Missouri Business Selection Worksheet

Description

How to fill out Business Selection Worksheet?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a range of legal form templates that you can download or create.

By utilizing the website, you can find thousands of forms for both business and individual purposes, organized by categories, states, or keywords. You can access the most recent documents like the Missouri Business Selection Worksheet in mere seconds.

If you hold a subscription, Log In and download the Missouri Business Selection Worksheet from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Make edits. Fill out, modify, print, and sign the downloaded Missouri Business Selection Worksheet. Every template saved in your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need. Access the Missouri Business Selection Worksheet through US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your town/county.

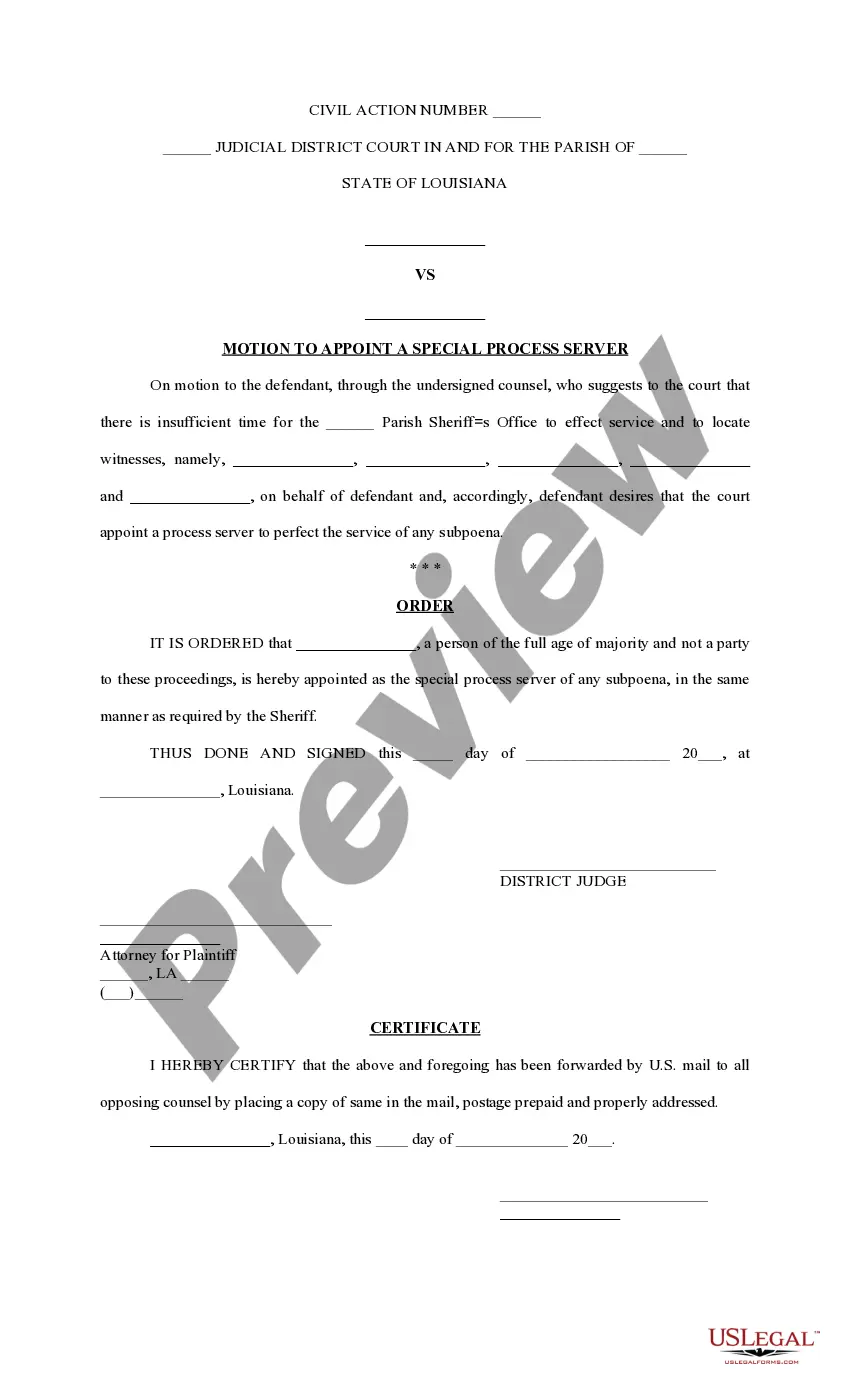

- Click the Preview button to review the content of the form.

- Read the form description to verify that you have chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

1. Missouri Withholding Tax Multiply the employee's Missouri taxable income by the applicable annual payroll period rate. Begin at the lowest rate and accumulate the total withholding amount for each rate. The result is the employee's annual Missouri withholding tax.

Initially, there were six new schedules, but the IRS has since consolidated these down to three: Schedule 1 for additional income and "above the line" deductions. Schedule 2 for additional taxes. Schedule 3 for additional credits and payments.

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

Federal income tax withholding was calculated by:Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).More items...

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

All three schedules ask for different informationSchedule 1, Additional Income and Adjustments to Income. This schedule reports income from state tax refunds, businesses, rentals, partnerships, unemployment compensation, and more.Schedule 2, Additional Taxes.Schedule 3, Additional Credits and Payments.

Schedule III drugs, substances, or chemicals are defined as drugs with a moderate to low potential for physical and psychological dependence. Schedule III drugs abuse potential is less than Schedule I and Schedule II drugs but more than Schedule IV.

Include only Missouri withholding as shown on your Forms W-2, 1099, or 1099-R. Do not include withholding for federal taxes, local taxes, city earnings taxes, other state's withholding, or payments submitted with Form MO-2NR or Form MO-2ENT. Attach a copy of all Forms W-2 and 1099.

Schedule 3 has the additional information added for 2019, Part II - Other Payments and Refundable Credits. If entries are made on Schedule 3 the form would be attached to the Form 1040 or Form 1040-SR. Line items 8-13 listed below.