Missouri Installment Payment and Purchase Agreement

Description

How to fill out Installment Payment And Purchase Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates you can download or print. By utilizing the website, you will access a vast selection of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Missouri Installment Payment and Purchase Agreement within moments. If you have an account, Log In to download the Missouri Installment Payment and Purchase Agreement from the US Legal Forms library. The Obtain button appears on every form you review. You can find all previously downloaded forms in the My documents section of your account.

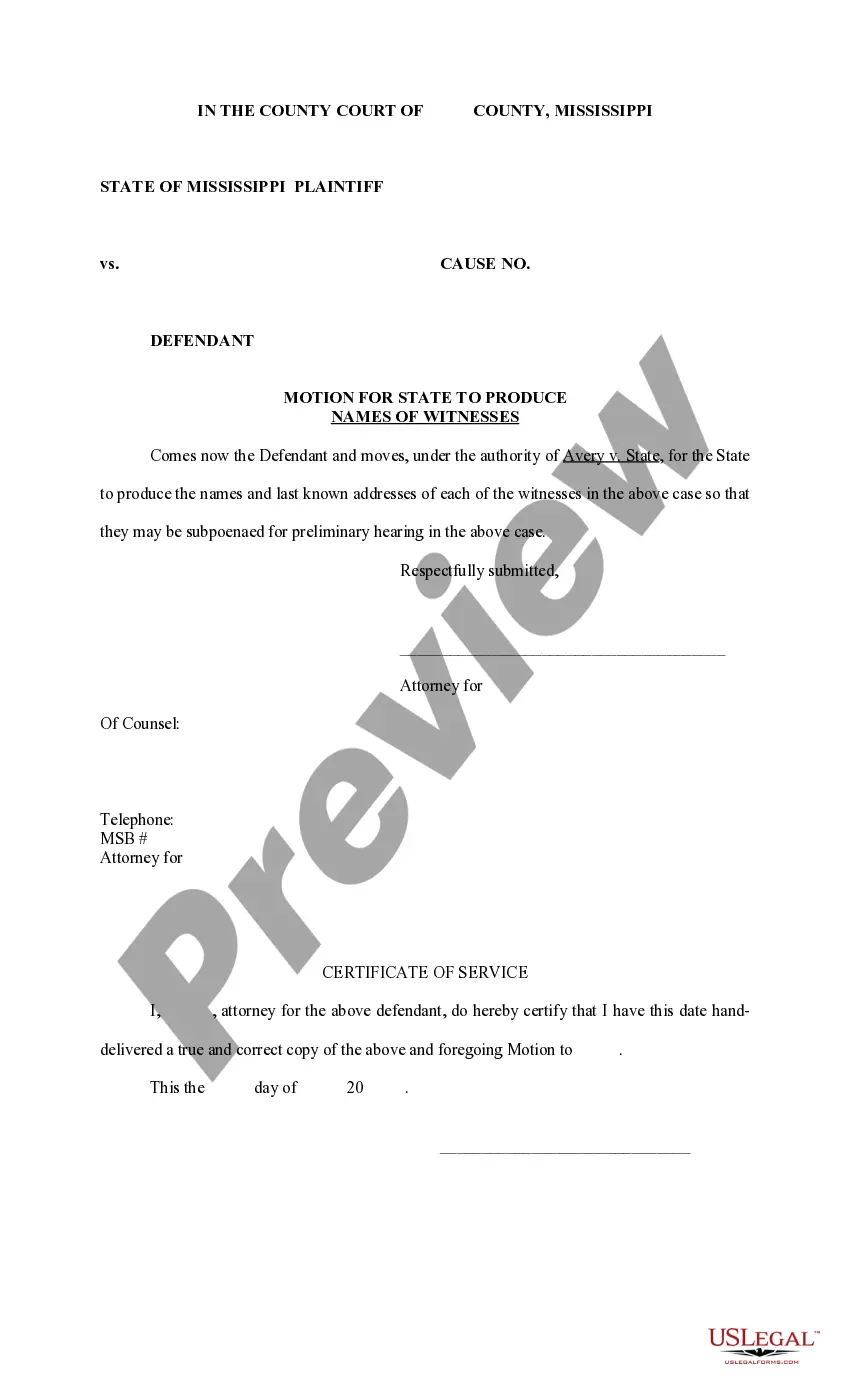

If you are accessing US Legal Forms for the first time, here are simple steps to help you begin: Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Check the form details to confirm that you have chosen the correct document.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

Access the Missouri Installment Payment and Purchase Agreement through US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements.

- If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, validate your choice by clicking the Acquire now button.

- Then, select your preferred payment option and submit your details to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the document to your device.

- Edit. Fill out, modify, and print the downloaded Missouri Installment Payment and Purchase Agreement.

Form popularity

FAQ

If you already have an installment agreement and you also expect to owe taxes for the current year, you must act quickly to request a change to your existing installment agreement. Once a new tax balance is assessed by the IRS, you will be considered in default of the current agreement.

You can request an amendment to the installment agreement by:Calling the IRS at 1-800-829-7650.Visiting a local IRS office.Completing Form 9465 with information about both the original agreement balance and the expected new balance.

In most cases, a taxpayer that qualifies for a guaranteed agreement will also qualify for the streamlined installment agreement. A streamlined installment agreement has the following requirements: The tax liability, interest, and penalties do not exceed $50,000; The balance can be paid off within 72 months; and.

In the event that you are unable to pay the entire income tax amount due in full, a tax payment installment agreement may be requested online at or by submitting this completed form. Before a payment agreement can be considered, all tax returns must be filed.

Taxpayers should contact their bank directly to stop payments if they prefer to suspend direct debit payments during the suspension period. Banks are required to comply with customer requests to stop recurring payments within a specified timeframe.

Can You Make Payments on Missouri State Taxes? Yes, you can do this through a Missouri Department of Revenue payment plan if you're having tax problems. The Missouri Department of Revenue accepts online payments in the form of a credit card or E-Check (electronic bank draft).

Unfortunately, the answer is no. There can only be one installment agreement that includes all of the tax years for which you owe an outstanding tax debt. A new, unpaid tax balance due would automatically put your existing installment agreement into default.

To get started on an installment agreement for your Missouri tax debt you can call the Missouri Department of Revenue at 573-751-7200, or you can set up an installment agreement and pay your taxes online. Further Reading: Internet Installment Agreements on the Missouri Department of Revenue Website.

To reiterate you cannot have two installment agreements with the IRS. However, you can pay off more than one tax debt through your existing installment payment. When you owe the government money, the IRS marks a deficit on your tax account. Further debt accrued simply increases that balance due.

Long-term Payment Plan (Installment Agreement) Pay amount owed in monthly payments. Payment Options. Costs. Option 1: Pay through Direct Debit (automatic monthly payments from your checking account), also known as a Direct Debit Installment Agreement (DDIA).