Missouri Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

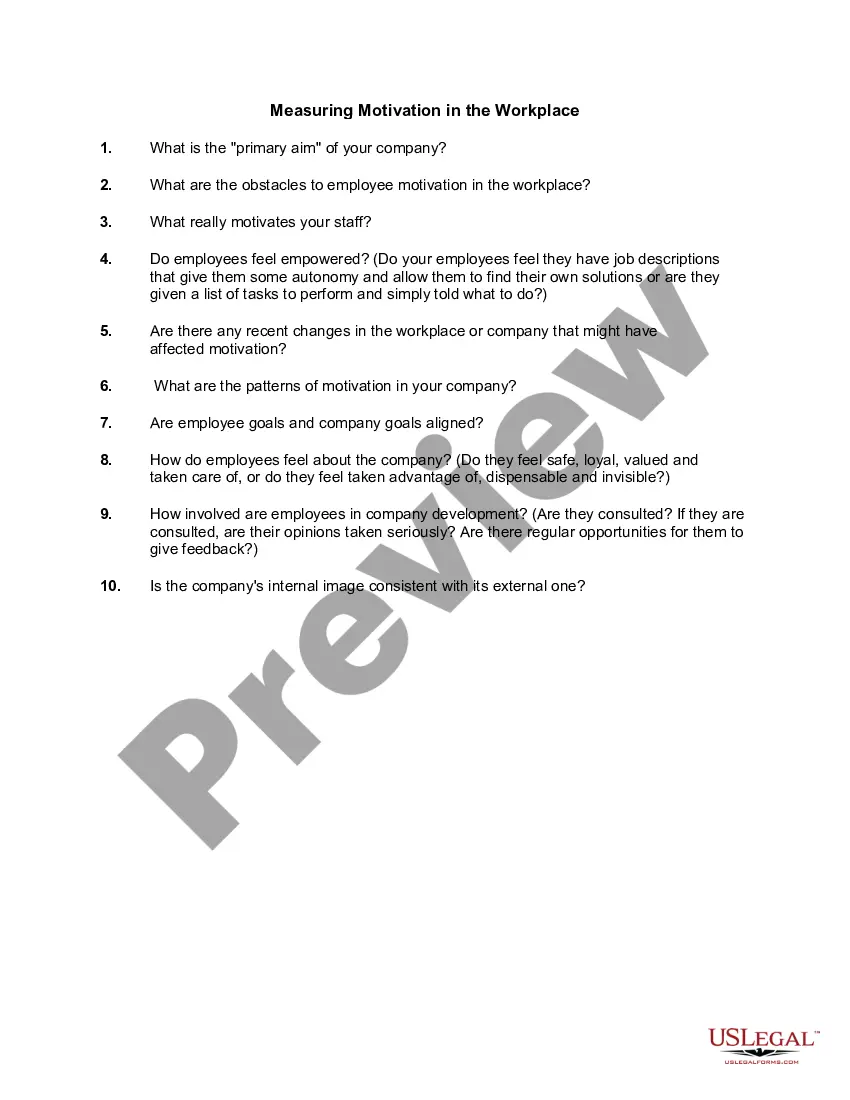

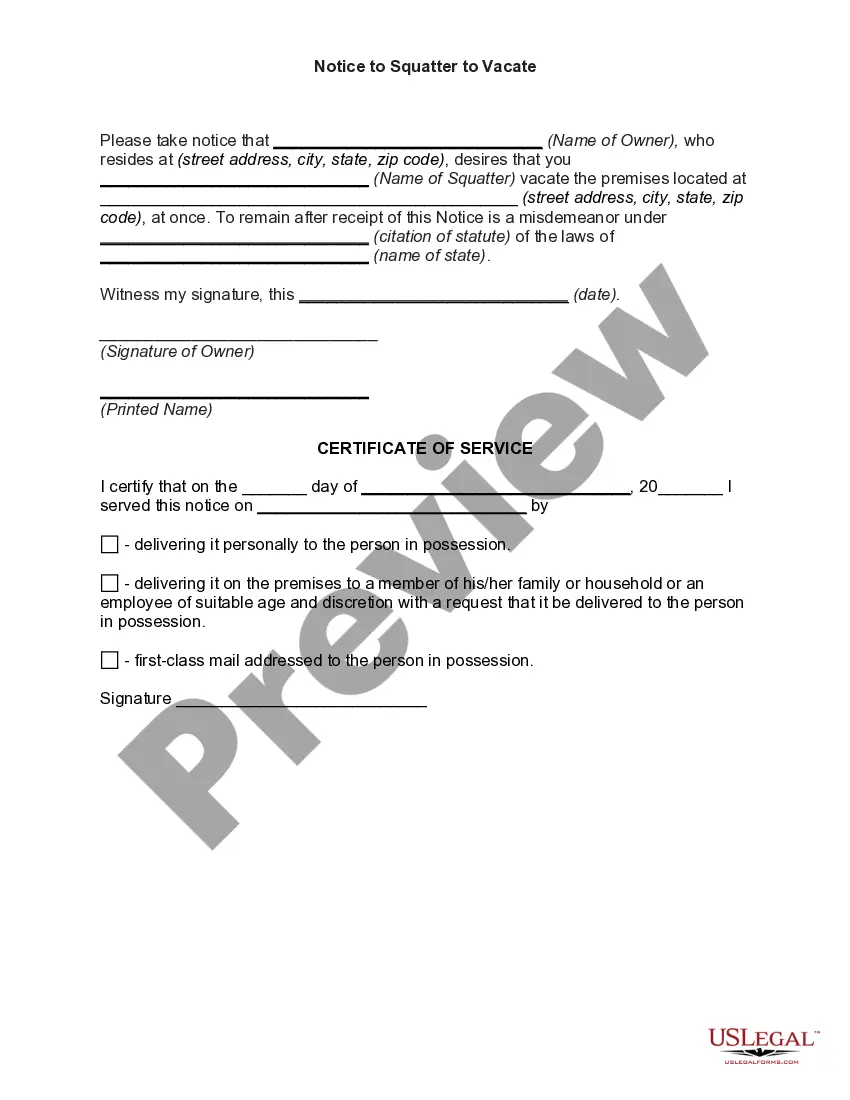

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Locating the appropriate authentic file template can be a challenge.

Of course, there are numerous templates available on the internet, but how can you get the genuine form you require.

Utilize the US Legal Forms website. The service offers a plethora of templates, including the Missouri Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, which you can use for both business and personal purposes.

First, make sure you have selected the appropriate form for your area/county. You can review the form using the Review button and examine the form description to ensure this is indeed the right choice for you. If the form does not meet your needs, use the Search area to find the correct form. Once you are certain the form is accurate, select the Buy now option to purchase the form. Choose the subscription plan you want and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, and print out the Missouri Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status. US Legal Forms is the largest repository of legal forms where you can access various document templates. Leverage the service to download professionally crafted documents that adhere to state regulations.

- All the documents are reviewed by experts and satisfy federal and state regulations.

- If you are already registered, sign in to your account and click the Acquire button to obtain the Missouri Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- Use your account to search for the legal forms you have previously purchased.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, the following are straightforward steps for you to follow.

Form popularity

FAQ

How to Form a Missouri Nonprofit CorporationChoose directors for your nonprofit.Choose a name for your nonprofit.Appoint a registered agent.File Missouri nonprofit Articles of Incorporation.Prepare nonprofit bylaws.Hold a meeting of your board of directors.Obtain an employer identification number (EIN).More items...

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).

Any social, civic, religious, political subdivision or educational organization can apply for a sales tax exemption by completing Form 1746 Document, Missouri Sales Tax Exemption Application. This form lists the information needed to verify the organization is indeed a tax-exempt non-profit organization.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

A first important distinction to make is that granting nonprofit status is done by the state, while applying for tax-exempt designation (such as 501(c)(3), the charitable tax-exemption) is granted by the federal government in the form of the IRS.

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

You are a resident and have less than $1,200 of Missouri adjusted gross income; You are a nonresident with less than $600 of Missouri income; OR. Your Missouri adjusted gross income is less than the amount of your standard deduction plus your exemption amount.

Visit dor.mo.gov/taxation/business/tax-types/sales-use/exemptions.php for additional information. Select the appropriate box for the type of exemption to be claimed and complete any additional information requested.

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.