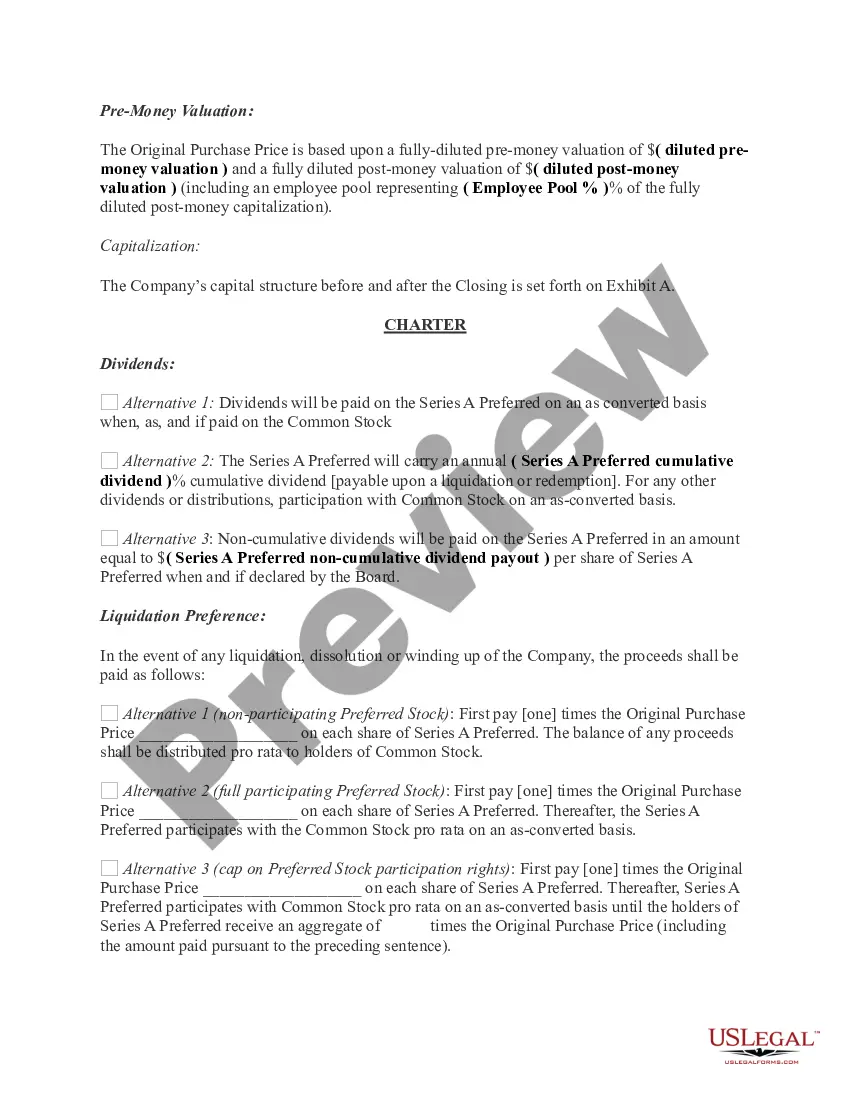

Missouri Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Are you inside a placement in which you require documents for both enterprise or personal reasons almost every day? There are a variety of lawful file layouts available online, but finding versions you can trust isn`t easy. US Legal Forms provides thousands of form layouts, much like the Missouri Term Sheet - Series A Preferred Stock Financing of a Company, that are created in order to meet federal and state requirements.

In case you are already acquainted with US Legal Forms web site and have an account, just log in. Afterward, it is possible to obtain the Missouri Term Sheet - Series A Preferred Stock Financing of a Company design.

Unless you come with an accounts and want to start using US Legal Forms, adopt these measures:

- Get the form you will need and ensure it is for that proper area/state.

- Take advantage of the Preview key to review the shape.

- Read the description to ensure that you have chosen the appropriate form.

- If the form isn`t what you are looking for, utilize the Research area to get the form that meets your needs and requirements.

- Whenever you discover the proper form, click Acquire now.

- Opt for the rates strategy you need, fill in the desired information and facts to generate your money, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Pick a convenient paper formatting and obtain your backup.

Find each of the file layouts you have purchased in the My Forms menu. You may get a extra backup of Missouri Term Sheet - Series A Preferred Stock Financing of a Company any time, if required. Just select the required form to obtain or produce the file design.

