Missouri Shipping Reimbursement

Description

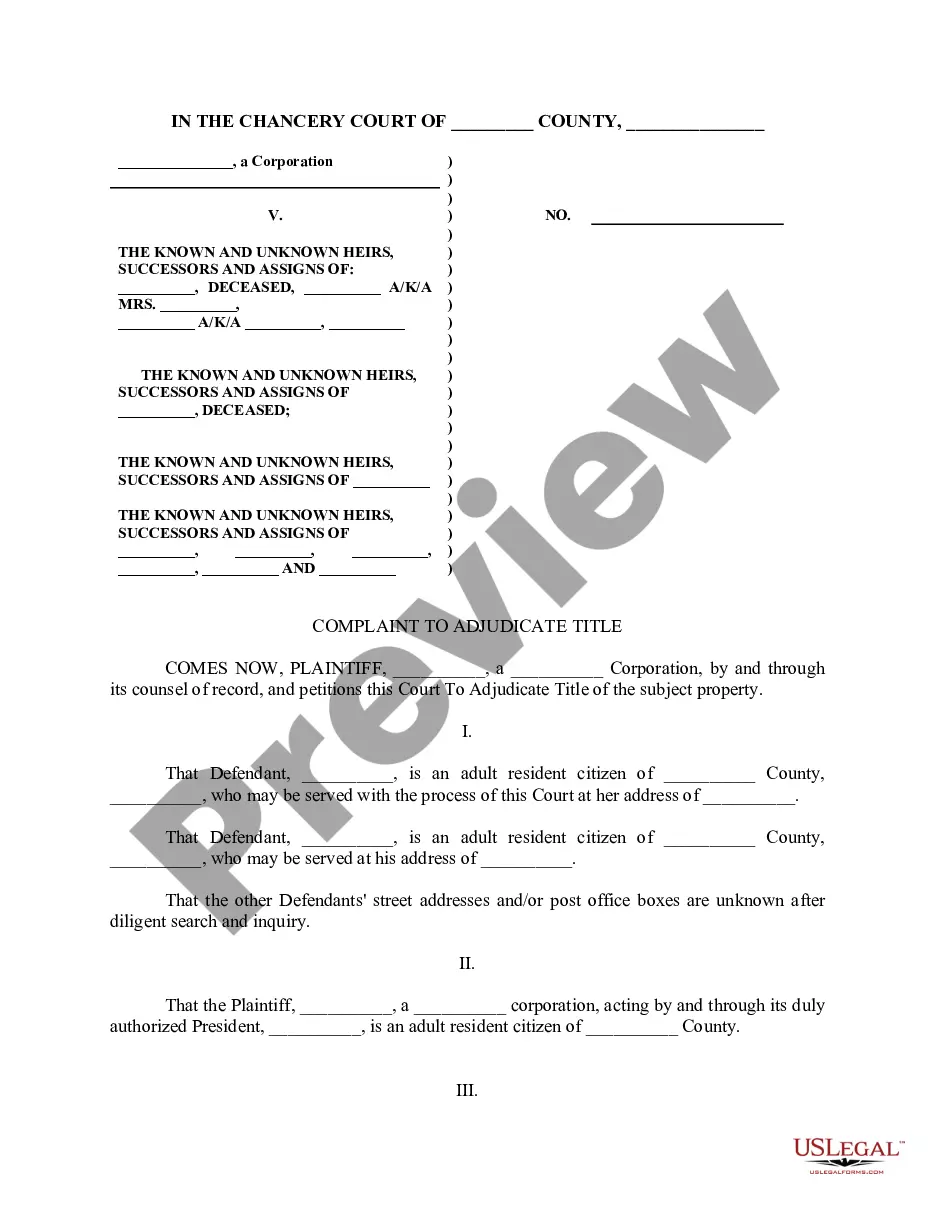

How to fill out Shipping Reimbursement?

It is feasible to spend hours online looking for the legal document template that conforms to the federal and state regulations you need.

US Legal Forms offers numerous legal documents that can be evaluated by experts.

You can easily download or print the Missouri Shipping Reimbursement from the service.

If available, utilize the Review button to browse the document template as well.

- If you have an existing US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the Missouri Shipping Reimbursement.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen area/city.

- Review the form description to ensure you have selected the right document.

Form popularity

FAQ

Missourians will only be refunded on the 2.5 cent increase per gallon, and not the entire fuel tax. Additionally, only Missouri motor fuel vehicles weighing less than 26,000 pounds for highway use will be eligible.

Generally, a business has nexus in Missouri when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

For the most part, if you ship taxable items, then all shipping charges are taxable. And if you ship all non-taxable items in a parcel, then the shipping charges for that parcel are non-taxable.

The diesel rebate service allows you to apply online for a diesel rebate under the Diesel Rebate Scheme (DRS)....Once you have registered:click on the 'My Services' section from the ROS main menu.click on the 'File a return' section.select the return type of 'Diesel Rebate' and 'Diesel Rebate Claim'.25-Feb-2021

According to Missouri DOR, A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and available for inspection by the department for three years. Refund claims can be submitted from July 1, 2022, to Sept. 30, 2022 on purchases made after Oct.

Form MO-NRI: Form MO-NRI is used when a nonresident elects to pay taxes on the percentage of income (Missouri income percentage) earned in Missouri, or when a part-year resident chooses to pay taxes on the percentage of income earned while a Missouri resident.

You can use Form 4136 to claim the credit for mixtures or fuels sold or used during the 2021 calendar year. Use Form 4136 to claim the following. during your income tax year.

Shipping and handling Shipping charges for taxable goods are generally taxable in Missouri, if included in the sale price or when the purchaser is required to pay it. If the purchaser is not required to pay shipping and the charges are separately stated, they're generally exempt.

According to Missouri DOR, A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and available for inspection by the department for three years. Refund claims can be submitted from July 1, 2022, to Sept. 30, 2022 on purchases made after Oct.

As of August 28, 2017, separately stated delivery charges are exempt from sales and use taxes. Missouri Governor Eric Greitens signed Senate Bill No. 16, indicating that gross receipts should not include usual and customary delivery charges, and that delivery charges should be stated separately from the sale price.