Missouri Documentation Required to Confirm Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

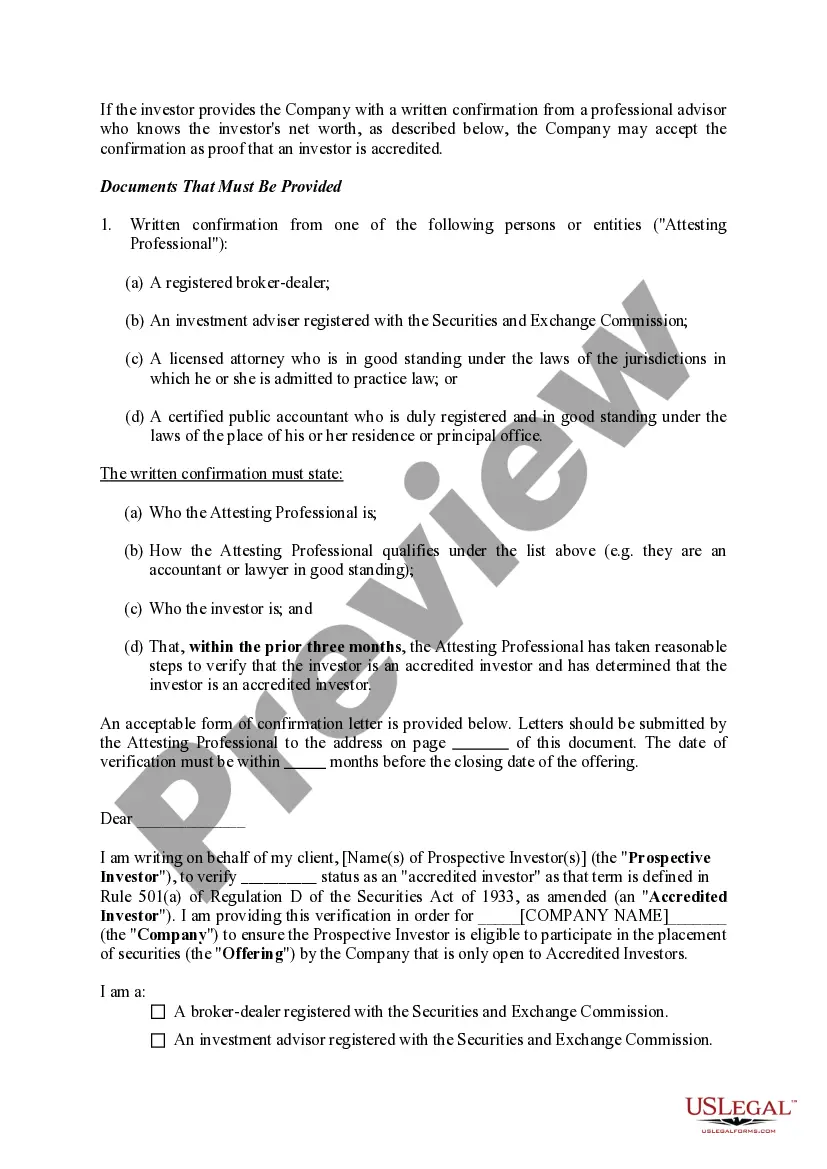

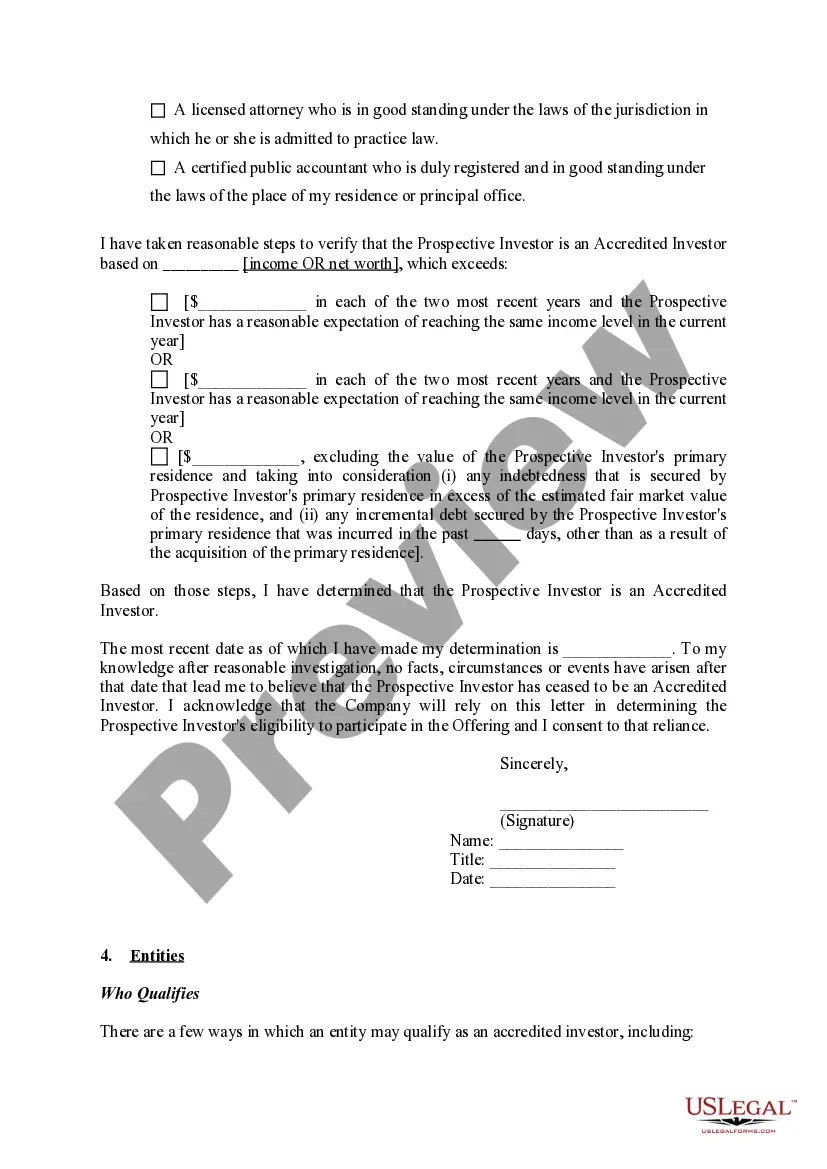

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

Choosing the best authorized record template can be a have a problem. Of course, there are plenty of templates accessible on the Internet, but how can you discover the authorized kind you require? Use the US Legal Forms internet site. The services delivers a large number of templates, like the Missouri Documentation Required to Confirm Accredited Investor Status, which you can use for enterprise and private requires. Every one of the forms are examined by experts and fulfill federal and state demands.

When you are previously listed, log in to your account and click on the Acquire button to get the Missouri Documentation Required to Confirm Accredited Investor Status. Use your account to appear throughout the authorized forms you may have acquired in the past. Proceed to the My Forms tab of your account and have another version from the record you require.

When you are a fresh user of US Legal Forms, listed here are easy recommendations that you should follow:

- First, make certain you have chosen the correct kind for your personal metropolis/area. You may look over the shape making use of the Preview button and study the shape description to guarantee this is basically the best for you.

- In case the kind will not fulfill your expectations, take advantage of the Seach area to find the correct kind.

- Once you are positive that the shape would work, select the Acquire now button to get the kind.

- Pick the prices program you desire and enter in the essential information and facts. Build your account and pay money for the order using your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and download the authorized record template to your product.

- Comprehensive, change and printing and indicator the attained Missouri Documentation Required to Confirm Accredited Investor Status.

US Legal Forms is the greatest local library of authorized forms that you can see numerous record templates. Use the company to download appropriately-created papers that follow condition demands.

