Missouri Lost Receipt Form

Description

How to fill out Lost Receipt Form?

Have you ever found yourself in a situation where you require documents for various business or personal purposes frequently.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides a vast selection of template forms, including the Missouri Lost Receipt Form, designed to comply with state and federal regulations.

Once you locate the appropriate form, click Get now.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Lost Receipt Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/county.

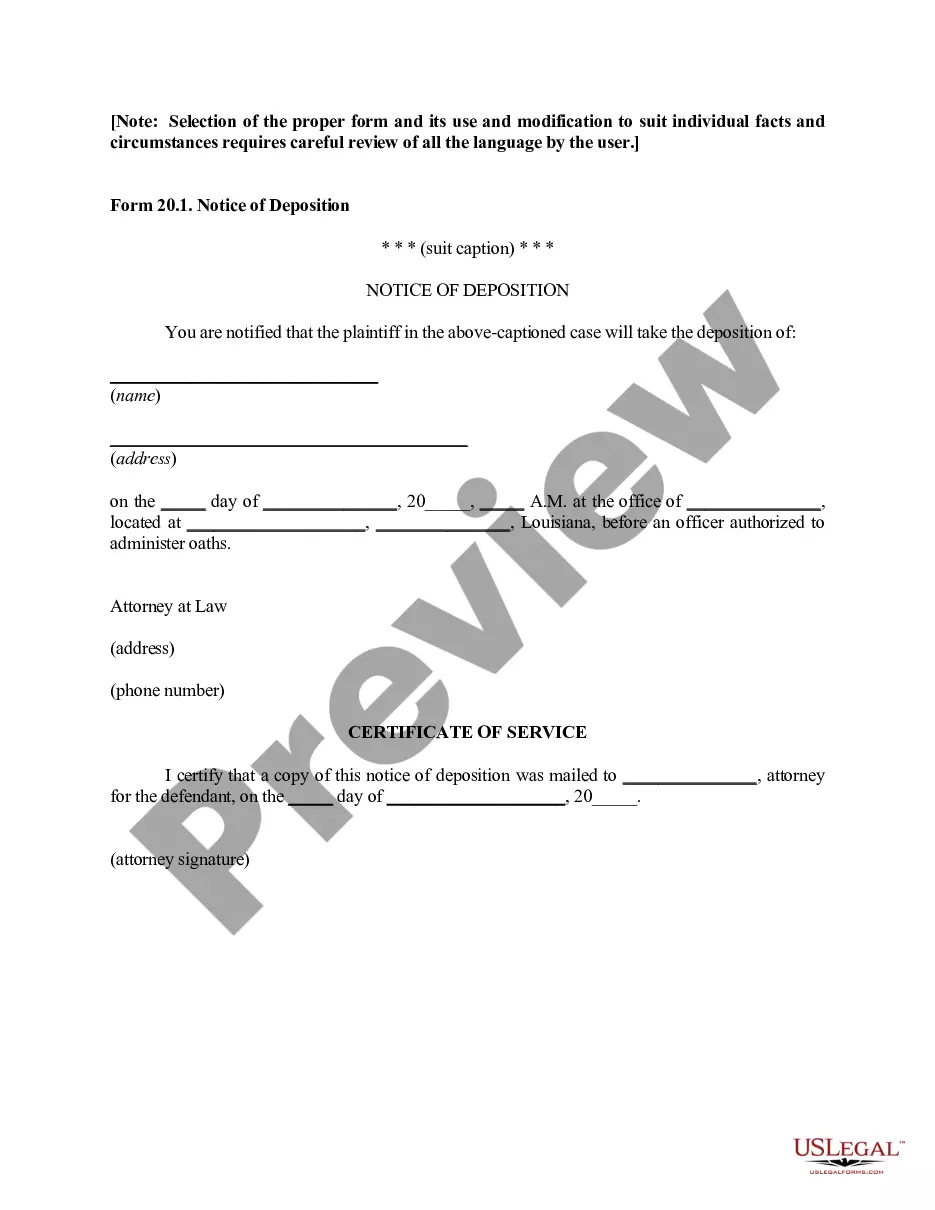

- Utilize the Review feature to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form does not match what you're looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

To register an out-of-state title in Missouri, gather your out-of-state title, identification, and proof of residency. It is crucial to visit a local Missouri Department of Revenue office to submit your documents. If you have lost any documents during the process, remember that a Missouri Lost Receipt Form can assist you in obtaining replacements.

Missouri's bills of sale for automobiles can be notarized, but it isn't legally required. The seller is, however, required to fill out an odometer disclosure statement form. A bill of sale is required to register a vehicle in Missouri, and the seller also needs to fill out a Notice of Sale (Form 5049).

This Bill of Sale form is also necessary to receive a clear title and registration for your vehicle. Thousands and thousands of vehicles are sold in Missouri every year. As a seller, there are certain things you should know before you enter into the sale of a vehicle.

Yes. A Missouri bill of sale is required to register your vehicle. The bill of sale should be turned over to the Department of Revenue by the seller. The seller will also need to complete a Notice of Sale (Form 5049).

To obtain a duplicate registration receipt, you must submit a completed, signed, and notarized form Application for Duplicate Title/Registration Receipt (Form 2519) with a check for $14.50, payable to the Missouri Department of Revenue.

Remember: All sellers and purchasers must print their names and sign the back of the title in the assignment area. These signatures do not need to be notarized. The seller must write in the odometer reading and date of sale.

Missouri law states that all sellers must submit either a Notice of Sale (form 5049) or Bill of Sale (DOR-1957) to the state's Department of Revenue within 30 days from the date of sale. The Bill of Sale needs to include the following information and should be notarized: Year and Make of the Vehicle. Title number.

If the state does not require a title, you must obtain a bill of sale. The bill of sale must include the buyer's and seller's names, addresses, signatures; and the purchase date, purchase price, year, make, and vehicle identification number of the vehicle being sold.

Missouri's bills of sale for automobiles can be notarized, but it isn't legally required. The seller is, however, required to fill out an odometer disclosure statement form. A bill of sale is required to register a vehicle in Missouri, and the seller also needs to fill out a Notice of Sale (Form 5049).

Effective January 1, 2006, the seller of a motor vehicle, trailer, or all-terrain vehicle must report the sale within 30 days to the Department. Sellers, other than Missouri licensed dealers, must submit a completed Notice of Sale (Form 5049) Document or Bill of Sale (Form 1957) Document form to report the sale.