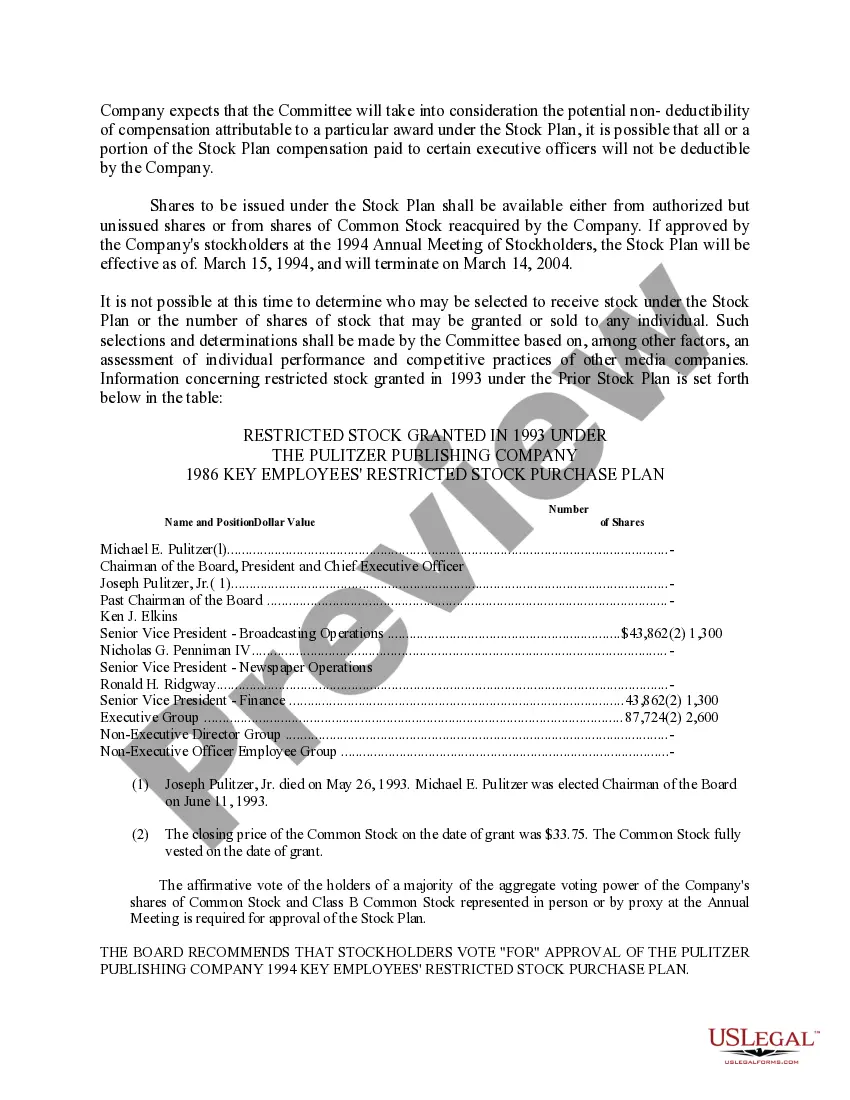

Missouri Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.

Description

How to fill out Approval Of Key Employees' Restricted Stock Purchase Plan Of The Pulitzer Publishing Co.?

US Legal Forms - one of the biggest libraries of legal types in America - provides a wide range of legal papers templates you can down load or print. Utilizing the internet site, you can find a huge number of types for enterprise and personal functions, categorized by types, suggests, or keywords and phrases.You will find the most up-to-date versions of types much like the Missouri Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. within minutes.

If you already possess a registration, log in and down load Missouri Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. from the US Legal Forms local library. The Acquire option can look on each and every type you look at. You have access to all in the past acquired types from the My Forms tab of your own bank account.

In order to use US Legal Forms for the first time, allow me to share straightforward directions to obtain started off:

- Be sure to have picked the correct type to your area/state. Click on the Review option to analyze the form`s information. Look at the type explanation to ensure that you have selected the proper type.

- When the type does not suit your specifications, utilize the Research discipline on top of the screen to obtain the one who does.

- Should you be content with the shape, validate your option by simply clicking the Purchase now option. Then, opt for the prices strategy you favor and supply your qualifications to register for the bank account.

- Approach the financial transaction. Make use of bank card or PayPal bank account to accomplish the financial transaction.

- Choose the formatting and down load the shape in your device.

- Make changes. Fill up, revise and print and indication the acquired Missouri Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co..

Each design you included with your bank account does not have an expiry time which is your own property for a long time. So, if you want to down load or print one more version, just go to the My Forms segment and click on about the type you will need.

Gain access to the Missouri Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. with US Legal Forms, the most comprehensive local library of legal papers templates. Use a huge number of expert and status-specific templates that meet up with your organization or personal requirements and specifications.

Form popularity

FAQ

We'd recommend maximizing your ESPP sometimes even before maximizing your 401(k). The percentage will vary, but you'll want to maximize your ESPP contributions however you can. Note: If you have the ability to max out an HSA or Roth IRA, those should be priorities as well.

The IRS limits purchases under a Section 423 plan to $25,000 worth of stock value (based on the grant date fair market value) for each calendar year in which the offering period is effective.

An ESPP must be approved by the stockholders of the sponsoring corporation within the period commencing 12 months before and ending 12 months after the ESPP is adopted by the sponsoring corporation's board of directors.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.

However, there is a limit on ESPP maximum contribution. Under a Section 423 plan, the IRS limits purchases to $25,000 worth of stock value (based on the FMV on the offering date) for each calendar year.

If your company offers a tax-qualified ESPP and you decide to participate, the IRS will only allow you to purchase a maximum of $25,000 worth of stock in a calendar year. Any contributions that exceed this amount are refunded back to you by your company.