Missouri Sales Order Form

Description

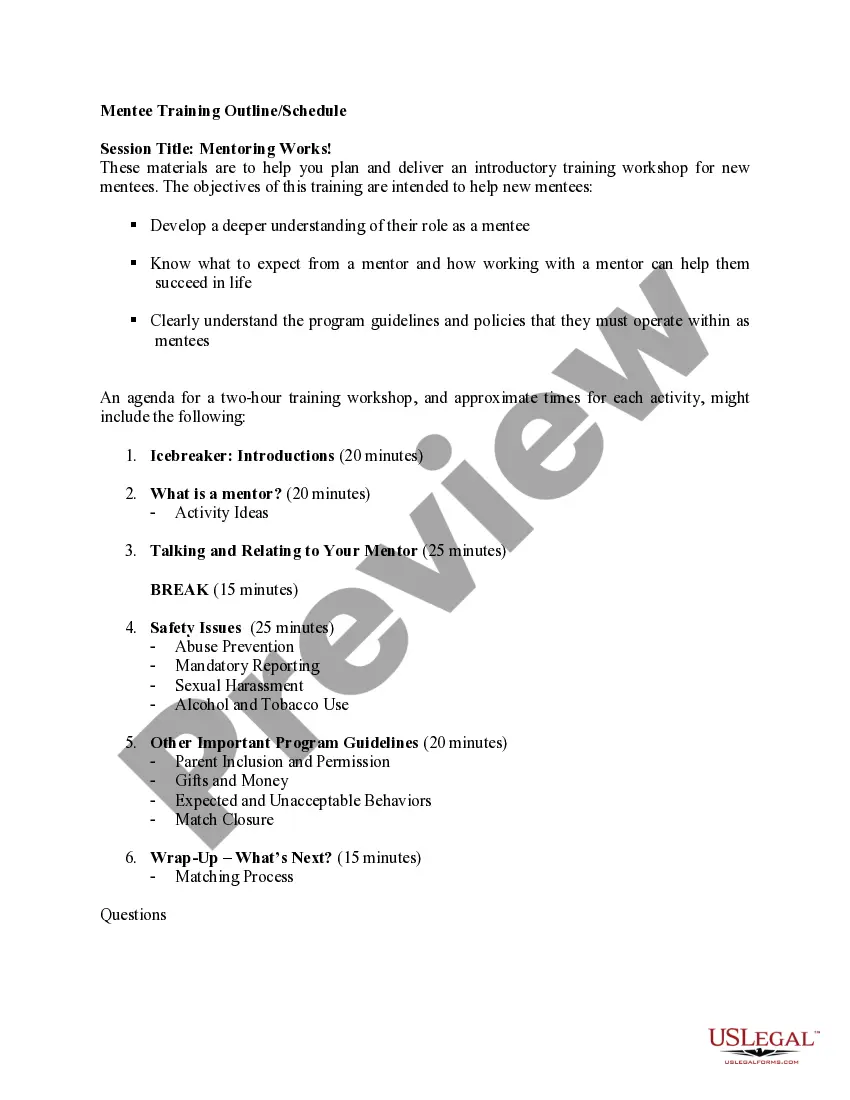

How to fill out Sales Order Form?

