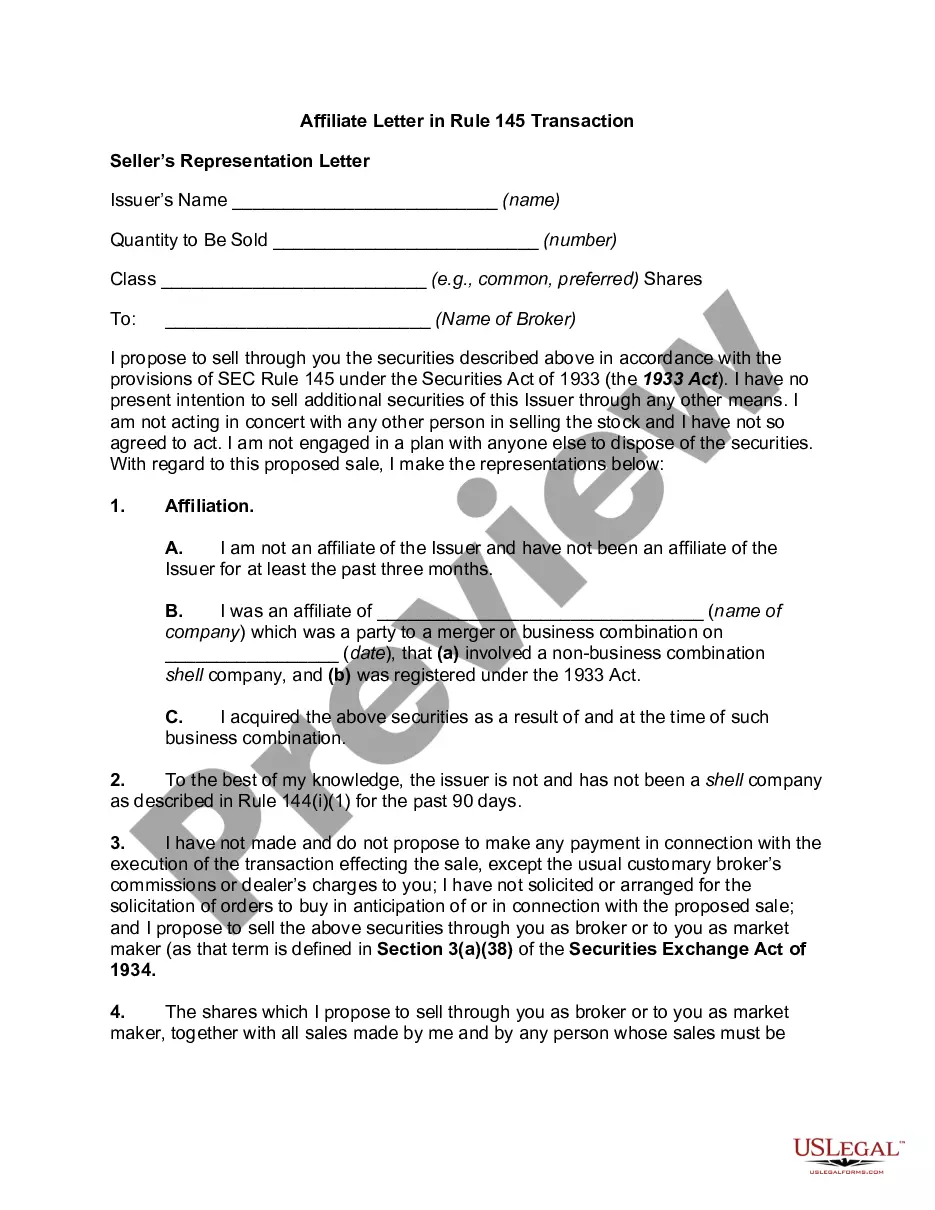

Missouri Affiliate Letter in Rule 145 Transaction

Description

How to fill out Affiliate Letter In Rule 145 Transaction?

You might spend hours online looking for the legal paperwork format that meets the federal and state regulations you require.

