Missouri Log of Records Retention Requirements

Description

How to fill out Log Of Records Retention Requirements?

If you want to be thorough, acquire, or producing valid document templates, utilize US Legal Forms, the most extensive range of legal forms available on the Internet.

Utilize the site's simple and effective search tool to obtain the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to acquire the Missouri Log of Records Retention Requirements in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account.

Choose the My documents section and select a form to print or download again. Stay competitive and acquire, and print the Missouri Log of Records Retention Requirements with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to locate the Missouri Log of Records Retention Requirements.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

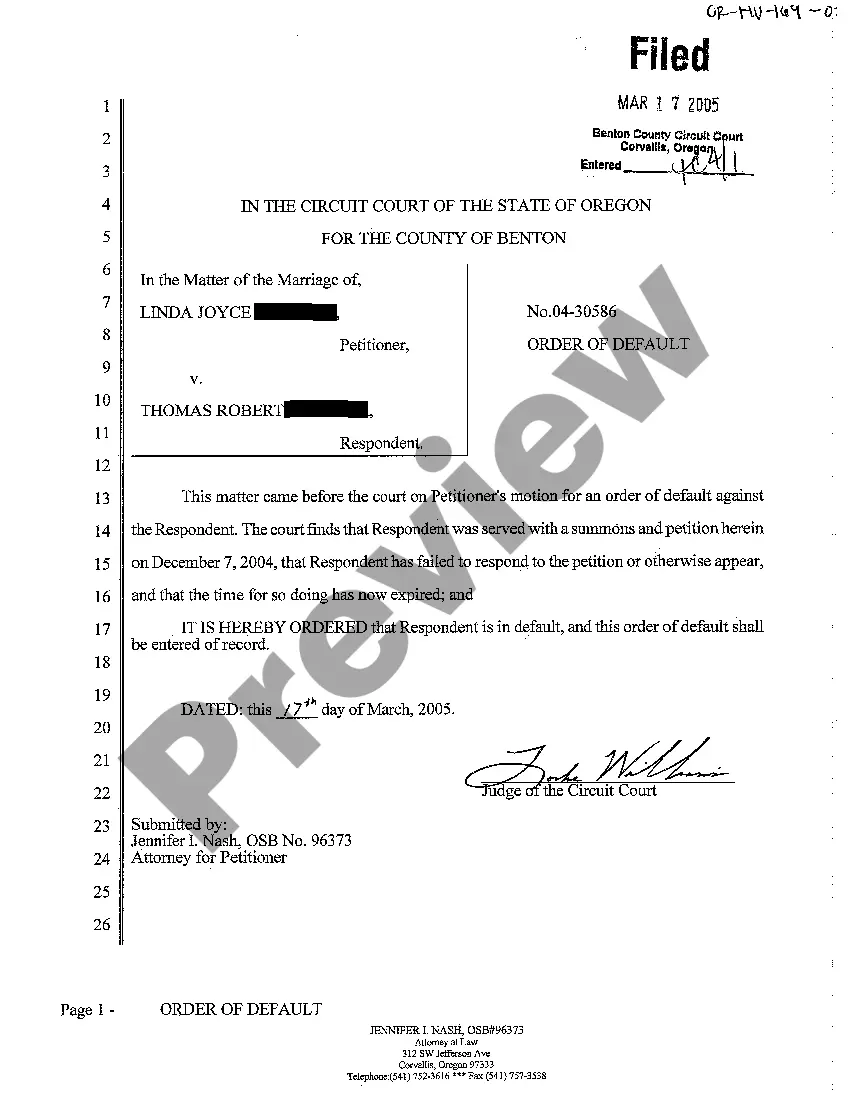

- Step 2. Use the Preview feature to examine the form's details. Remember to review the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and provide your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Missouri Log of Records Retention Requirements.

Form popularity

FAQ

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Any legal records, such as licenses, patents, registration forms and tax ID forms should also be kept throughout the business' life. Tax records have to be kept for a minimum of three years, however, these records may come in handy to your business in the long run so it does not hurt to hold on to them indefinitely.

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

The general minimum amount of time to keep business records is a minimum of 7 years. The following documents and records should be kept; Business Tax Returns and other supporting documents: Until the IRS can no longer audit your return.

The minimum retention period is the shortest amount of time that a WORM file can be retained in a SnapLock volume. If the application sets the retention period shorter than the minimum retention period, Data ONTAP adjusts the retention period of the file to the volume's minimum retention period.

Employers must keep a record of the name, address, and job description of each employee, the rate of pay, the amount paid each pay period, and the number of hours worked each day and each workweek (see Section 290.520 RSMo). These records must be kept for a period of no less than three years.

How much should be the retention of internal audit and MRM records? The logical answer is a minimum of 3 years as that is the time frame of ISO certificate.

Howevber, the law states that employers must retain employee records in certain situations (for example working time and tax) and employers are advised to retain the records for themselves for six years in case they are sued for breach of contract.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.