Missouri Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

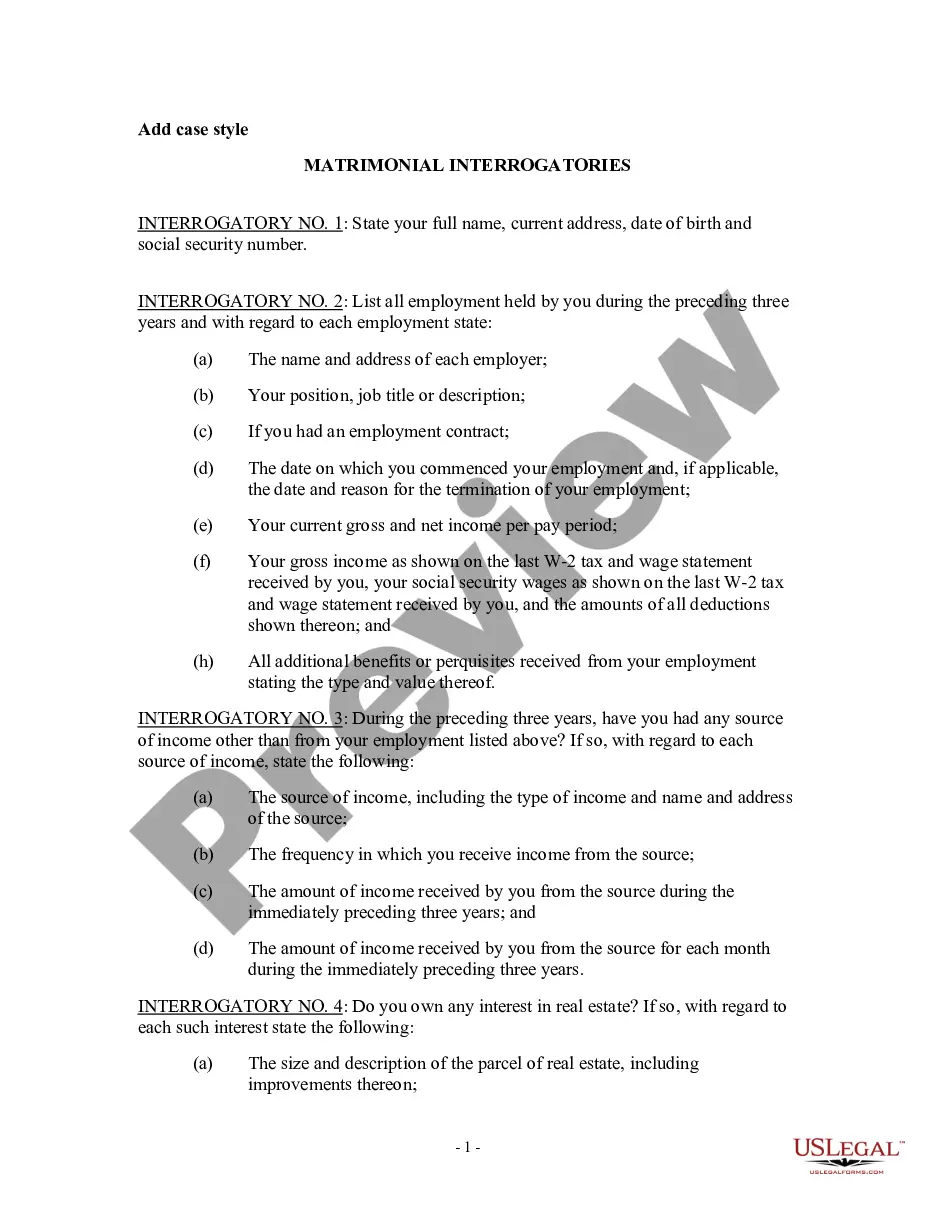

How to fill out Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

If you wish to total, obtain, or print legal document templates, use US Legal Forms, the primary selection of legal forms, available online.

Utilize the site’s straightforward and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Acquire now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the payment.

- Employ US Legal Forms to find the Missouri Sale of Assets of Corporation with No Obligation to Conform to Bulk Sales Laws with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to download the Missouri Sale of Assets of Corporation with No Obligation to Conform to Bulk Sales Laws.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the document’s content. Don’t forget to check the description.

- Step 3. If you are not content with the form, utilize the Search area at the top of the page to find other versions of the legal document format.

Form popularity

FAQ

In selling, 'bulk' refers to a substantial part of a seller's assets being transferred to a buyer in a single transaction. This can include inventory, equipment, or other assets. When a sale involves bulk assets, special regulations like the bulk sales Act may apply. Awareness of these terms is essential in matters related to the Missouri Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

If the property is classified as ordinary asset, the income from such sale is subject to ordinary income tax. If the property is a residential lot, or a residential house and lot, and the selling price thereof is P1,500,000 or more, P2,500,000 or more, respectively, the same is subject to the 12% value added tax (VAT).

In an asset sale, sellers are subject to potentially higher taxes than in a stock sale. While intangible assets, such as goodwill, are taxed at capital gains rates, other hard assets may be taxed at higher ordinary income tax rates. Currently, federal capital gains rates are around 20%, while state rates vary.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

Both the seller and purchaser of a group of assets that makes up a trade or business must use Form 8594 to report such a sale if:goodwill or going concern value attaches, or could attach, to such assets and.the purchaser's basis in the assets is determined only by the amount paid for the assets.

Tax Consequences Arising From Sale of AssetsA selling entity that is a C corporation, will pay federal and state income taxes on the net taxable gain from the asset sale.

The bulk transfer law is a law to protect business creditors. It provides that if a buyer of a business notifies the creditors of the seller in advance that it is buying the seller's assets, then the buyer will not be liable to those creditors for the debts and obligations of the seller.

You report gains on the sale of assets as non-operating income on your income statement. To measure the gain, subtract the value of the asset in your ledgers from the sale price.