US Legal Forms offers thousands of legal templates that are vetted by professionals.

You can acquire or print the Missouri Affiliate Letter in Rule 145 Transaction from our service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can complete, modify, print, or sign the Missouri Affiliate Letter in Rule 145 Transaction.

- Each legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, confirm that you have selected the correct document template for the state/city of your choice.

- Review the form details to ensure you have chosen the right template.

Form popularity

FAQ

The term affiliate is defined in Rule 405 promulgated under the Securities Act of 1933 as a person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

(1) An affiliate of an issuer is a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer. Control means the power to direct the management and policies of the company in question, whether through the ownership of voting securities, by contract, or otherwise.

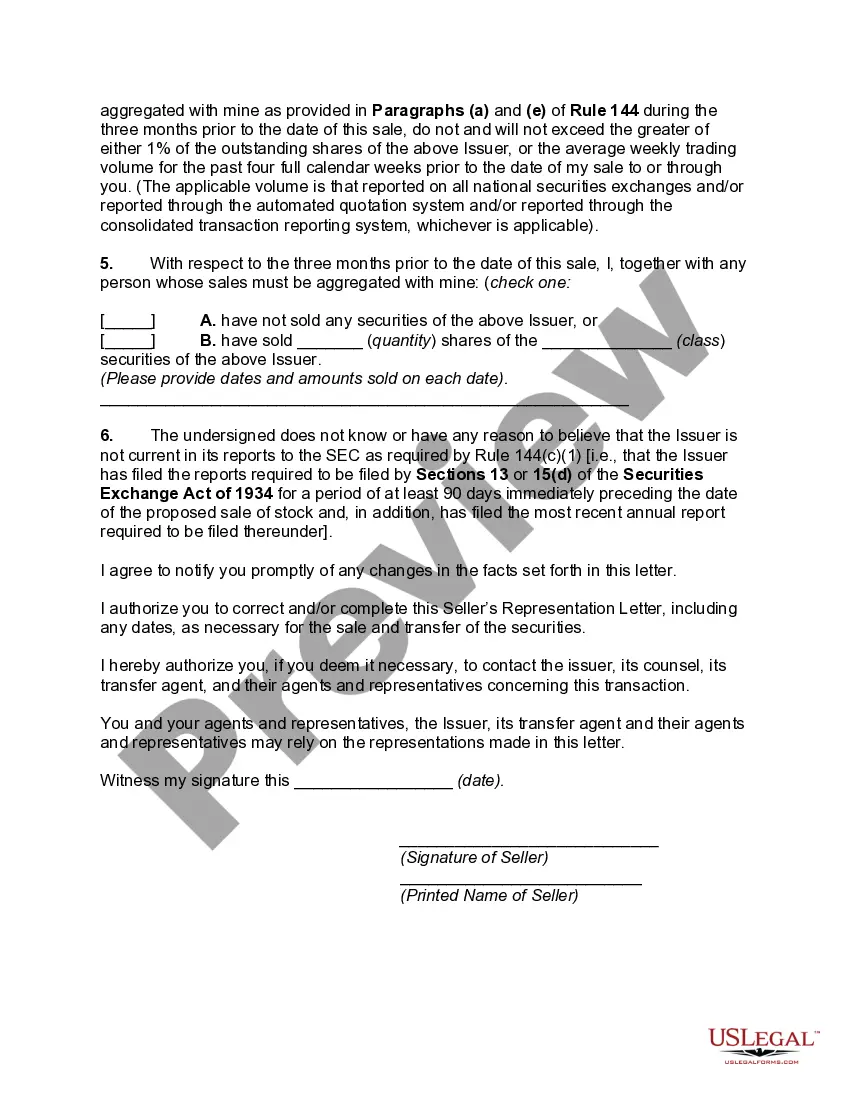

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

The Commission raised the Form 144 filing thresholds so that affiliates must file Form 144 if their proposed sales in reliance on Rule 144 within a three-month period exceed 5,000 shares or $50,000. Non-affiliates no longer need to file Form 144.

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.