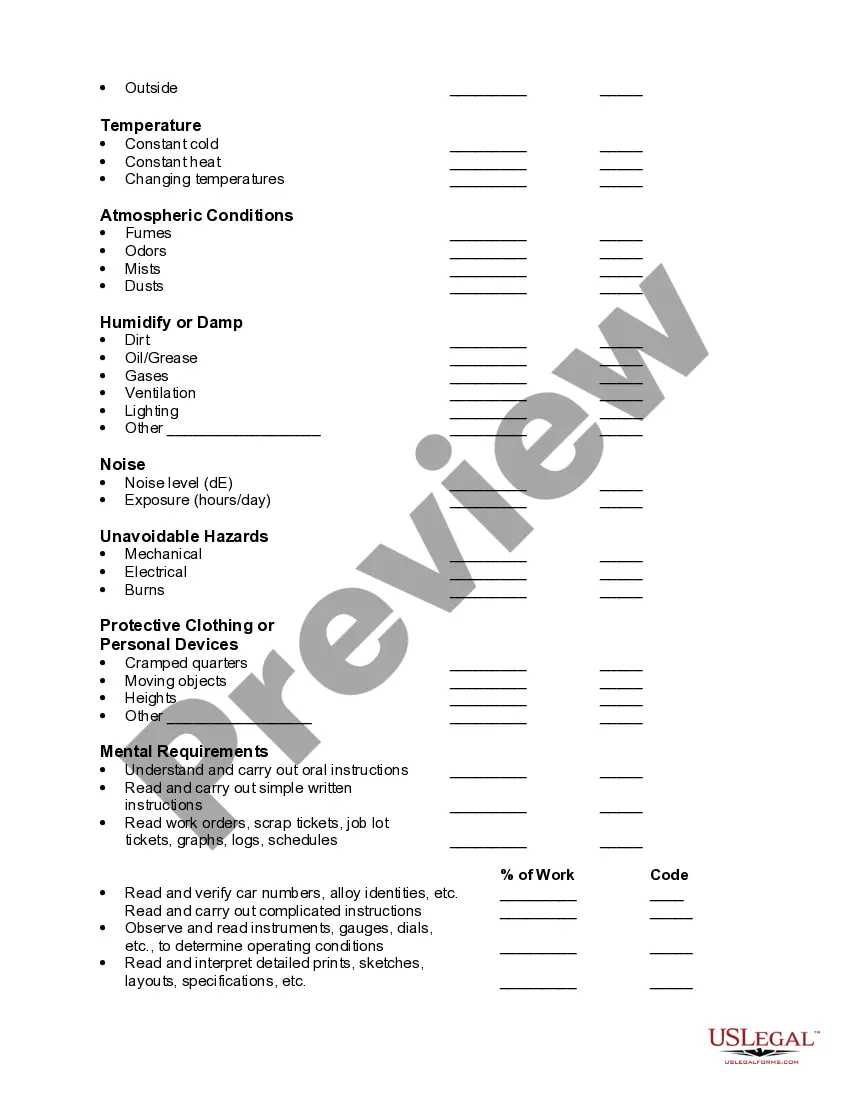

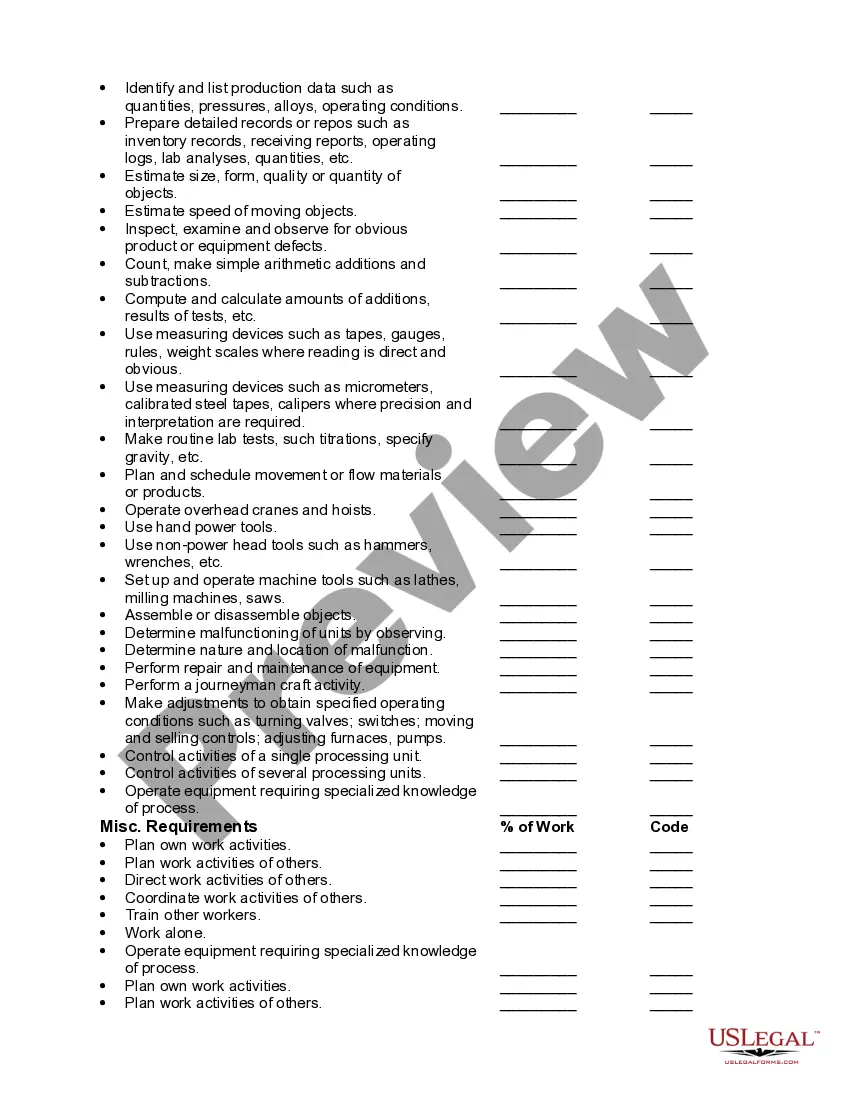

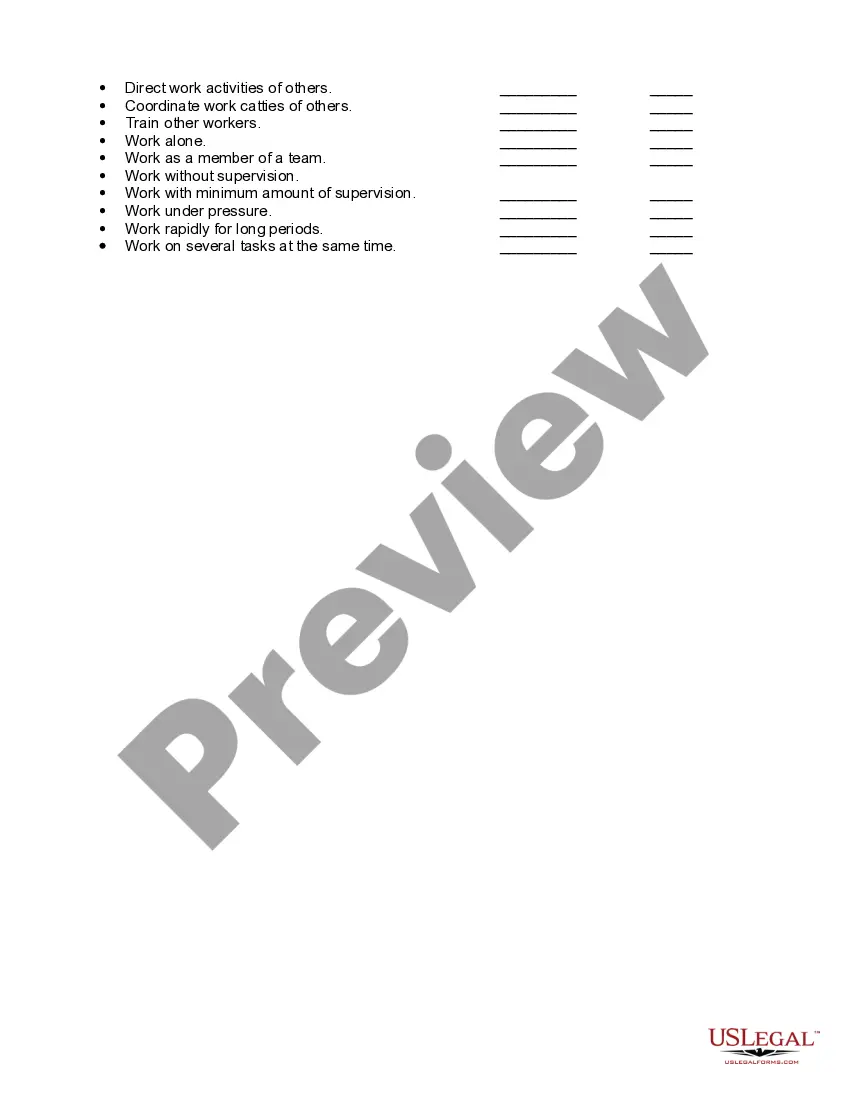

Missouri Sample Job Requirements Worksheet

Description

How to fill out Sample Job Requirements Worksheet?

If you wish to finish, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's simple and user-friendly search feature to locate the documents you require.

Many templates for business and personal use are categorized by types and jurisdictions, or by keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment option you prefer and provide your details to sign up for the account.

Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Missouri Sample Job Requirements Worksheet in just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click the Obtain button to access the Missouri Sample Job Requirements Worksheet.

- You can also find forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your correct region/country.

- Step 2. Use the Preview option to review the content of the form. Remember to examine the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the page to find other variations in the legal form format.

Form popularity

FAQ

Self-employed individuals in Missouri typically use Form 1040, along with Schedule C to report income and expenses. You should also review other forms that may be relevant to your specific situation. When preparing these forms, the Missouri Sample Job Requirements Worksheet can serve as a helpful tool in organizing your employment-related documents.

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Real estate tax paid for a prior year cannot be claimed on this form. To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2019 real estate tax in calendar year 2020, you must file a 2019 Property Tax Credit Claim (Form MO-PTC).

The Missouri Property Tax Credit is available for the following qualified individuals: Individual or spouse must be 65 years old or older or be 100 percent disabled. Must be resident of Missouri for entire calendar year. Individual 60 years or older receiving spouse Social Security benefits may qualify.

1. Missouri Withholding Tax Multiply the employee's Missouri taxable income by the applicable annual payroll period rate. Begin at the lowest rate and accumulate the total withholding amount for each rate. The result is the employee's annual Missouri withholding tax.

Form MO-PTS - 2019 Property Tax Credit Schedule. Page 1. This form must be attached to Form MO-1040 or MO-1040P.

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

Form MO W-4C Withholding Affidavit for Missouri Residents. Page 1. This form is to be completed by a Missouri resident employed in a foreign state.