A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Missouri Check Disbursements Journal

Description

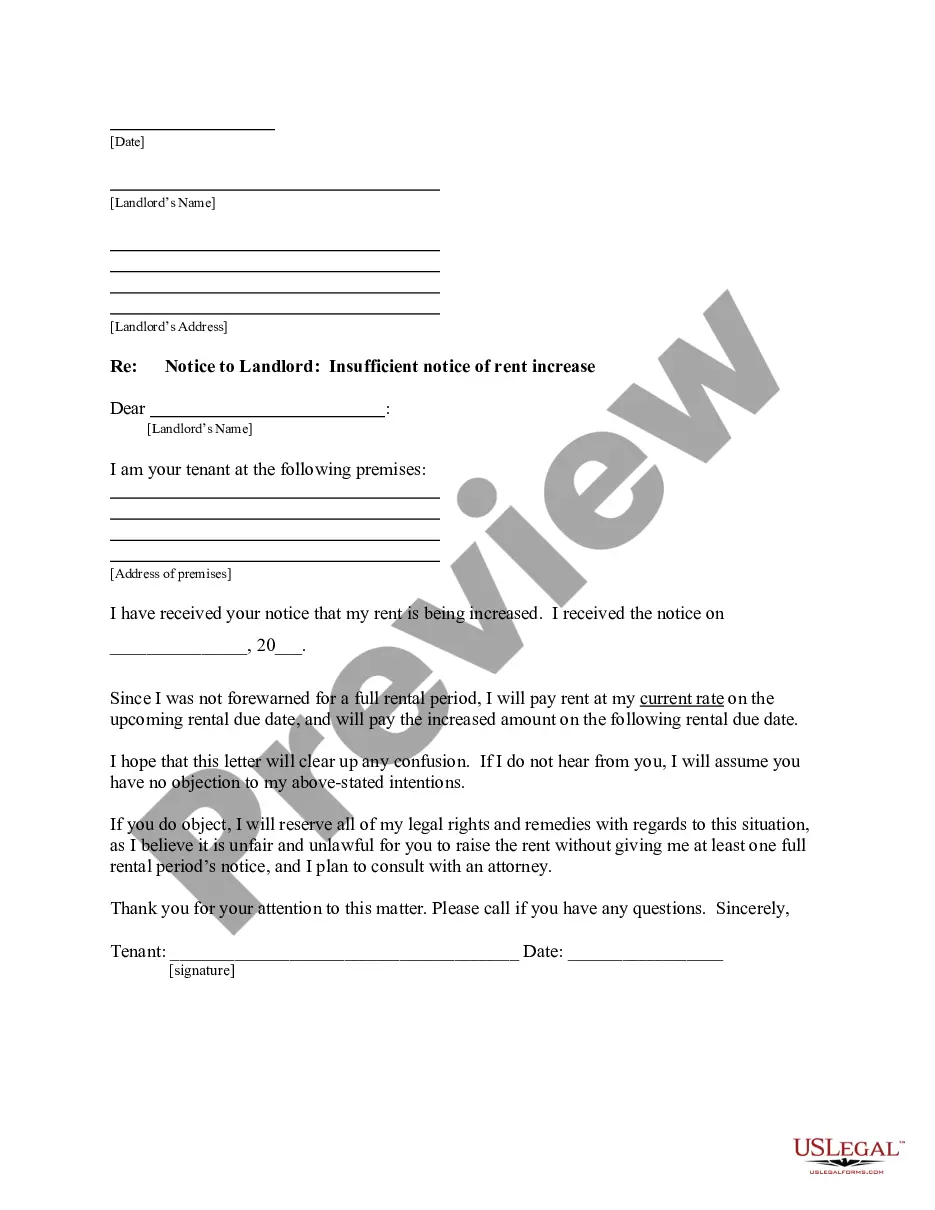

How to fill out Check Disbursements Journal?

You can invest time online searching for the approved document format that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can obtain or print the Missouri Check Disbursements Journal from our platform.

First, ensure that you have selected the correct document format for the state/region of your preference. Review the document description to confirm you have chosen the right form. If available, utilize the Preview button to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, edit, print, or sign the Missouri Check Disbursements Journal.

- Each legal document format you obtain is yours permanently.

- To get another copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

Form popularity

FAQ

The due date for Missouri sales tax typically falls on the 20th of the month following the reporting period. Businesses must file their sales tax returns and remit payments by this deadline to stay compliant with state regulations. Keeping a precise Missouri Check Disbursements Journal allows you to track your sales tax liabilities effectively and meet your financial obligations. To simplify the process, consider using US Legal Forms for streamlined tax management solutions.

The Missouri vendor use tax applies to purchases made from out-of-state vendors when the items are used, consumed, or stored in Missouri. This tax ensures that goods obtained from outside the state contribute to local revenue, just like those purchased within Missouri. It is essential for businesses to maintain accurate records in their Missouri Check Disbursements Journal to ensure compliance with this tax requirement. By properly documenting vendor use tax, you can avoid potential audits and penalties.

You can mail your tax payment to the address designated by your local or state tax department. Check your tax forms or the department's website for the exact mailing address. Adhering to the correct mailing procedures guarantees that your payment is recorded accurately in your tax records and the Missouri Check Disbursements Journal. Stay proactive to avoid late fees.

Mail your Missouri state tax payment to the appropriate address based on the type of tax you owe. You can find the correct address on the Missouri Department of Revenue's website or your tax form. Proper mailing practices will help keep your records accurate and organized in the Missouri Check Disbursements Journal. Always ensure that you include any required payment stubs.

Send your Missouri state tax payment to the address specified on the tax form you are using. If you’re unsure, the Missouri Department of Revenue offers guidance on their website. Accuracy is vital for ensuring your payment is processed promptly and reflected in the Missouri Check Disbursements Journal. Double-check the address to avoid any delays.

To address an envelope to the IRS, write 'Internal Revenue Service' on the first line. On the next line, include the applicable street address, and on the final line, add the city, state, and ZIP code. This clear format ensures your correspondence reaches the correct department. Following these guidelines can simplify interactions with tax authorities, which can be reflected in your Missouri Check Disbursements Journal.

The state sales tax rate in Missouri is currently set at 4.225%. However, local jurisdictions may impose additional sales taxes, so the total rate can vary by location. Understanding these rates is essential for maintaining accurate records in the Missouri Check Disbursements Journal. Always check the local regulations to ensure compliance.

When writing a check for Missouri state taxes, address it to the "Missouri Department of Revenue." Ensure that you include your tax identification number on the check to avoid any delays. This information helps track your payment in the Missouri Check Disbursements Journal. Timely payments prevent potential penalties and interest.

If you are wondering where your Missouri refund check is, start by checking the Missouri Department of Revenue's online portal. It will give you the most current updates on your refund status. Additionally, referring to the Missouri Check Disbursements Journal can provide specific information related to your refund. If you're still facing issues, services such as uslegalforms can help navigate the situation more effectively.

To track your refund check, use the online tracking feature from the Missouri Department of Revenue. They provide timely updates regarding your refund as it moves through their system. The Missouri Check Disbursements Journal can offer useful insights on the status of your payment. For further assistance, platforms like uslegalforms can guide you with useful tips to ensure your tracking is effective.