Missouri Elimination of the Class A Preferred Stock

Description

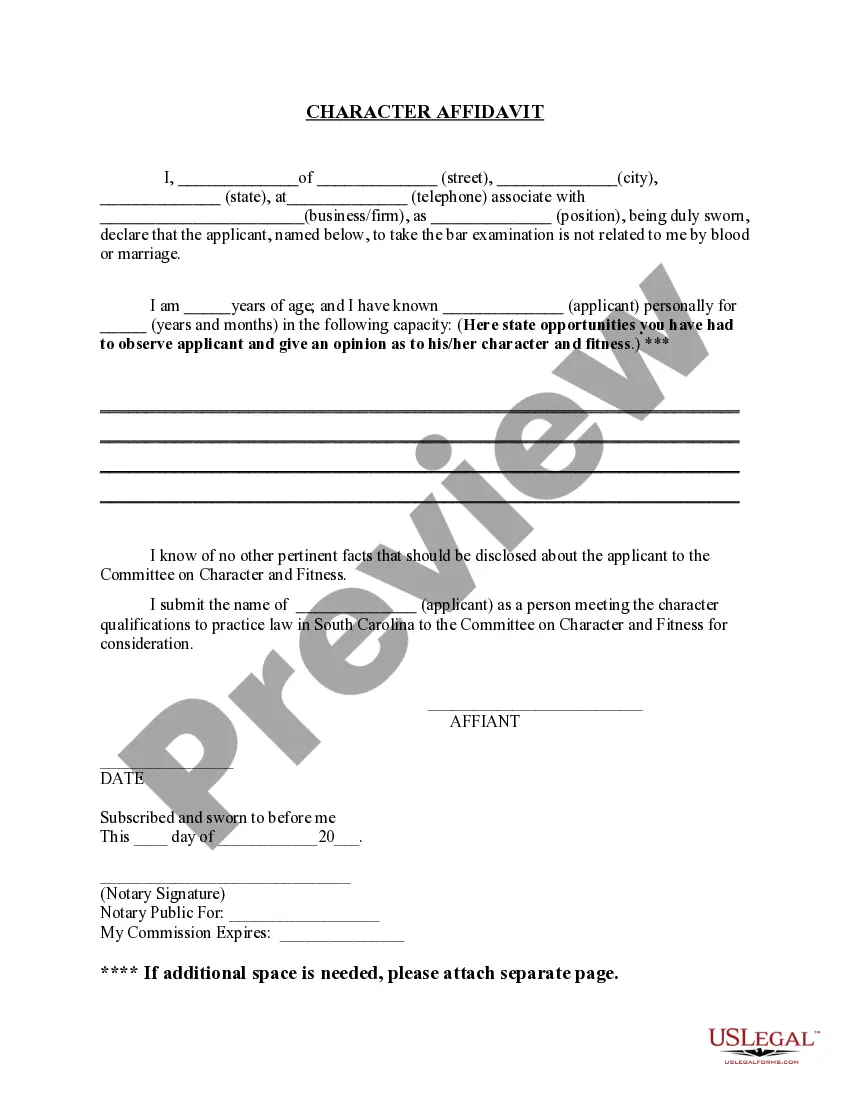

How to fill out Elimination Of The Class A Preferred Stock?

It is possible to spend hrs on the web trying to find the lawful papers template which fits the state and federal requirements you want. US Legal Forms provides 1000s of lawful varieties which can be reviewed by specialists. You can actually down load or print the Missouri Elimination of the Class A Preferred Stock from your support.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Down load button. Next, it is possible to comprehensive, change, print, or signal the Missouri Elimination of the Class A Preferred Stock. Every single lawful papers template you get is your own property forever. To acquire yet another copy of the bought type, check out the My Forms tab and click the related button.

If you work with the US Legal Forms website initially, adhere to the basic guidelines under:

- Very first, make sure that you have selected the correct papers template to the area/area of your choice. Browse the type outline to ensure you have picked out the right type. If offered, use the Preview button to check with the papers template also.

- In order to locate yet another model of the type, use the Search industry to find the template that meets your requirements and requirements.

- When you have found the template you desire, click on Buy now to carry on.

- Choose the rates strategy you desire, type in your credentials, and register for your account on US Legal Forms.

- Full the purchase. You can utilize your bank card or PayPal bank account to fund the lawful type.

- Choose the format of the papers and down load it for your product.

- Make adjustments for your papers if possible. It is possible to comprehensive, change and signal and print Missouri Elimination of the Class A Preferred Stock.

Down load and print 1000s of papers web templates while using US Legal Forms web site, that offers the biggest collection of lawful varieties. Use expert and condition-distinct web templates to deal with your business or specific requires.