Form popularity

FAQ

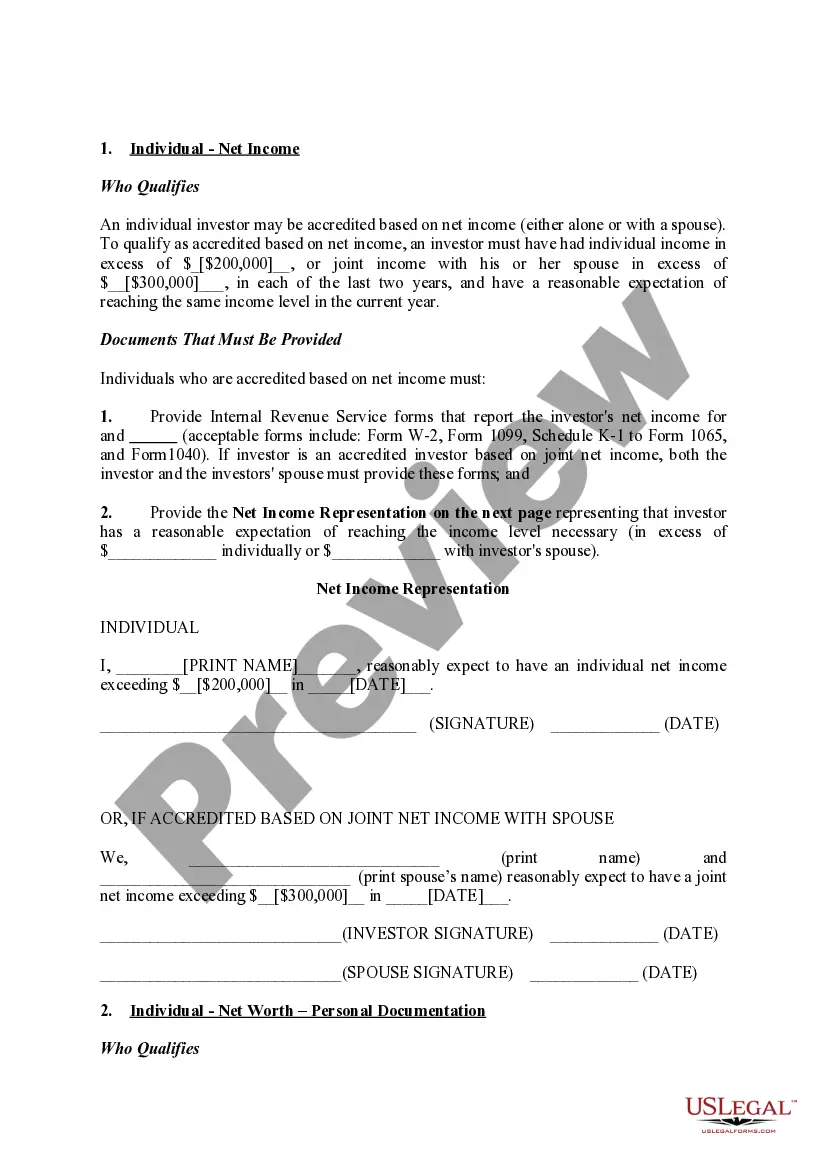

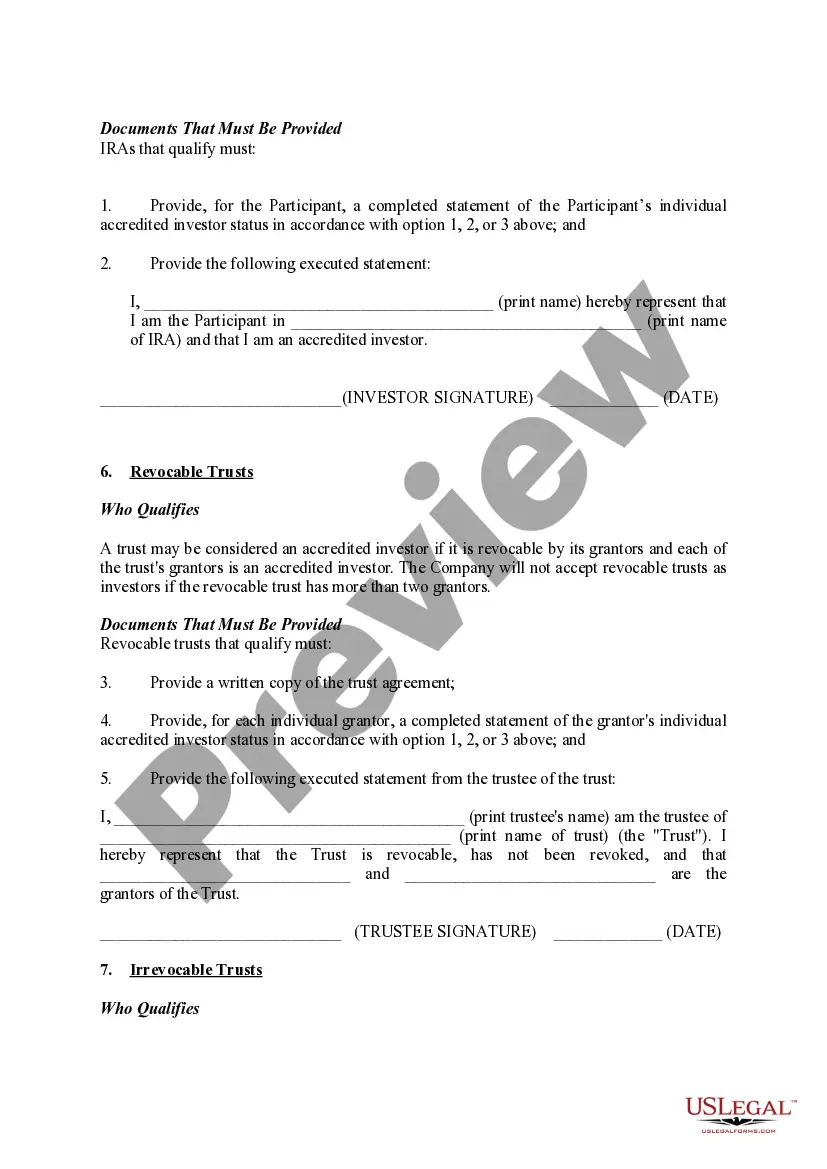

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

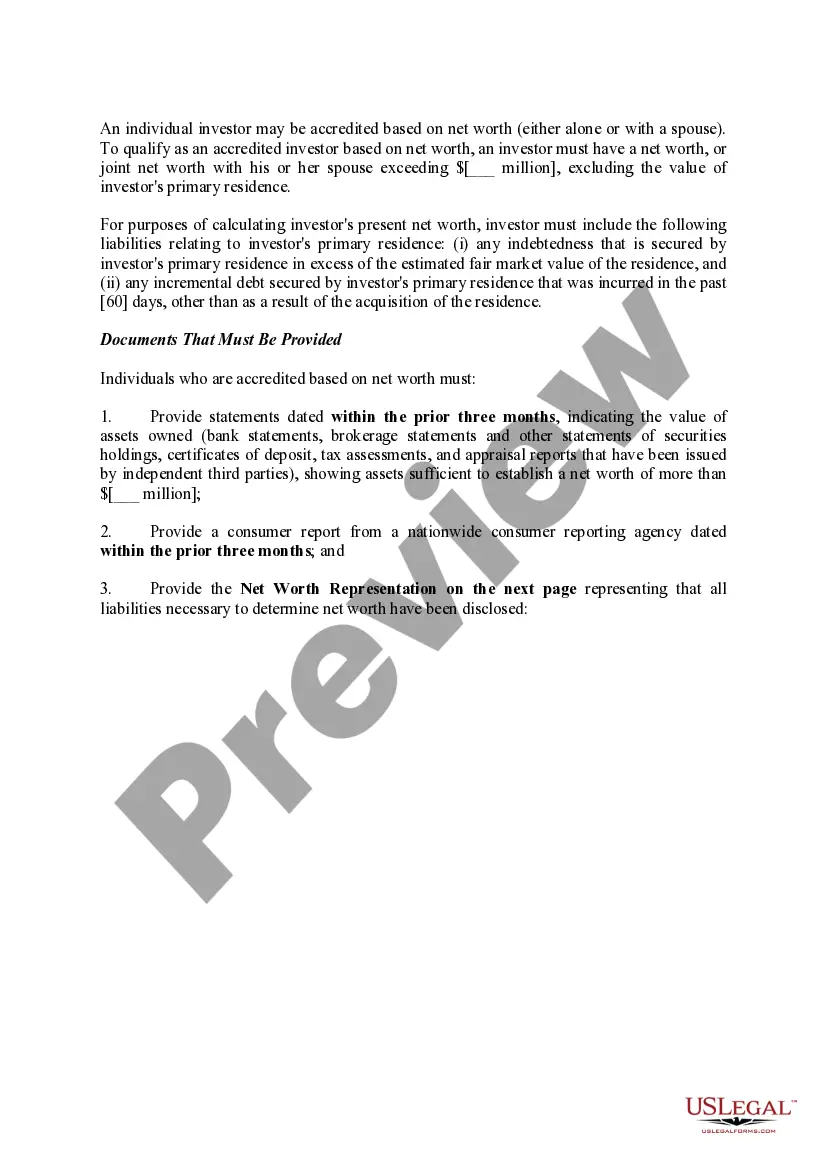

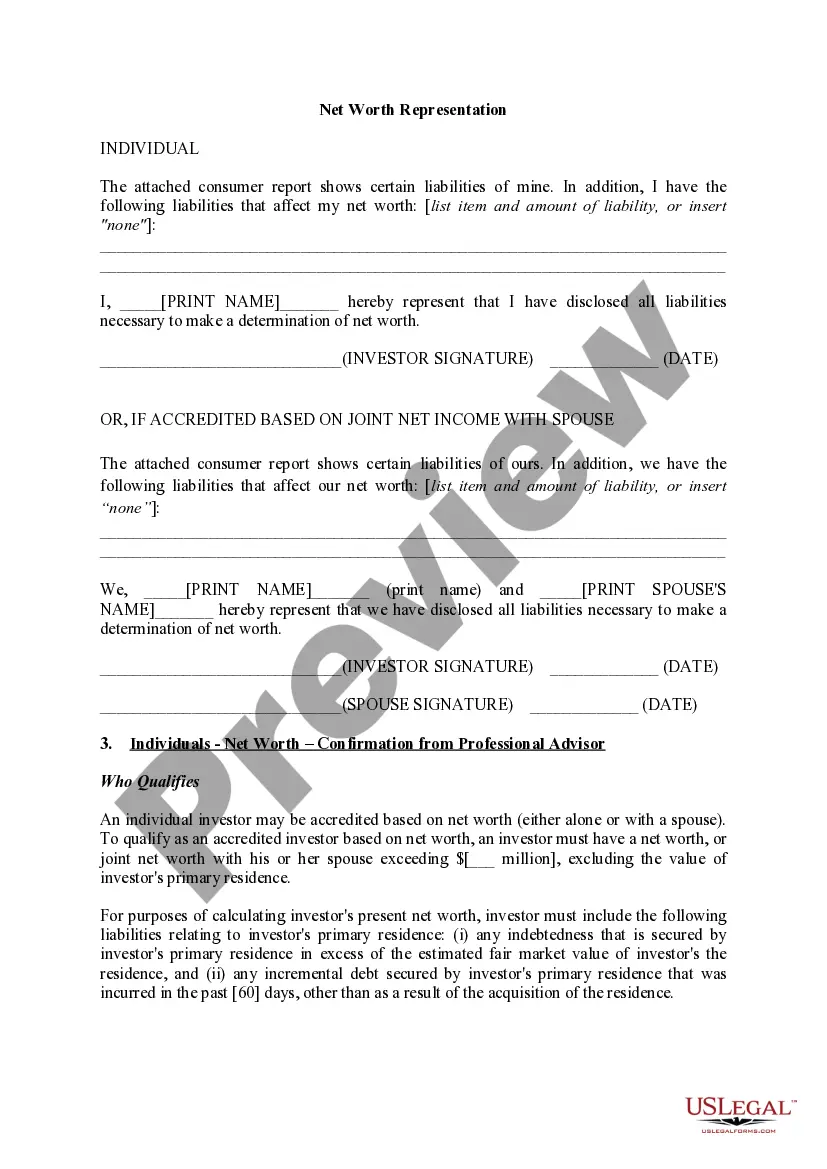

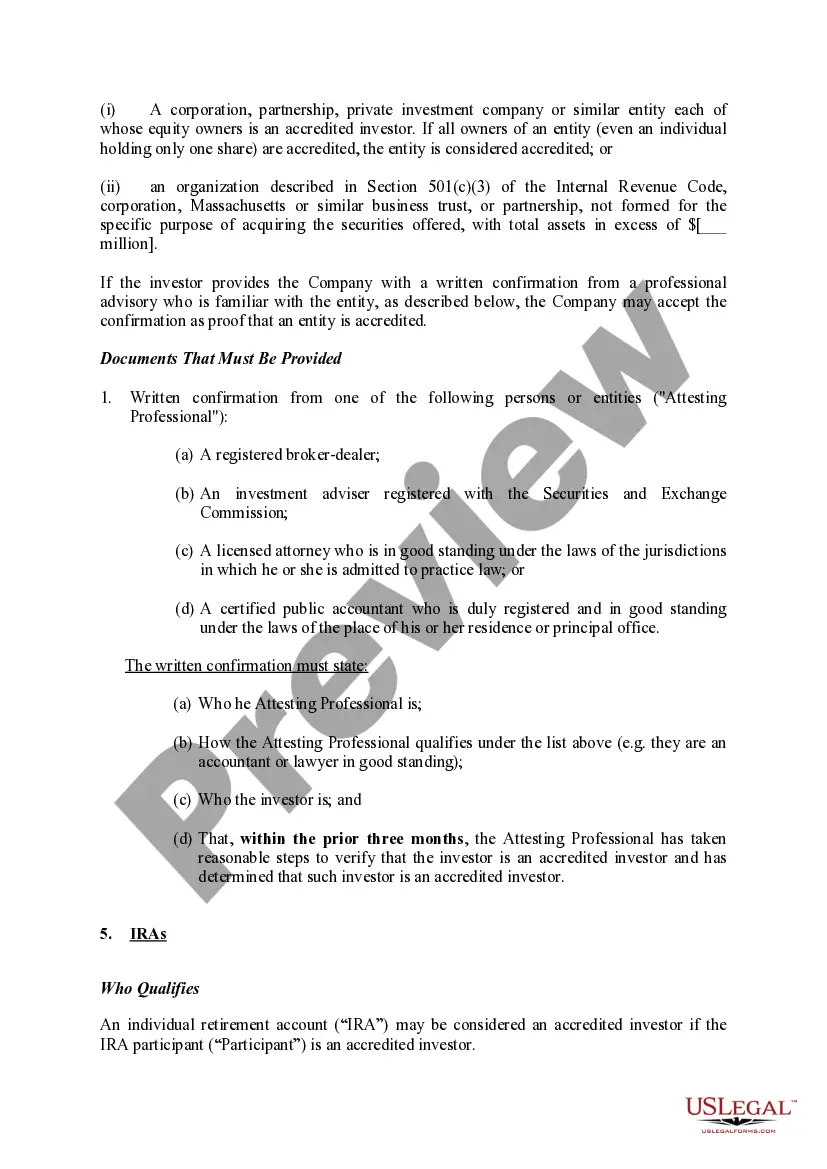

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

To claim accredited investor status, you must meet at least one of the following requirements: Hold (in good standing) a Series 7, 65 or 82 license. Have a net worth exceeding $1 million individually or combined with a spouse or spousal equivalent (excluding the value of the primary residence)

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant. Other paths require cumbersome documentation that can deter would-be investors from profitable investments, such as InvestinKona.com.

Examples of supporting documents Latest statement from brokerage houses showing net personal assets For net equity of property: Title deeds free of encumbrances. Latest housing loan statement For income: Salary Slip.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.