Missouri Home Based Worker Policy

Description

How to fill out Home Based Worker Policy?

Selecting the finest legal document template can be a challenge. Of course, there are numerous templates available online, but how can you find the legal form you require.

Visit the US Legal Forms website. The service offers thousands of templates, such as the Missouri Home Based Worker Policy, which can be utilized for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already a member, Log In to your account and click the Download button to acquire the Missouri Home Based Worker Policy. Use your account to browse the legal forms you have previously purchased. Check the My documents tab in your account to get another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted paperwork that adheres to state regulations.

- First, ensure you have selected the correct form for your jurisdiction/state.

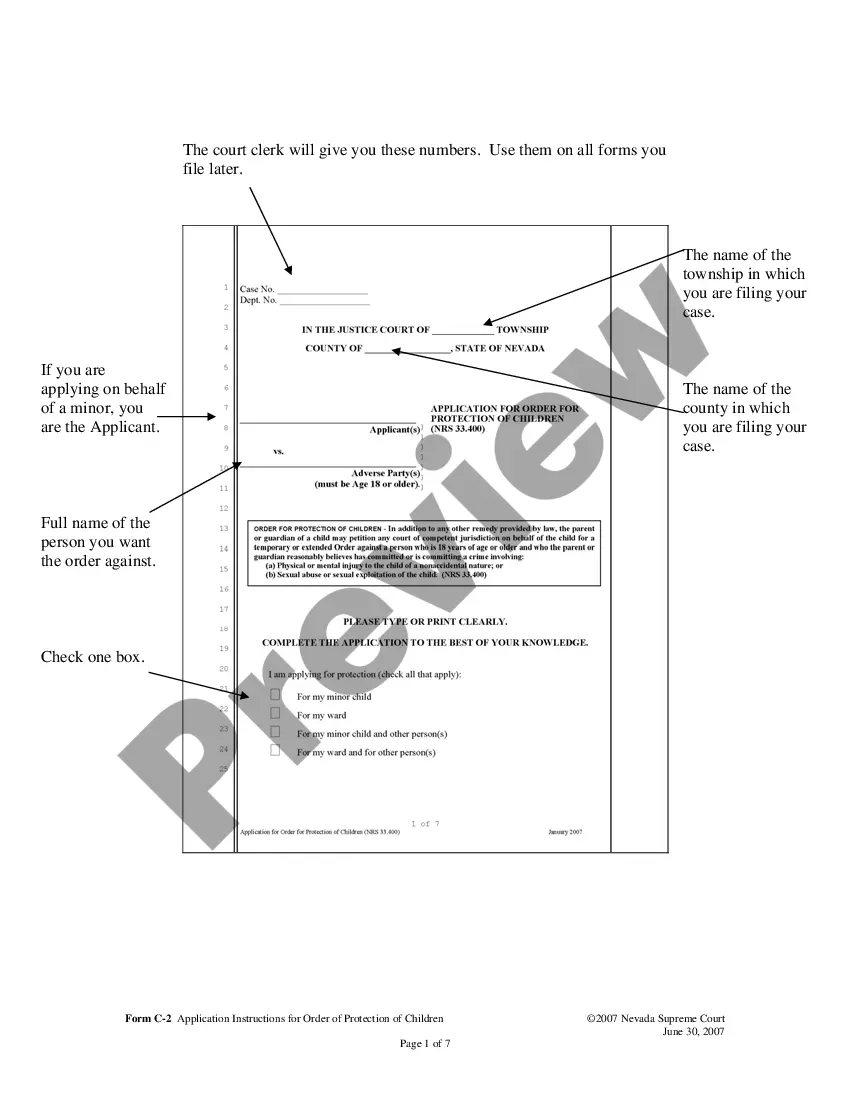

- You can preview the template using the Review button and read the form description to verify it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the right form.

- Once you are confident the form is appropriate, click the Purchase now button to acquire the form.

- Choose the payment method you prefer and enter the required details.

- Create your account and finalize the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the downloaded Missouri Home Based Worker Policy.

Form popularity

FAQ

Generally, remote work performed for a Missouri employer outside of Missouri may not be taxable if certain conditions are met. The specific tax implications vary based on state laws and the nature of the work done. Understanding these nuances is important under the Missouri Home Based Worker Policy, so consulting a tax advisor can be beneficial.

Yes. Any time an employee is performing services for an employer in exchange for wages in Missouri, those wages are subject to Missouri withholding. This rule also applies when an employee is located in Missouri and performs services for the employer within Missouri on a remote basis.

You're required to file a Missouri tax return if you receive income from a Missouri source. There are a few exceptions: You're a Missouri resident, and your state adjusted gross income is less than $1,200. You're a nonresident, and your Missouri income was less than $600.

Are my nonresident partners required to file an income tax return if I make a withholding payment for them? Yes, each nonresident partner is required to file a Missouri Income Tax Return (Form MO-1040).

Call the Missouri Department of Health and Senior Services at 573-751-6400 or apply through the local Missouri Department of Social Services office.

As a Missouri resident, you can receive payment as a caregiver through the Cash and Counseling program. This is a Medicaid program that provides beneficiaries with cash assistance and the ability to self-direct the spending of that cash on caregivers of their choosing.

You are a resident and have less than $1,200 of Missouri adjusted gross income; You are a nonresident with less than $600 of Missouri income; OR. Your Missouri adjusted gross income is less than the amount of your standard deduction plus your exemption amount.

History of Missouri Labor LawsThe minimum wage was $9.45 per hour in 2020, $8.60 per hour in 2019, $7.85 per hour in 2018, $7.70 per hour in 2017 and $7.65 per hour in 2016. The hourly wage will continue to increase as follows: $11.15, effective Jan. 1, 2022.

Per Genworth's 2019 Cost of Care Survey, the cost of non-medical home care in Missouri averages $22.00 / hour throughout the state in 2020. In Jefferson City, Springfield, and Cape Girardeau, the hourly cost of home care is the most affordable in the state at $17.38 $21.16 / hour.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.