Use US Legal Forms, by far the most considerable collection of lawful varieties, to conserve time and avoid errors. The support provides skillfully made lawful file layouts that can be used for a variety of reasons. Generate an account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

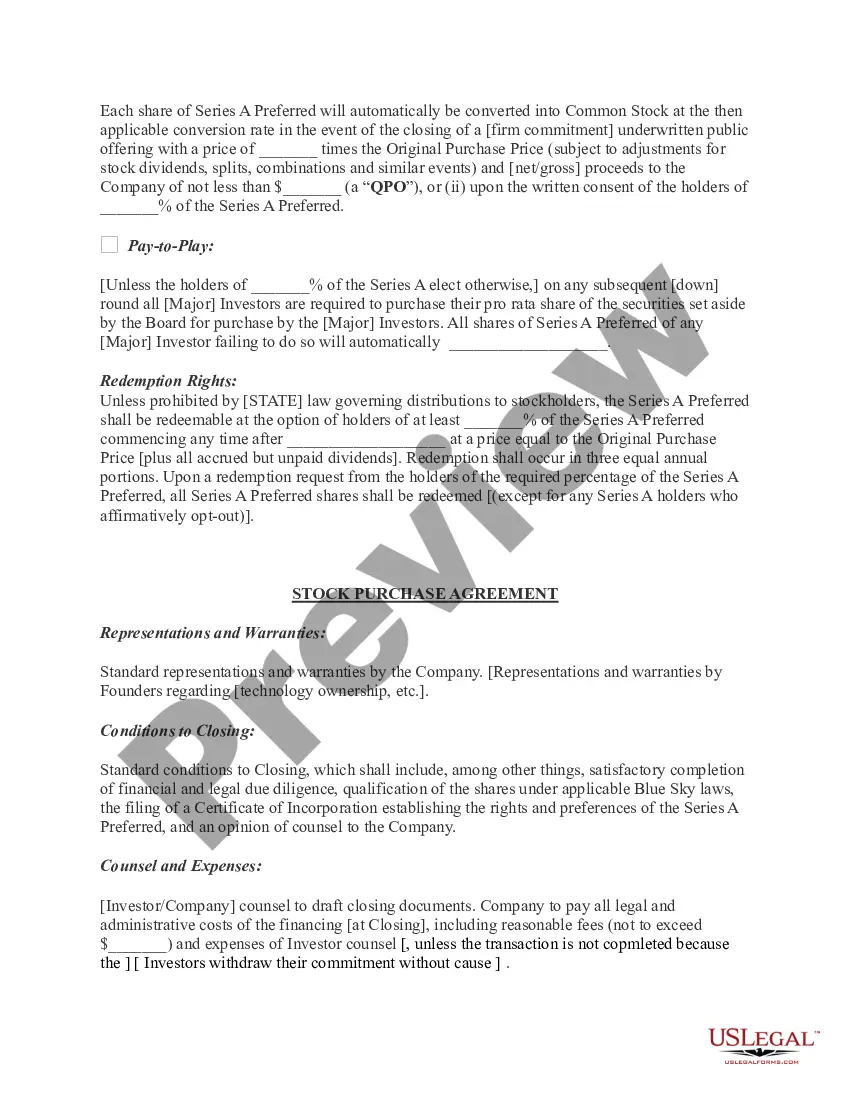

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Seed and series A funding is designed to establish the startup and secure a market share, series B funding is then used to scale the opportunity. Series B funding can be used by a startup to meet many different costs associated with growth.

