Missouri Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder

Description

How to fill out Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder?

Discovering the right legitimate record template can be a battle. Obviously, there are plenty of themes available on the Internet, but how will you get the legitimate form you need? Take advantage of the US Legal Forms website. The services delivers a huge number of themes, for example the Missouri Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder, which can be used for company and private requires. Every one of the kinds are examined by experts and satisfy state and federal specifications.

Should you be previously listed, log in to your accounts and click on the Obtain option to obtain the Missouri Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder. Utilize your accounts to search through the legitimate kinds you possess bought earlier. Check out the My Forms tab of your own accounts and get yet another copy in the record you need.

Should you be a whole new customer of US Legal Forms, listed here are easy directions that you should comply with:

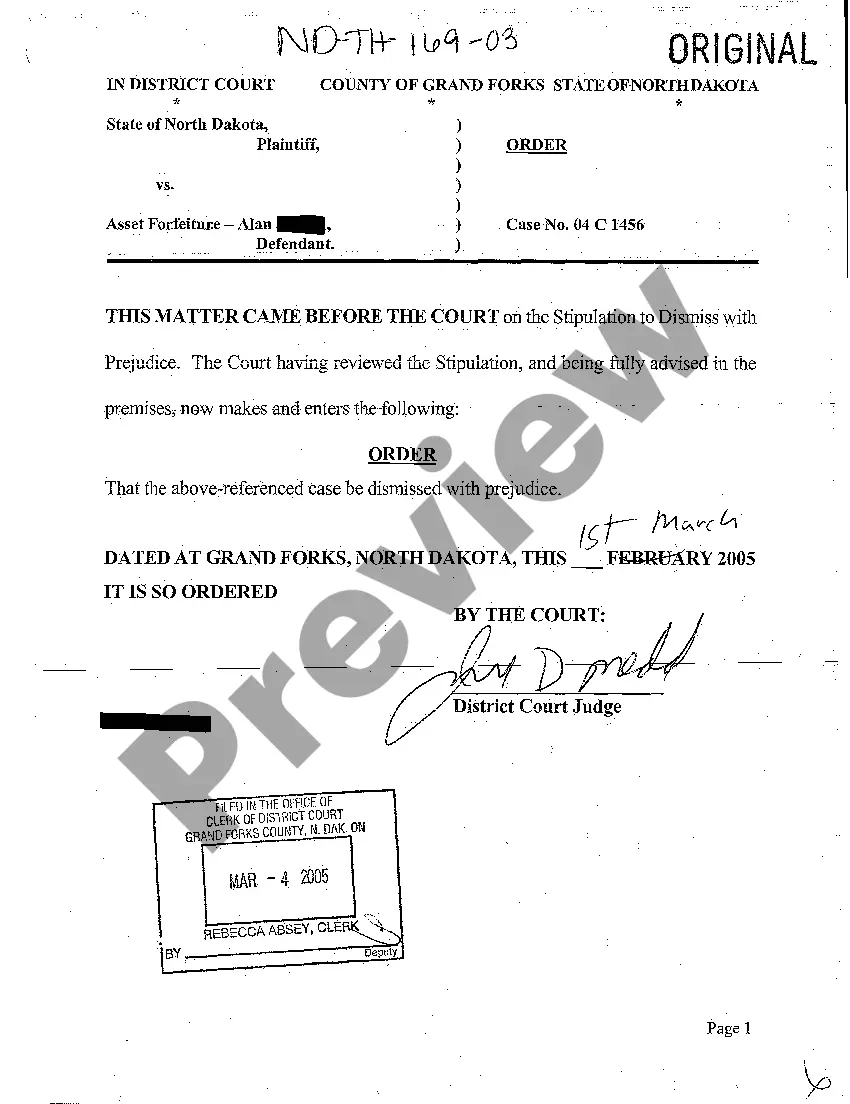

- Initially, ensure you have chosen the correct form for your area/area. It is possible to look through the shape while using Review option and read the shape outline to guarantee it is the right one for you.

- When the form fails to satisfy your requirements, use the Seach discipline to get the appropriate form.

- When you are certain the shape is proper, select the Get now option to obtain the form.

- Opt for the costs program you would like and type in the required information and facts. Make your accounts and buy the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Pick the submit structure and down load the legitimate record template to your device.

- Full, change and print out and indication the received Missouri Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder.

US Legal Forms will be the most significant local library of legitimate kinds where you can find different record themes. Take advantage of the company to down load skillfully-manufactured documents that comply with express specifications.