Missouri Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

Are you currently in a situation where you require documents for either business or personal purposes every single day.

There are numerous legal document templates accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms provides an extensive collection of form templates, such as the Missouri Trust Agreement for Pension Plan with Corporate Trustee, designed to comply with federal and state regulations.

Take advantage of US Legal Forms, one of the most comprehensive collections of legal documents, to save time and avoid mistakes.

The service offers properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Trust Agreement for Pension Plan with Corporate Trustee template.

- If you don't have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct city/region.

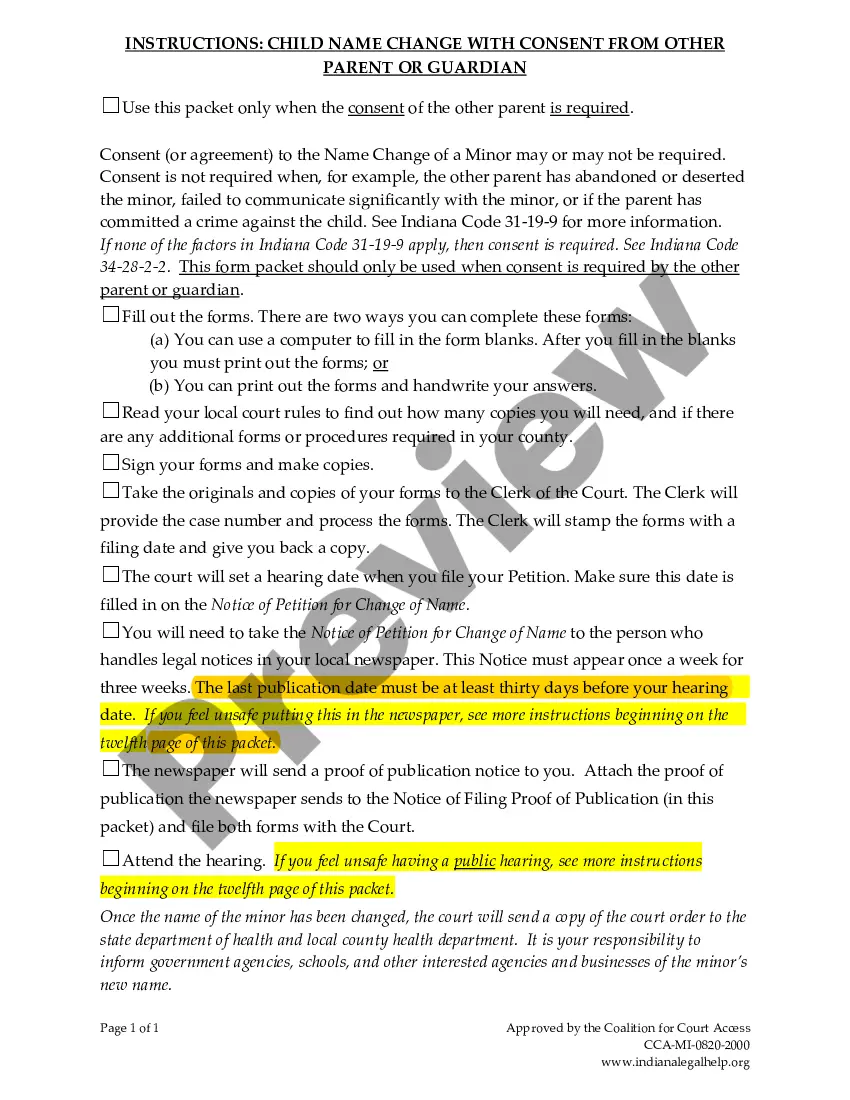

- Utilize the Preview feature to review the form.

- Check the description to confirm that you've selected the right form.

- If the form isn't what you're seeking, use the Search field to find the form that meets your requirements.

- Once you find the correct form, click Get now.

- Choose the pricing plan you need, enter the required information to create your account, and pay for the order using your PayPal or Visa or MasterCard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You can retrieve an additional copy of the Missouri Trust Agreement for Pension Plan with Corporate Trustee at any time if needed. Simply click on the required form to download or print the document template.

Form popularity

FAQ

Even if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire, or investment experience to manage your trust yourself, or perhaps you just feel that someone with more time and experience could do a better job than you.

Advantages of a Trust include that: limited liability is possible if a corporate trustee is appointed. the structure provides more privacy than a company. there can be flexibility in distributions among beneficiaries.

The main advantages of naming a corporate trustee are expertise, experience, resources and objectivity.

Corporate trustees are departments at banks or other investment firms hired to build and manage a trust. People hire corporate trustees for their professional experience in trust matters that a family member or friend may not have.

Corporate trust services can provide assistance with both the issuance and administration of corporate debt. Corporate trusts might distribute the interest payments from the corporation to the bondholders and ensure that the issuer is adhering to the covenants of the bond agreement.

A trustee is a person or company, acting separately from the employer, who holds assets in the trust for the beneficiaries of the scheme. Trustees are responsible for ensuring that the pension scheme is run properly and that members' benefits are secure.

Why Have a Corporate Trustee For a Family Trust? It is a common practice to have corporate trustees for family trusts for tax benefits. This ensures the limitation of the trustees' liability to the corporate asset. Generally, corporate trustees are shell corporations with no, or minimal, assets.