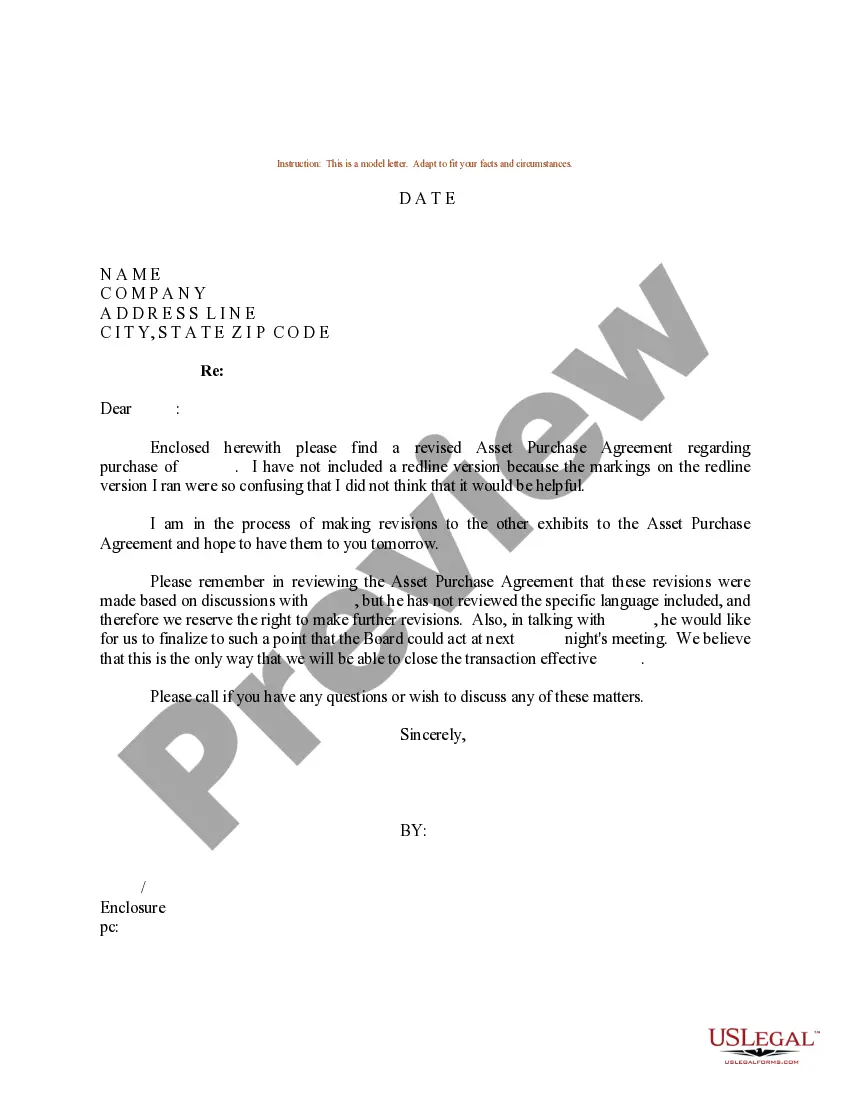

Missouri Sample Letter regarding Revolving Note and Loan Agreement

Description

How to fill out Sample Letter Regarding Revolving Note And Loan Agreement?

If you want to finalize, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search function to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

