Missouri Partnership Agreement

Description

How to fill out Partnership Agreement?

You can devote hrs on the Internet looking for the lawful file web template that meets the state and federal demands you want. US Legal Forms gives 1000s of lawful kinds which can be analyzed by experts. You can easily obtain or produce the Missouri Partnership Agreement from your services.

If you already have a US Legal Forms accounts, you can log in and then click the Obtain switch. Next, you can complete, edit, produce, or sign the Missouri Partnership Agreement. Every lawful file web template you get is your own eternally. To have another backup for any bought kind, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site the very first time, adhere to the easy instructions under:

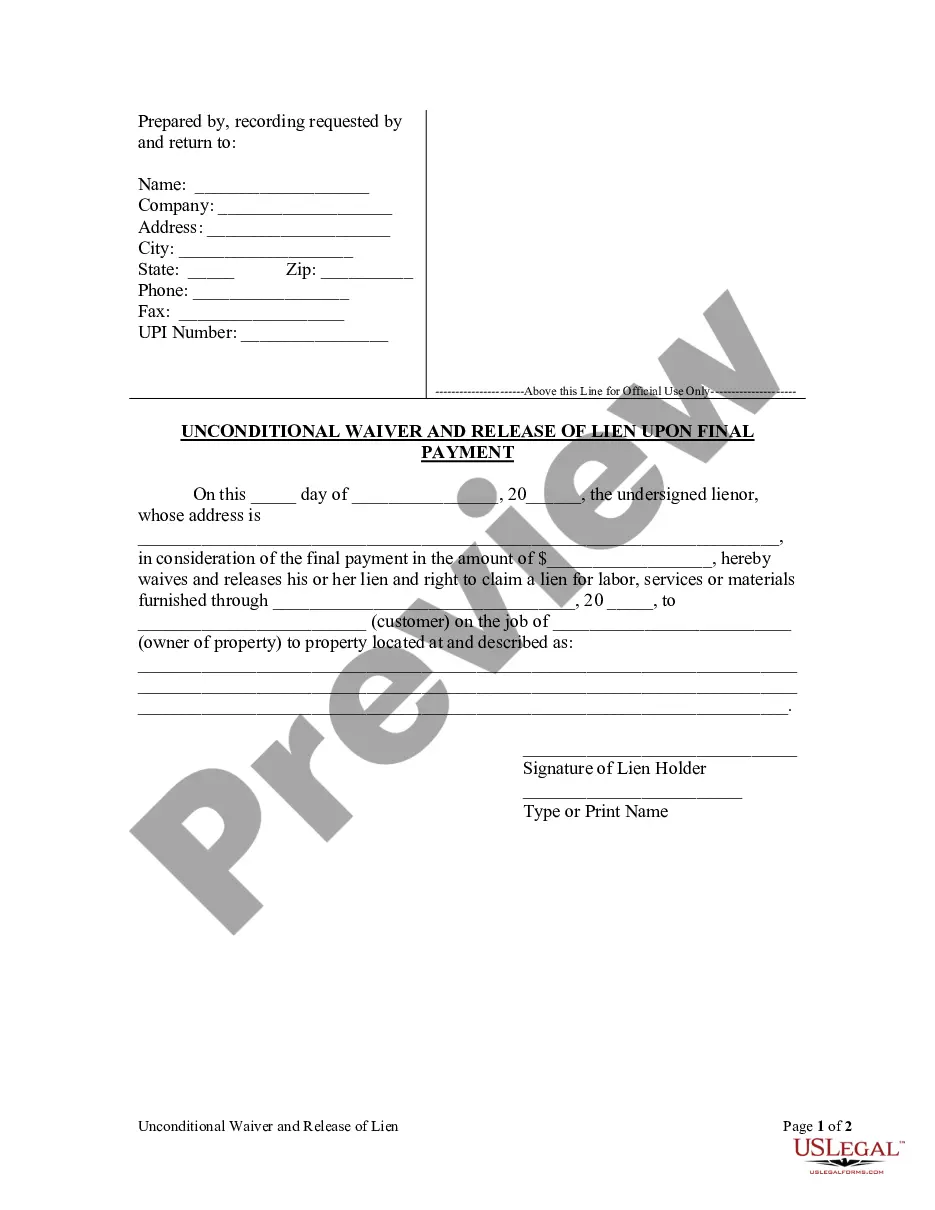

- Initial, be sure that you have chosen the correct file web template to the area/metropolis that you pick. See the kind information to ensure you have picked the proper kind. If offered, take advantage of the Review switch to appear through the file web template at the same time.

- If you wish to locate another model of the kind, take advantage of the Look for area to discover the web template that meets your needs and demands.

- Once you have located the web template you want, simply click Purchase now to proceed.

- Choose the costs program you want, key in your references, and sign up for an account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal accounts to cover the lawful kind.

- Choose the format of the file and obtain it in your device.

- Make adjustments in your file if possible. You can complete, edit and sign and produce Missouri Partnership Agreement.

Obtain and produce 1000s of file web templates while using US Legal Forms Internet site, which offers the biggest collection of lawful kinds. Use specialist and state-specific web templates to handle your business or person demands.

Form popularity

FAQ

How to form a Missouri General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

For LLCs electing to be taxed as corporations, Form MO-1120 must be filed in Missouri. A single-member LLC that is considered disregarded for federal taxation purposes must report income and expenses accrued by the LLC on the member's tax return. In Missouri, a state tax identification number is required.

Who Must File Form MO-1065 Form MO-1065 must be filed, if Federal Form 1065 is required to be filed and the partnership has (1) a partner that is a Missouri resident or (2) any income derived from Missouri sources, Section 143.581, RSMo.

You don't have to file paperwork to form a partnership?you create a partnership when you agree to go into business with another person. While you can form a partnership without formally filing or registering the entity, partnerships must comply with licensing and tax requirements that apply to all businesses.

In California, like every other state, there are no formal filing or registration requirements needed to create a general partnership. However, you must still comply with registration, filing, and tax requirements applicable to any business. Need Professional Help? Talk to a Business Law Attorney.

Rather, Missouri law will recognize the existence of a general partnership when 1) two or more people 2) carry on a business as co-owners with 3) the intent to make a profit. Even if it is unintentional, a Court will determine that such a relationship is a general partnership.

In Missouri, partnerships typically need to be on file with the state, pay a filing fee, and file the required paperwork. Missouri has some additional and/or different paperwork for out of state businesses. General partnerships (GP): GPs file with the state if doing business under an assumed name.