Missouri Term Sheet - Six Month Promissory Note

Description

How to fill out Term Sheet - Six Month Promissory Note?

US Legal Forms - one of several greatest libraries of legitimate forms in the USA - offers an array of legitimate file themes you can down load or produce. Using the internet site, you can find 1000s of forms for business and specific reasons, sorted by categories, claims, or search phrases.You will find the newest models of forms such as the Missouri Term Sheet - Six Month Promissory Note within minutes.

If you already possess a monthly subscription, log in and down load Missouri Term Sheet - Six Month Promissory Note from your US Legal Forms library. The Download key will appear on every form you see. You get access to all earlier saved forms from the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed here are easy instructions to help you get started:

- Make sure you have chosen the proper form to your town/area. Go through the Review key to analyze the form`s content material. Look at the form information to ensure that you have chosen the correct form.

- In the event the form does not suit your demands, make use of the Look for area on top of the monitor to obtain the one who does.

- When you are satisfied with the form, affirm your selection by clicking on the Purchase now key. Then, opt for the prices prepare you want and give your accreditations to sign up for the bank account.

- Method the deal. Make use of your bank card or PayPal bank account to perform the deal.

- Choose the formatting and down load the form on your product.

- Make modifications. Fill out, change and produce and indication the saved Missouri Term Sheet - Six Month Promissory Note.

Every single template you added to your account does not have an expiry time which is yours permanently. So, if you wish to down load or produce yet another duplicate, just visit the My Forms portion and click on in the form you want.

Get access to the Missouri Term Sheet - Six Month Promissory Note with US Legal Forms, by far the most substantial library of legitimate file themes. Use 1000s of professional and state-distinct themes that satisfy your organization or specific demands and demands.

Form popularity

FAQ

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

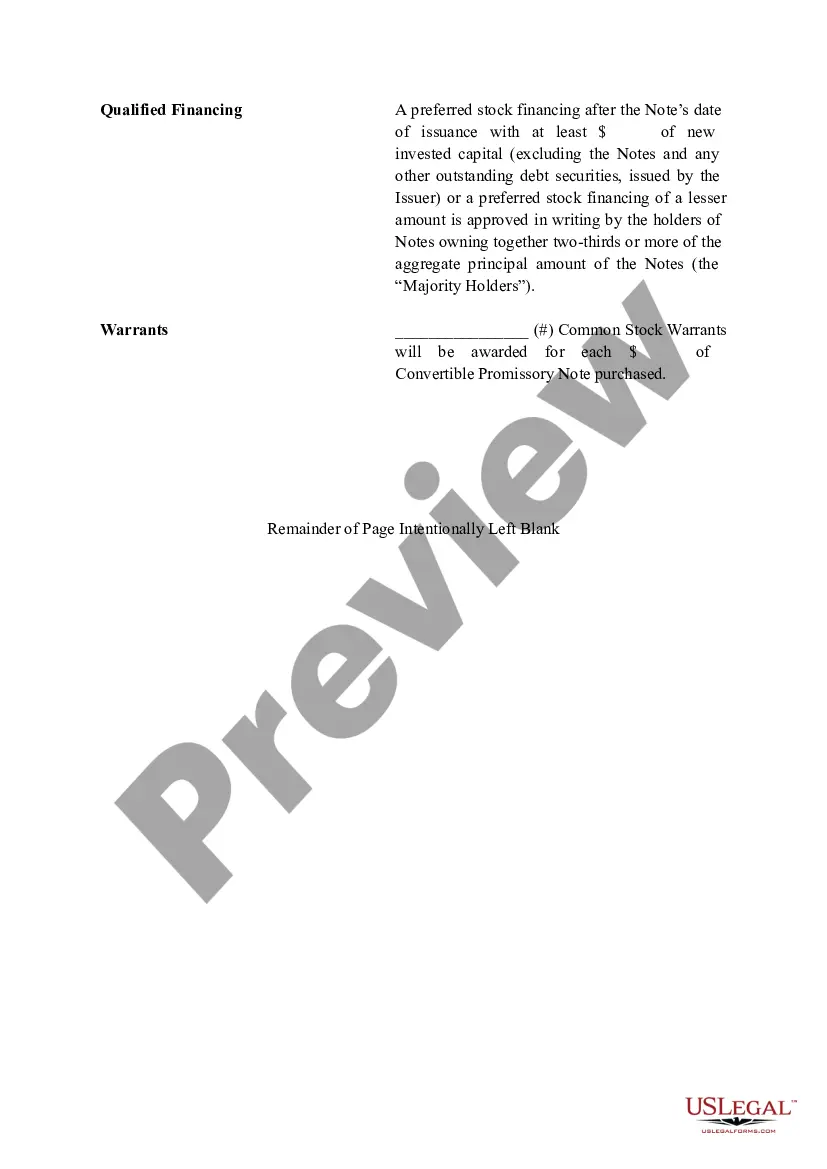

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note. But specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

A demand note is a promissory note that becomes payable any time the holder of the note requests payment. This differs from notes that are due by a certain date or have a repayment schedule. Sometimes, banks are willing to issue demand loans to customers they have worked with for a long time and have favorable credit.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

What Does a Promissory Note Contain? A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.