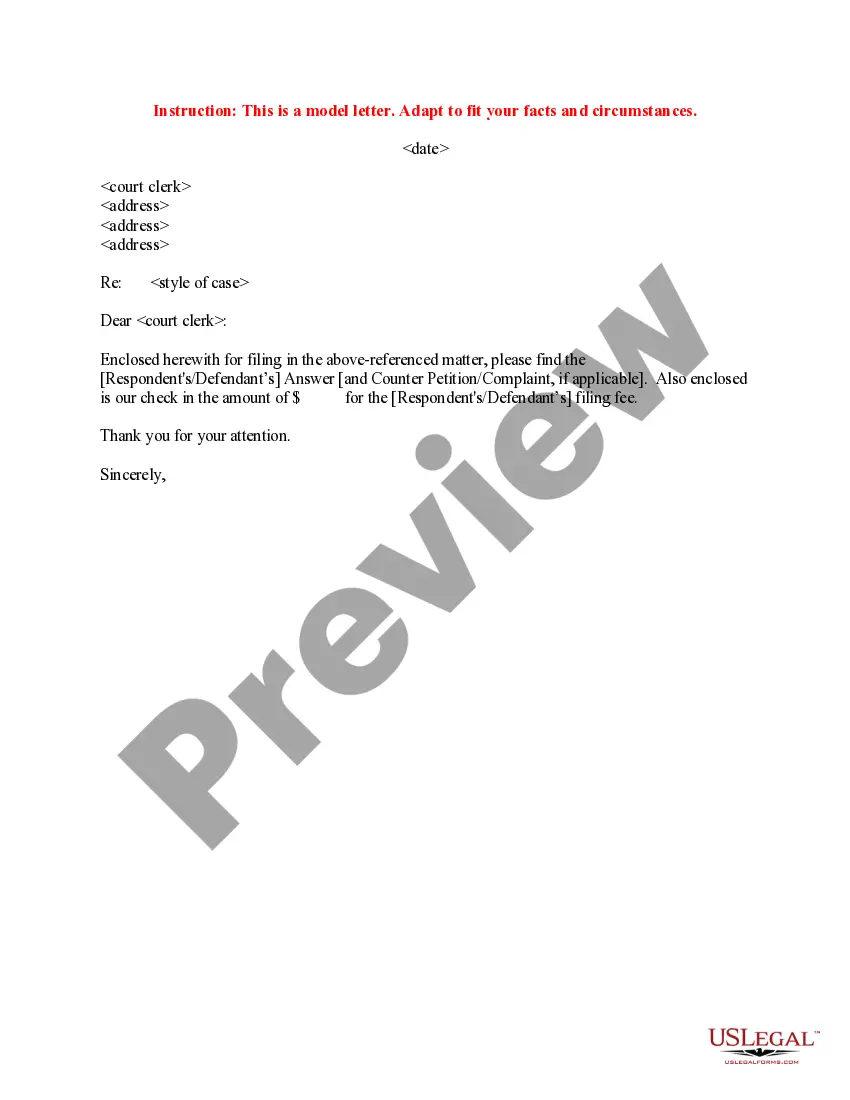

Complete and download, and print the Missouri Sample Letter regarding Revolving Note and Loan Agreement with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Missouri Sample Letter related to Revolving Note and Loan Agreement with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Obtain button to get the Missouri Sample Letter concerning Revolving Note and Loan Agreement.

- You can also access forms you previously saved in the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

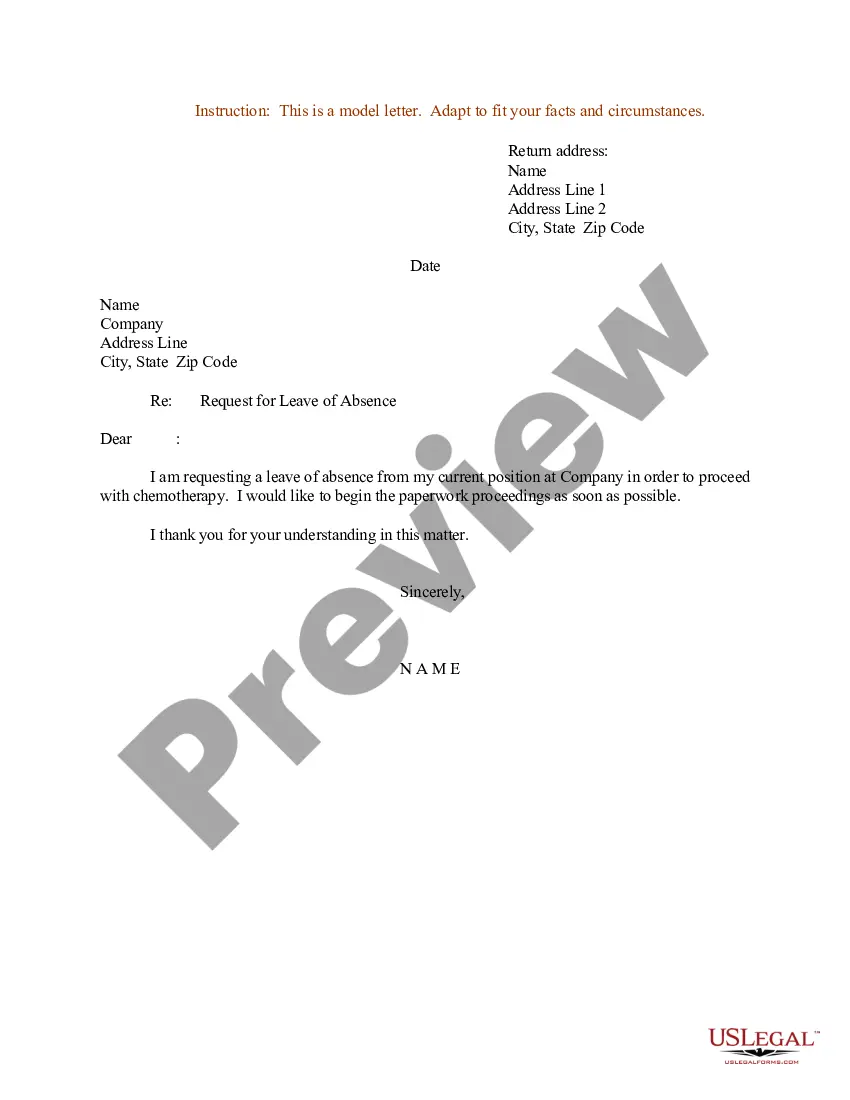

- Step 2. Use the Preview option to review the form's content. Make sure to read through the description.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to discover other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of your legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Missouri Sample Letter regarding Revolving Note and Loan Agreement.

