checked out by pros and meet state and federal specifications.

In case you are presently signed up, log in to the bank account and click on the Down load key to get the Missouri Letter of Transmittal. Use your bank account to check through the lawful forms you may have ordered formerly. Go to the My Forms tab of the bank account and get one more copy in the document you need.

In case you are a whole new consumer of US Legal Forms, listed here are straightforward directions for you to comply with:

- Very first, make sure you have selected the correct type to your city/region. You are able to check out the form making use of the Review key and study the form explanation to make sure it is the best for you.

- If the type will not meet your requirements, take advantage of the Seach industry to obtain the right type.

- Once you are certain the form would work, click on the Get now key to get the type.

- Choose the costs strategy you need and enter the needed information. Create your bank account and buy the order making use of your PayPal bank account or credit card.

- Pick the data file format and down load the lawful document template to the product.

- Comprehensive, modify and print out and sign the acquired Missouri Letter of Transmittal.

US Legal Forms is definitely the biggest catalogue of lawful forms in which you can find various document templates. Make use of the service to down load skillfully-created papers that comply with status specifications.

Form popularity

FAQ

A Notice of Balance Due has been issued because of an outstanding tax delinquency. Failure to resolve the tax issue, within the stated time limits on the notice, will result in the suspension of your professional license or the loss of employment with the State of Missouri.

The Missouri Department of Revenue was created in 1945 by the Missouri Constitution to serve as the central collection agency for all state revenue. The primary duties of the Department are to collect taxes, title and register motor vehicles, and license drivers.

A Satisfaction/Discharge of Tax Lien will be issued within 45-60 days from the date that the debt was resolved. You may resolve the debt by either making payment in full or submitting documentation showing you do not owe the debt.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Signature. Mail to: Taxation Division. Phone: (573) 751-8750. P.O. Box 3330. Fax: (573) 522-6816. Jefferson City, MO 65105-3330. E-mail: withholding@dor.mo.gov. Instructions. MO W-3. Missouri Department of Revenue. Transmittal of Tax Statements.

An addition to tax is imposed for failure to file by the due date at the rate of 5 percent per month, not to exceed 25 percent of the unpaid balance. An addition to tax is imposed for failure to pay by the due date at the rate of 5 percent of the unpaid balance.

Companies who pay employees in Missouri must register with the MO Department of Revenue for a Withholding Account Number and the MO Department of Labor and Industrial Relations for an Employer Account Number. Apply for both online at the MO Online Business Registration Portal.

The IRS may send you a certified letter if there are issues with your tax return or other tax forms regarding your personal information. In this certified letter, the IRS will likely ask you to complete its identity verification process.