Missouri Web Site Use Agreement

Description

How to fill out Web Site Use Agreement?

Finding the right lawful file design could be a have difficulties. Naturally, there are a variety of templates available online, but how can you discover the lawful develop you will need? Utilize the US Legal Forms website. The services provides a large number of templates, including the Missouri Web Site Use Agreement, that can be used for business and personal requires. Each of the forms are checked by specialists and meet state and federal demands.

Should you be currently signed up, log in to the account and click the Download button to obtain the Missouri Web Site Use Agreement. Make use of your account to search with the lawful forms you possess ordered previously. Proceed to the My Forms tab of the account and acquire an additional version of your file you will need.

Should you be a whole new user of US Legal Forms, listed below are simple guidelines so that you can follow:

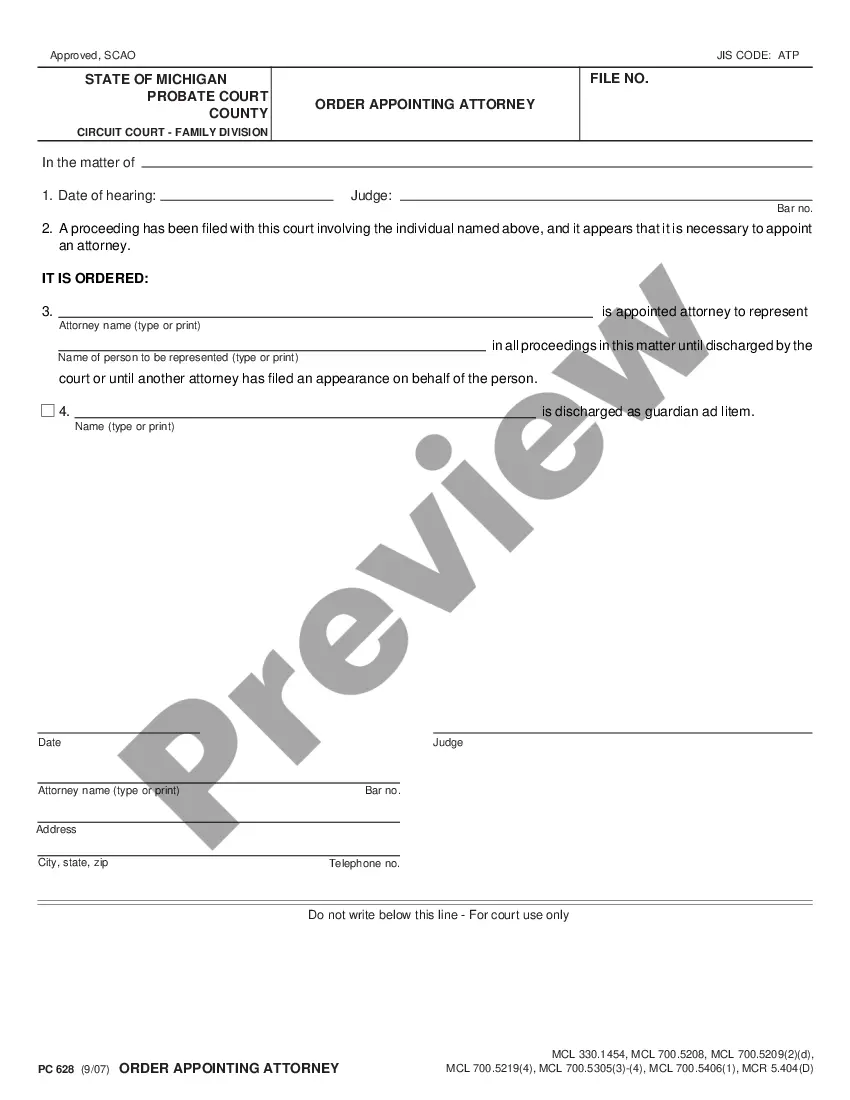

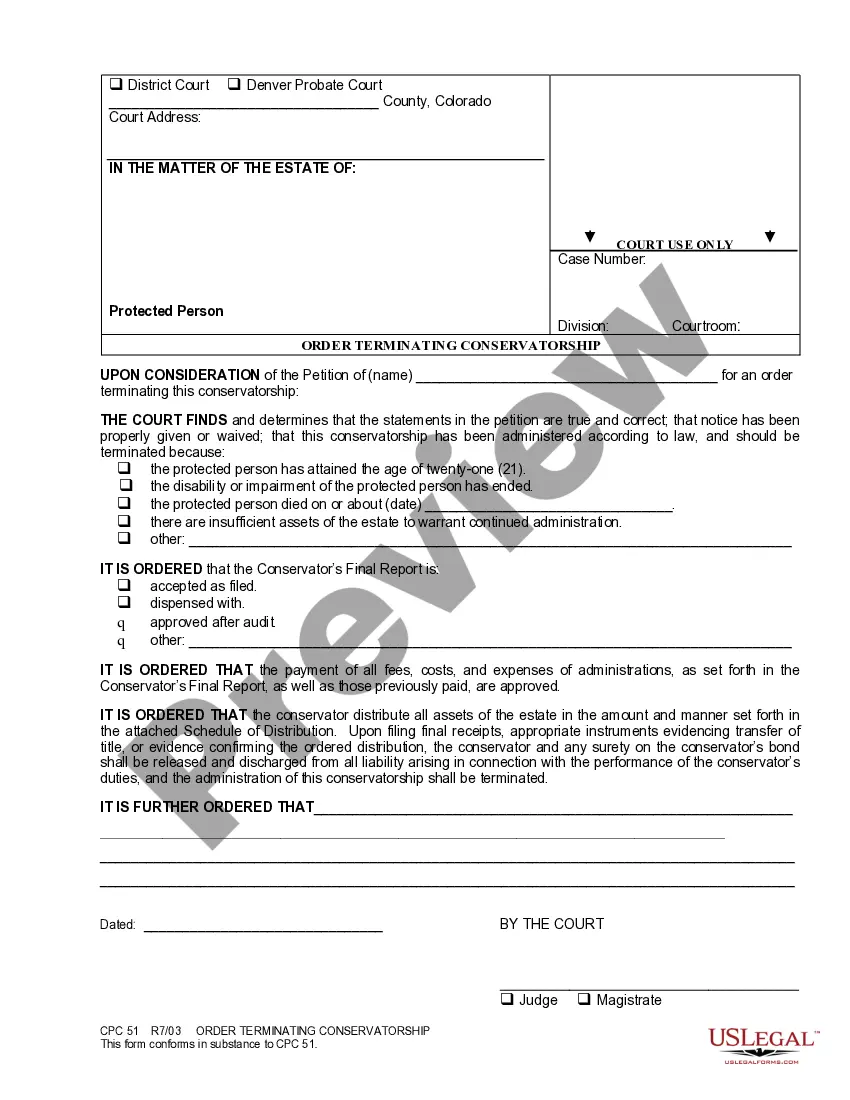

- Very first, make sure you have chosen the right develop for your city/state. It is possible to examine the form utilizing the Review button and read the form explanation to guarantee it will be the best for you.

- When the develop does not meet your needs, use the Seach discipline to obtain the correct develop.

- When you are certain that the form would work, click the Purchase now button to obtain the develop.

- Choose the pricing plan you need and enter the essential details. Create your account and pay for your order using your PayPal account or Visa or Mastercard.

- Choose the document formatting and download the lawful file design to the device.

- Comprehensive, modify and printing and sign the obtained Missouri Web Site Use Agreement.