Form popularity

FAQ

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

A revolving line of credit refers to a type of loan offered by a financial institution. Borrowers pay the debt as they would any other. However, with a revolving line of credit, as soon as the debt is repaid, the user can borrow up to her credit limit again without going through another loan approval process.

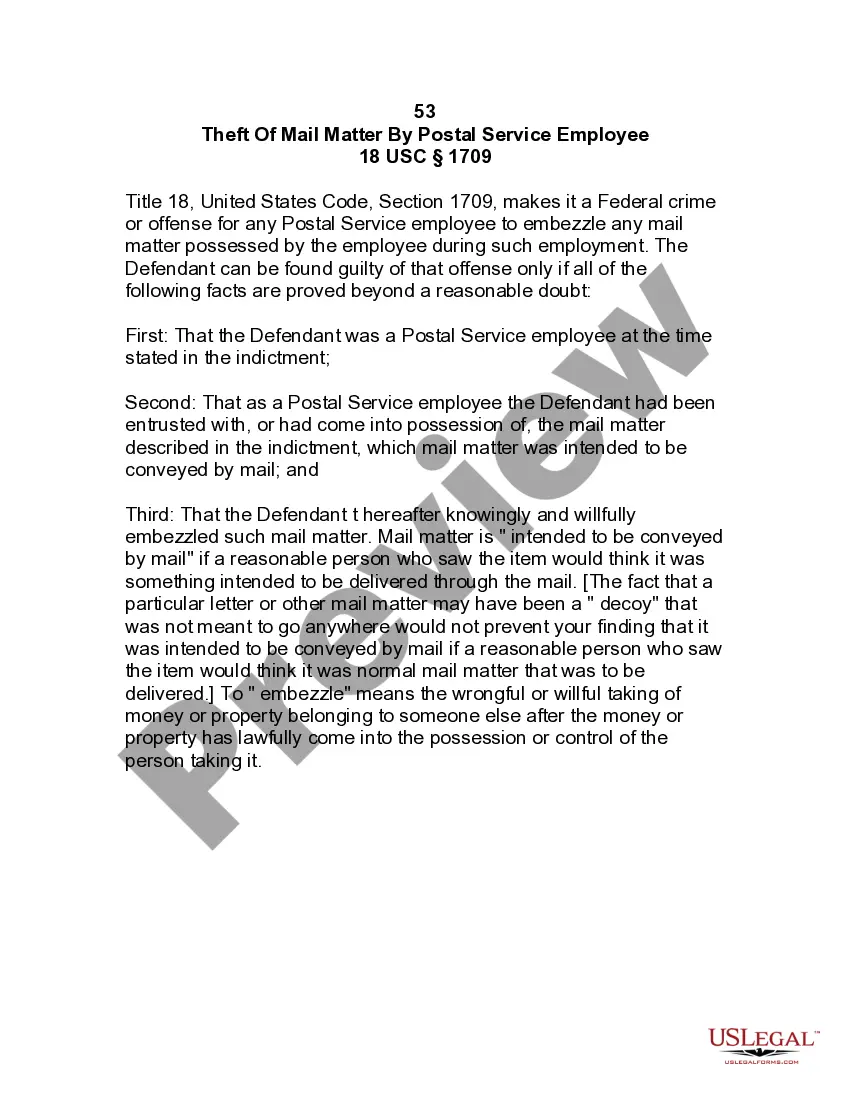

Legally, a loan note holds more significance than an informal IOU, even when the informal IOU is notarized. Generally, a loan note will be upheld unless either party can prove the agreement was entered into while under duress, which may make the conditions within the document void, rendering them unenforceable.

Term loans have a fixed repayment period, while revolving loans are repaid based on usage. Your assets can be used to pay back a defaulted loan.

A loan note is a type of promissory agreement that outlines the legal obligations of the lender and the borrower. A loan note is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, due date, principal amount, interest rate, and any prepayment penalties.

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in regular payments. Each payment, minus the interest and fees charged, replenishes the amount available to the account holder.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note.

Installment credit gives borrowers a lump sum, and fixed, scheduled payments are made until the loan is paid in full. Revolving credit allows a borrower to spend the money they have borrowed, repay it, and borrow again as needed.

Examples of revolving credit include credit cards, personal lines of credit and home equity lines of credit (HELOCs).

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...