Form popularity

FAQ

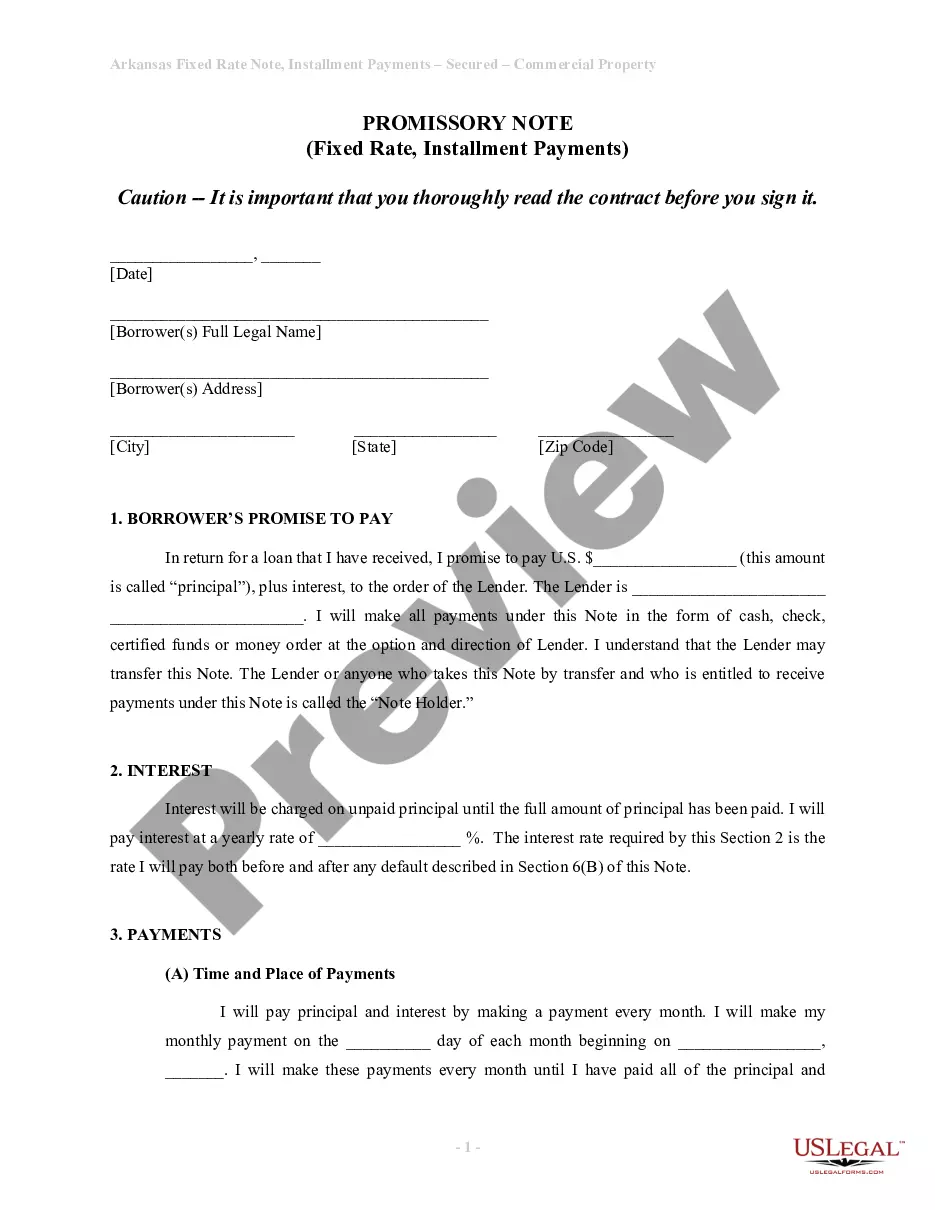

The company's par value is calculated by multiplying the par value per share by the total number of shares issued. That means you'll just need to grab your calculator and key in the math.

The balance sheet method In particular, the common stock line of the balance sheet will typically have a number that equals the par value of each share multiplied the number of shares issued. Therefore, if you have the balance sheet entry and the par value, you can calculate the issued share count. How to Calculate the Number of Shares in a Firm | The Motley Fool fool.com ? knowledge-center ? how-to-calc... fool.com ? knowledge-center ? how-to-calc...

The different variables to be considered in calculating the cost of preferred stock include: Par Value is the value at which the stock is issued. Dividend is the percentage of par value paid out as dividends. Market value is the current trading price of the preferred stock.

You can usually tell the difference between a company's common and preferred stock by glancing at the ticker symbol. The ticker symbol for preferred stock usually has a P at the end of it, but unlike common stock, ticker symbols can vary among systems; for example, Yahoo! How to Know the Difference between Common and Preferred Stock dummies.com ? article ? investing ? dividends dummies.com ? article ? investing ? dividends

The formula for calculating the cost of preferred stock is the annual preferred dividend payment divided by the current share price of the stock. Similar to common stock, preferred stock is typically assumed to last into perpetuity ? i.e. with unlimited useful life and a forever-ongoing fixed dividend payment.