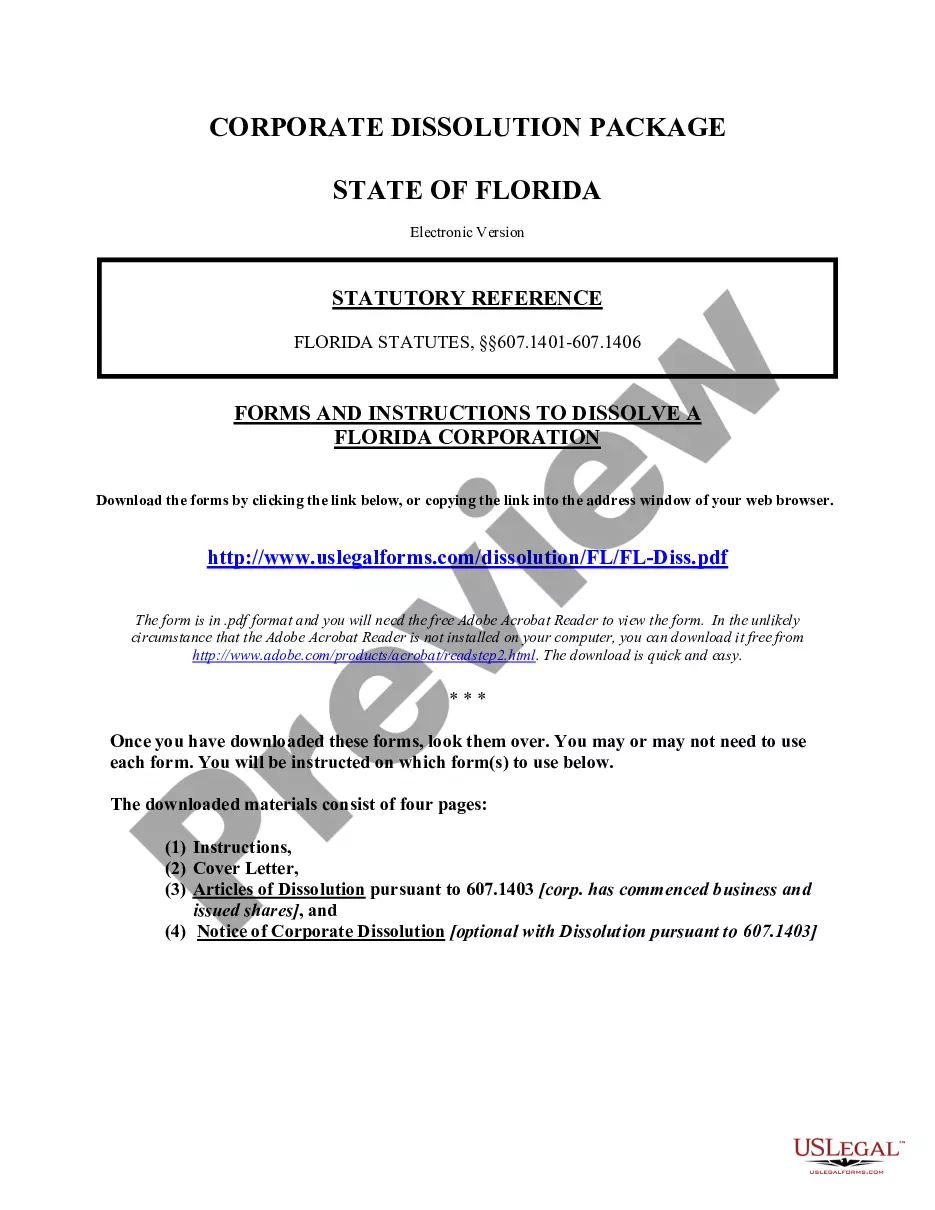

It is feasible to spend time online searching for the official document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of official forms that are examined by professionals.

It is easy to download or print the Missouri Sales Order Form from the service.

If available, use the Review option to look through the document format at the same time.

- If you already have a US Legal Forms account, you may Log In and then click the Download option.

- After that, you can fill out, modify, print, or sign the Missouri Sales Order Form.

- Every official document format you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the relevant option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the area/city of your choice.

- Check the form description to confirm that you have chosen the right form.

Form popularity

FAQ

You are not required to file a Missouri individual income tax return. However, please complete the "No Return Required - Military Online Form" to ensure the Department is aware you are not required to file a Missouri income tax return.

You're required to file a Missouri tax return if you receive income from a Missouri source. There are a few exceptions: You're a Missouri resident, and your state adjusted gross income is less than $1,200. You're a nonresident, and your Missouri income was less than $600.

The corporation charter number is issued by the Secretary of State's office when a Missouri corporation files articles of incorporation or an out-of-state corporation obtains a certificate of authority. The charter number is preprinted on the Annual Registration Report next to the corporation's name.

5728 Corporation or limited liability companyYou should have your charter number or certificate of authority number from the Missouri Secretary of State. (Most corporations and limited liability companies are required to obtain a charter number or certificate of authority number to operate in Missouri.)

Form. 2643A Missouri Tax Registration Application. Missouri Tax I.D. Number.

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.

Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN).

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.

You should file Form 1040 if: Your taxable income is greater than $100,000. You itemize deductions. You receive income from the sale of property.