Missouri Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Are you facing a circumstance where you require documentation for various company or personal reasons almost daily.

There are numerous legal document templates accessible online, but locating reliable ones is challenging.

US Legal Forms provides thousands of document templates, such as the Missouri Notice of Default on Promissory Note Installment, which can be tailored to fulfill federal and state requirements.

Once you find the correct template, click Buy now.

Choose the pricing plan you prefer, complete the required information to create your account, and make the payment using your PayPal or Visa/Mastercard. Select a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents section. You can retrieve a new copy of the Missouri Notice of Default on Promissory Note Installment anytime you need it. Just click on the desired template to download or print the document. Utilize US Legal Forms, which offers one of the largest collections of legal documents, to save time and prevent mistakes. The service provides well-crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess your account, simply Log In.

- After that, you will be able to download the Missouri Notice of Default on Promissory Note Installment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the template you need and ensure it pertains to your specific city/county.

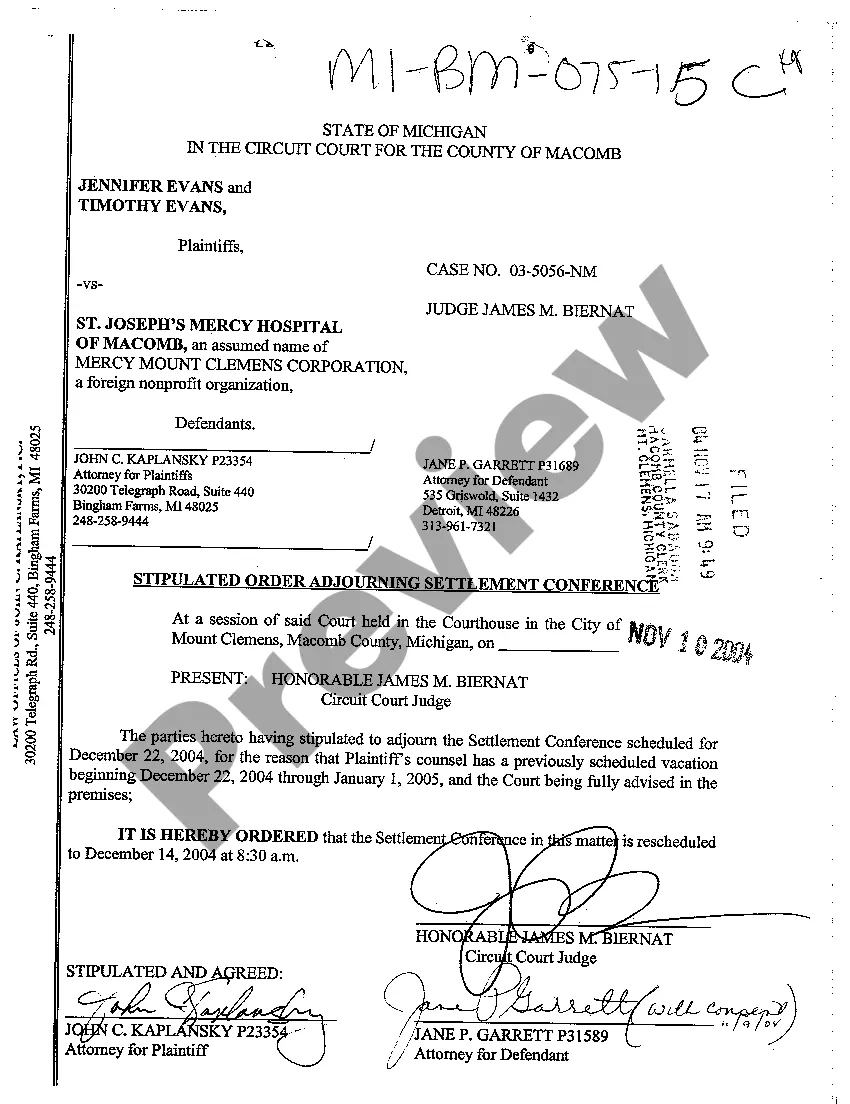

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the correct template.

- If the template is not what you are looking for, use the Search field to find the template that meets your needs.

Form popularity

FAQ

Not paying a promissory note doesn't directly lead to jail time, but it can result in serious legal consequences. If a lender files for a Missouri Notice of Default on Promissory Note Installment, they may pursue legal action to recover the owed amount, which could include judgments against you. However, incarceration typically only occurs in cases of fraud or other criminal activities. If you find yourself facing issues related to a promissory note, consider using resources like US Legal Forms for guidance and support in navigating your situation.

To issue a Missouri Notice of Default on Promissory Note Installment, first prepare the notice with all necessary details about the borrower and the default. Next, deliver the notice via certified mail to ensure there is a record of receipt. Following this, give the borrower the specified time to respond or cure the default. Utilizing documentation services like US Legal Forms can streamline this process and provide the necessary forms for issuing your notice.

To write a Missouri Notice of Default on Promissory Note Installment, start by clearly stating the debtor's information and the nature of the default. Include the amount owed and any relevant dates, such as the due date and the notice date. It is essential to express the potential consequences of not addressing the default. US Legal Forms provides templates to simplify the writing process and ensure you include all necessary components.

A Missouri Notice of Default on Promissory Note Installment typically includes specific details such as the debtor's name, the amount due, and a statement of the default's nature. It may also outline the consequences of failing to rectify the default and provide a deadline for the debtor to respond. The format is usually straightforward, ensuring clarity for both parties involved. You can find templates on platforms like US Legal Forms to guide you in structuring your notice.

The statute of limitations on a contract in Missouri is generally five years as well. This gives parties five years to bring a legal claim for enforcement after an alleged breach. If you are dealing with a Missouri Notice of Default on Promissory Note Installment, understanding this statute is crucial for protecting your interests. Using resources like uslegalforms can guide you through the implications of this timeline.

In Missouri, a debt typically becomes uncollectible after the statute of limitations expires, which is generally five years for most debts. Once this period passes, creditors lose their legal right to enforce collection. If you receive a Missouri Notice of Default on Promissory Note Installment, knowing the limitations can provide clarity on your situation. Make use of platforms like uslegalforms to explore your options and understand your rights.

The statute of limitations on a promissory note in Missouri is generally five years as well. This period starts from the time of the default or the last payment made, making it important to stay informed about your obligations. If you’re facing a Missouri Notice of Default on Promissory Note Installment, understanding this timeframe is vital for determining your next steps. Being aware of these details empowers you to take action before the statute expires.

If you default on a promissory note, the lender can pursue various remedies outlined in the agreement. Typically, this includes demanding immediate payment of the remaining balance and accruing interest. Moreover, receiving a Missouri Notice of Default on Promissory Note Installment signifies that the lender is considering taking action. Understanding these consequences can help you address default situations more proactively.

In Missouri, the statute of limitations for installment loans is typically five years. This means creditors have five years to initiate legal action to collect on a debt after a missed payment. It's crucial to understand this timeframe, especially if you receive a Missouri Notice of Default on Promissory Note Installment. Knowing your rights and timelines can help you respond effectively.

The remedies for defaulting on a promissory note can vary based on the agreement but often include demanding full payment, initiating collection efforts, or seeking to enforce collateral. In Missouri, understanding your legal standing through notices such as the Missouri Notice of Default on Promissory Note Installment is vital. You may also want to consider mediation or legal action to resolve the default effectively.