Missouri Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

You may commit several hours on-line trying to find the lawful papers template that meets the state and federal demands you will need. US Legal Forms supplies thousands of lawful varieties which are examined by professionals. It is simple to obtain or print out the Missouri Proposal to approve material terms of stock appreciation right plan from the support.

If you already have a US Legal Forms account, you can log in and click on the Download option. Afterward, you can full, edit, print out, or indication the Missouri Proposal to approve material terms of stock appreciation right plan. Each and every lawful papers template you purchase is your own property for a long time. To have an additional copy of any purchased develop, proceed to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms internet site the very first time, keep to the basic recommendations under:

- Very first, ensure that you have chosen the proper papers template for your state/metropolis of your liking. See the develop explanation to make sure you have selected the proper develop. If accessible, make use of the Review option to appear throughout the papers template as well.

- If you would like locate an additional edition in the develop, make use of the Lookup discipline to obtain the template that meets your requirements and demands.

- Once you have discovered the template you would like, just click Acquire now to move forward.

- Pick the costs strategy you would like, key in your credentials, and register for a free account on US Legal Forms.

- Full the financial transaction. You may use your credit card or PayPal account to fund the lawful develop.

- Pick the formatting in the papers and obtain it to the product.

- Make adjustments to the papers if required. You may full, edit and indication and print out Missouri Proposal to approve material terms of stock appreciation right plan.

Download and print out thousands of papers web templates utilizing the US Legal Forms Internet site, which offers the biggest collection of lawful varieties. Use professional and condition-certain web templates to take on your company or person needs.

Form popularity

FAQ

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

A stock appreciation right is a contract between an employer and an employee that grants the employee the right to receive a payment tied to any increase in the value of the employer's stock. When granting a stock appreciation right, the employer does not grant the employee any shares of the employer's stock.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Once a SAR vests, an employee can exercise it at any time prior to its expiration. The proceeds will be paid either in cash, shares, or a combination of cash and shares depending on the rules of an employee's plan.

There are no U.S. federal income tax consequences when an employee is granted SARs. However, at exercise an employee will recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

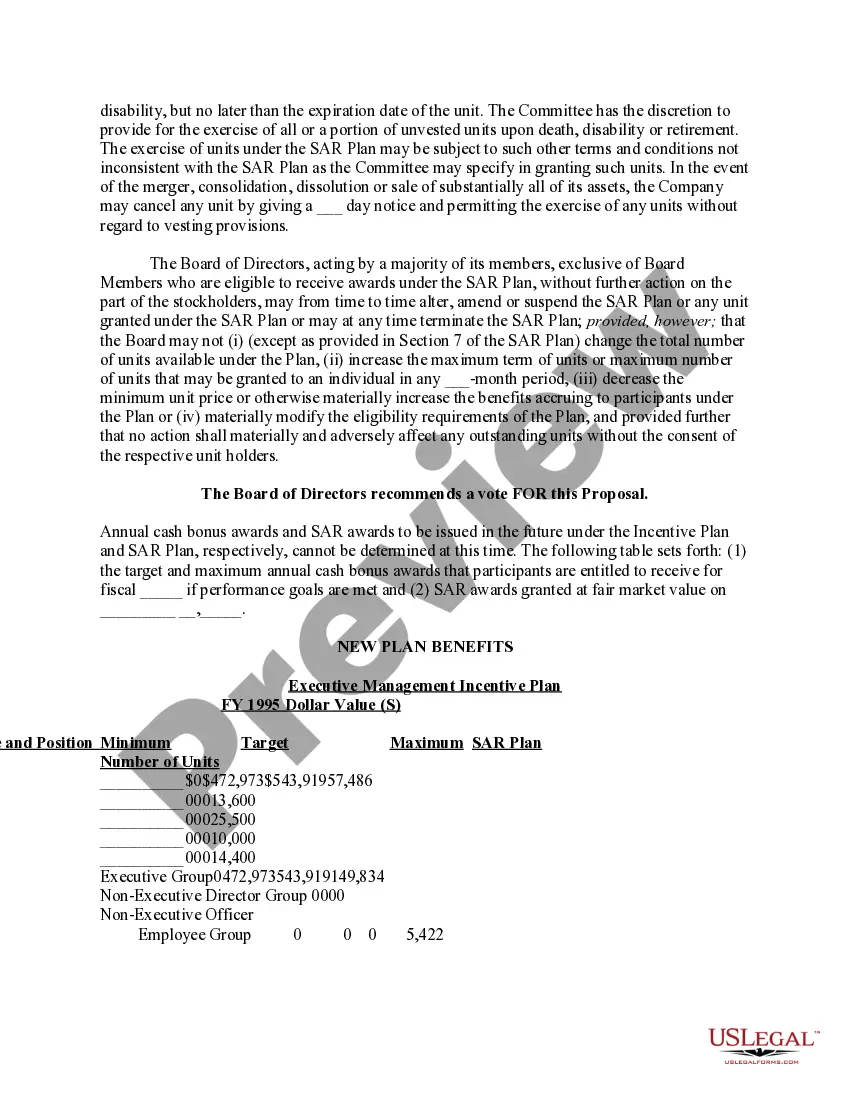

?Stock Appreciation Right? or ?SAR? means a hypothetical or ?phantom? unit of ownership in the Corporation, as awarded to a Participant under Section 5 of this Plan, having a total value equivalent to one share of Common Stock.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.