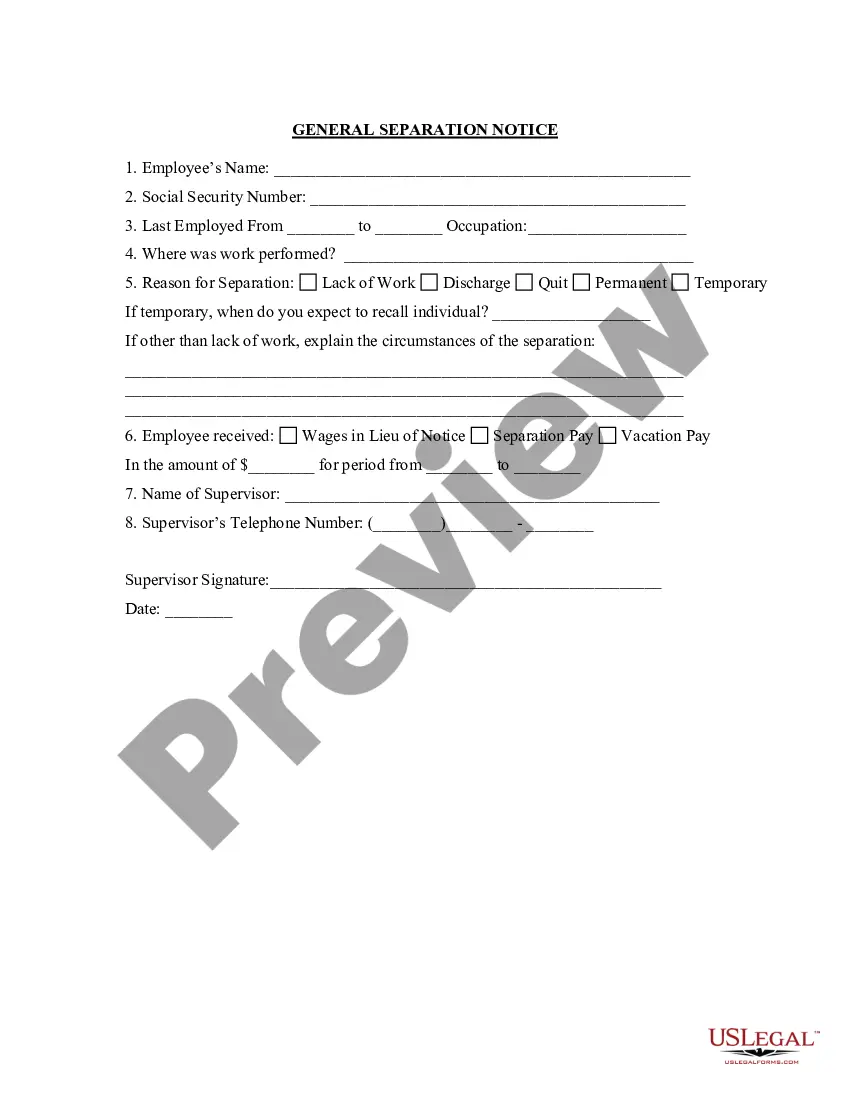

Missouri Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

If you wish to access, download, or print validated document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Take advantage of the site's straightforward and convenient search feature to find the files you need. Numerous templates for both personal and business purposes are organized by categories and states, or by terms.

Leverage US Legal Forms to obtain the Missouri Separation Notice for 1099 Employee with just a few clicks.

Every legal document template you purchase is yours permanently. You can access any form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Missouri Separation Notice for 1099 Employee with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms client, sign in to your account and click the Download button to obtain the Missouri Separation Notice for 1099 Employee.

- You can also retrieve forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's details. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to discover other varieties of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your preferred payment plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Missouri Separation Notice for 1099 Employee.

Form popularity

FAQ

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Because independent contractors pay self-employment tax, employers typically do not have to withhold taxes from their wages. There is, however, an exception known as backup withholding.

Unemployment compensation under the PUA program provides for up to 39 weeks of benefits for individuals who are self-employed (including independent contractors).

The DES notification will require those self-employed, gig workers, independent contractors, and those who otherwise do not qualify for regular unemployment benefits to provide proof of employment and they may also choose to provide proof of earnings to potentially increase the amount of benefits received each week.

The self-employed, gig workers and others that Congress made temporarily eligible for unemployment benefits can now claim them in Missouri. In a news release Monday, the state labor department said it is now processing claims for those newly eligible and laid out the process for filing for the new federal program.

In Missouri, certain employees have a right to request that their employer provide them a signed letter stating what they did for the employer and why they were discharged or voluntarily quit their employment.

What is the Self-Employment Tax? The self-employment tax rate is 15.3% (12.4% for Social Security tax and 2.9% for Medicare). The self-employment tax applies to your adjusted gross income. If you are a high earner, a 0.9% additional Medicare tax may also apply.

In most cases, businesses do not withhold taxes from any payments to an independent contractor. If, however, backup withholding applies, employers may be required to deduct a portion of the individual's earnings and send it to the IRS directly.

PUA provides benefits to qualifying individuals who are otherwise able to work and available for work within the meaning of state law, except that they are unemployed, partially unemployed, or unable or unavailable to work due to COVID-19 related reasons, as defined in the CARES Act.