US Legal Forms may be the most significant library of lawful forms in which you can discover a variety of file templates. Utilize the company to download professionally-manufactured papers that follow express demands.

Form popularity

FAQ

Registered Agent/Office An agent may be either an individual who is a resident of Missouri and whose business office is identical with the entity's registered office, or it may be a corporation authorized to transact business in Missouri and which has a business office identical with the entity's registered office.

A Missouri Retail Sales Tax number (or Use Tax) is needed if you will be selling at retail or wholesale. Collection of sales tax is required by any business making retail sales in any amount. Retailers should complete Missouri DOR form 2643.

Although there is no fee to get a Missouri sales tax ID number, Missouri statute does contain a bonding requirement for businesses making retail sales. Not-for-profit organizations can apply for a Missouri tax ID number by submitting Form 1746 (the Missouri Sales/Use Tax Exemption Application) Document.

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

File Your Missouri LLC Articles of Organization Select your LLC's official name. State the LLC's purpose. Provide the name and address of your registered agent. Decide how the LLC will be managed. Describe the duration of the LLC. Provide the names and addresses of your organizers. Select the type of LLC you're forming.

Only courts that have implemented the case management software as part of the Missouri Court Automation Program and only cases that have been deemed public under the Missouri Revised Statutes can be accessed through Case.net.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Income Tax Return for Estates and Trusts.