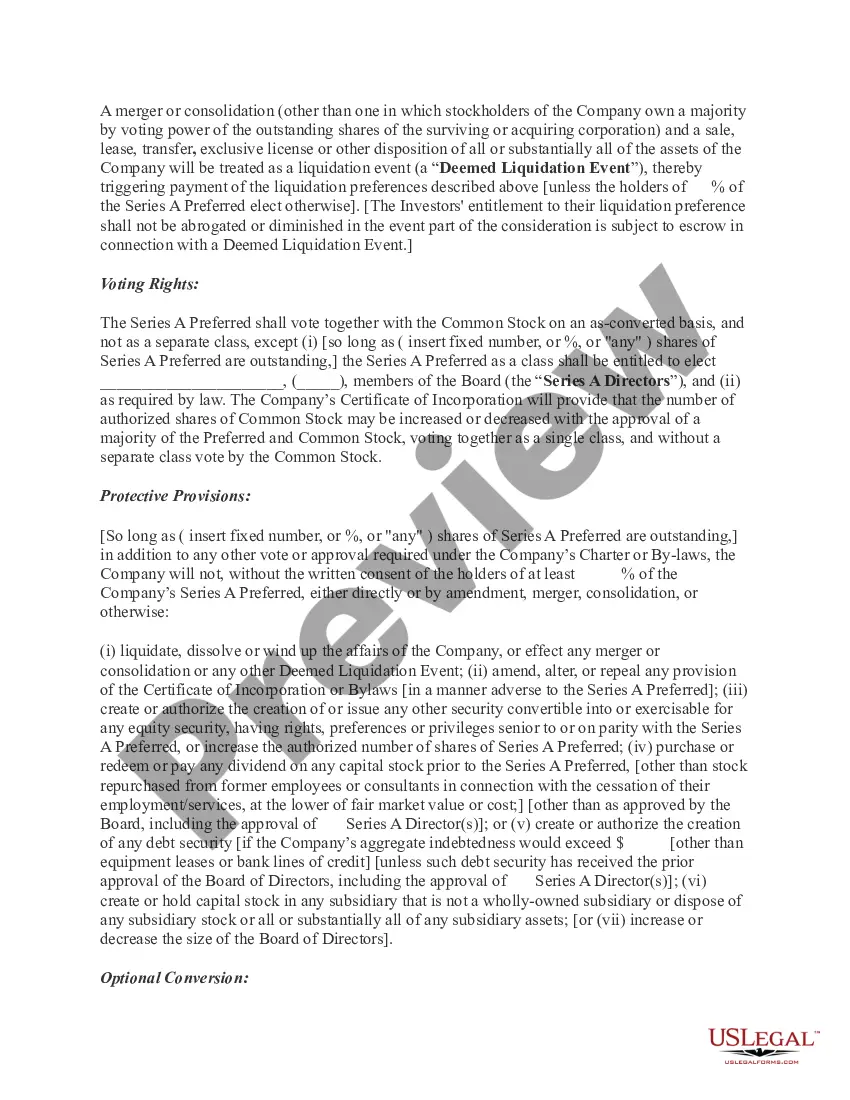

The Series A Preferred Stock, voting separately as a class at each annual meeting, shall be entitled to nominate and elect a number of directors equal to one-third of the total number of directorships (each director entitled to be elected by the Series A Preferred Stock, a ?Series A Director?).

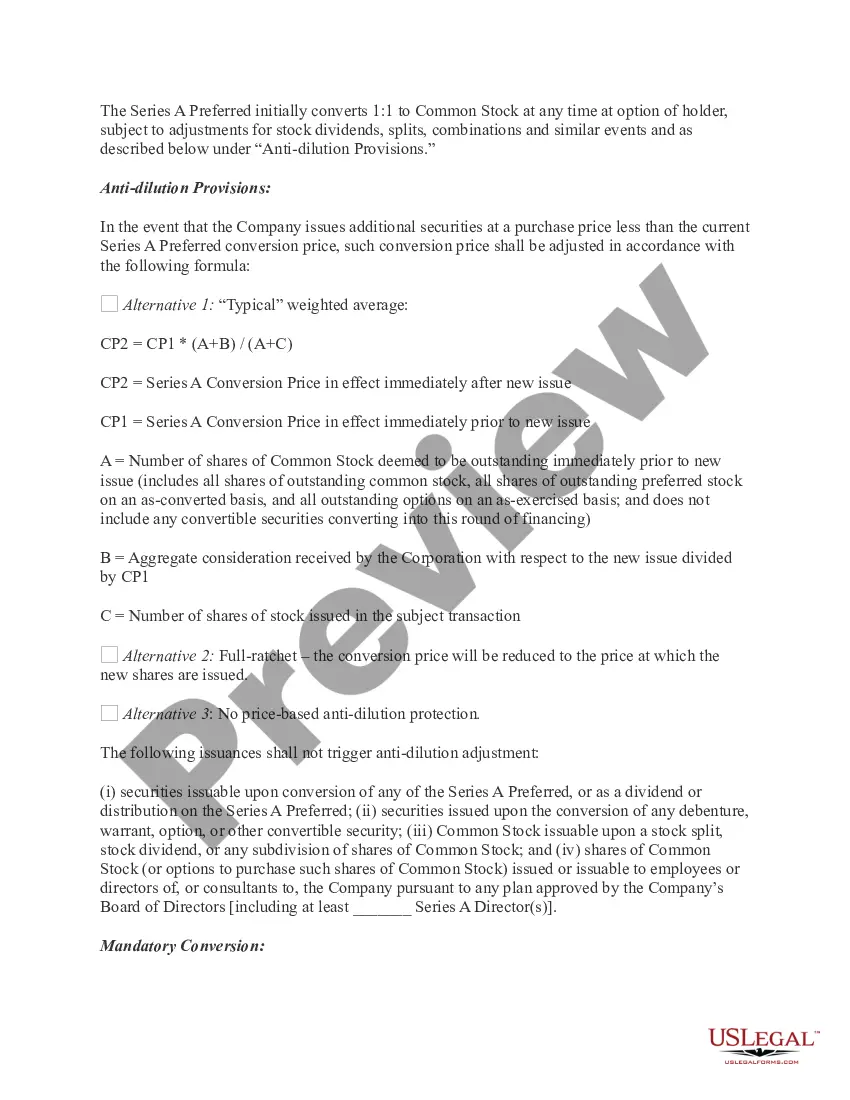

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

Series A is the next round of funding after the seed funding. By this point, a startup probably has a working product or service. And it likely has a few employees. Startups can raise an additional round of funding in return for preferred stock.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.