Missouri Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

If you wish to full, download, or produce authorized record web templates, use US Legal Forms, the biggest variety of authorized kinds, which can be found on the Internet. Use the site`s easy and practical lookup to get the paperwork you need. A variety of web templates for business and specific reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to get the Missouri Articles of Incorporation, Not for Profit Organization, with Tax Provisions with a handful of click throughs.

Should you be presently a US Legal Forms buyer, log in to your profile and click the Download key to have the Missouri Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Also you can entry kinds you in the past saved inside the My Forms tab of your profile.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for the right city/region.

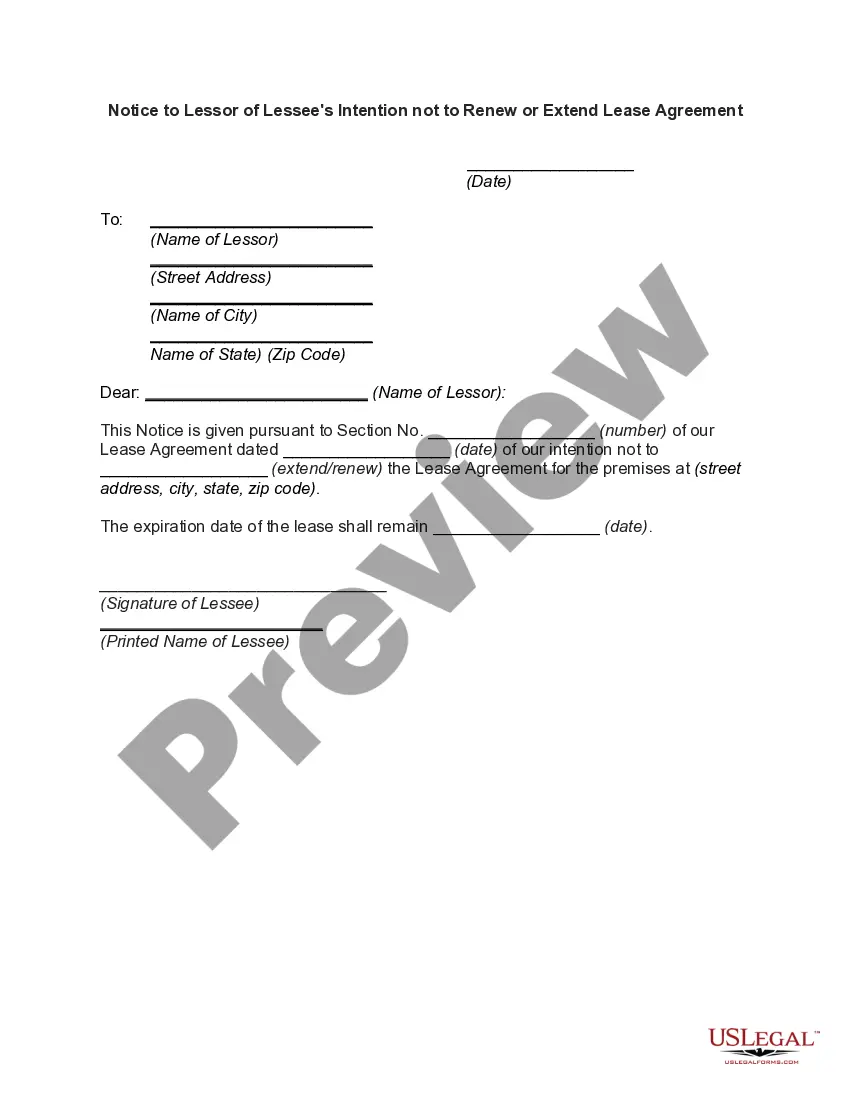

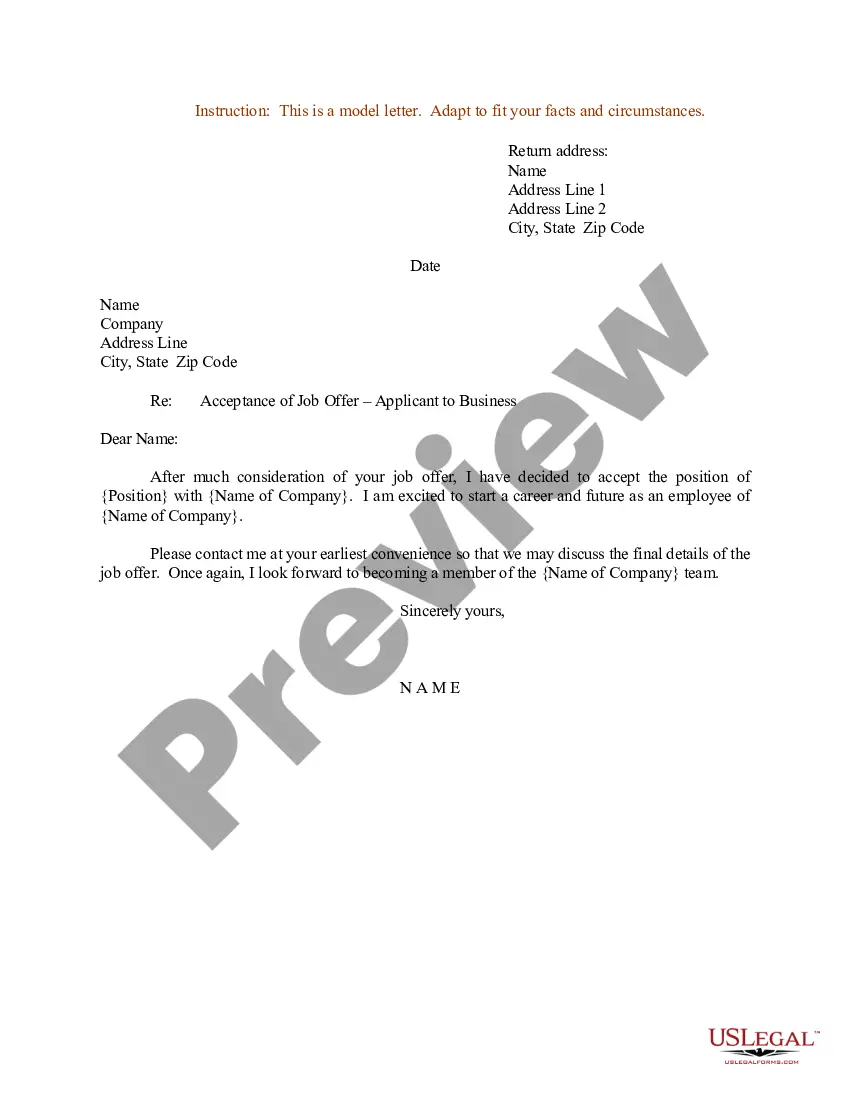

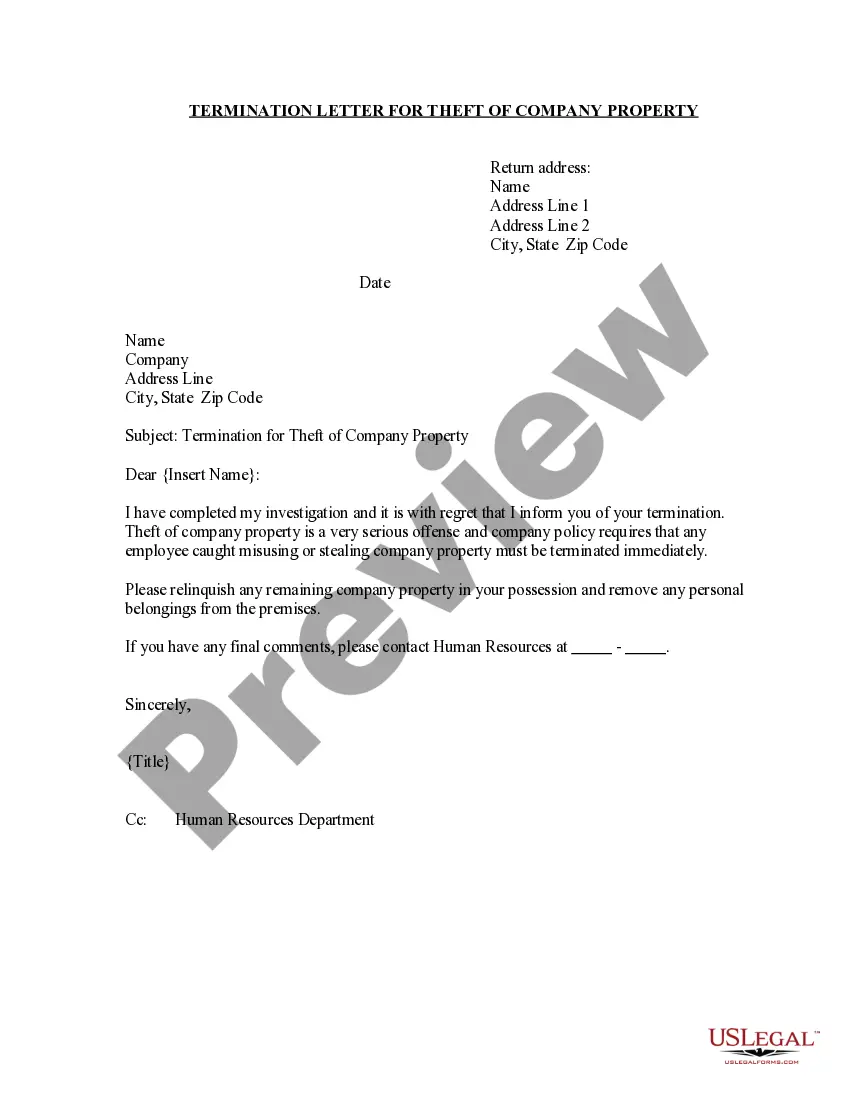

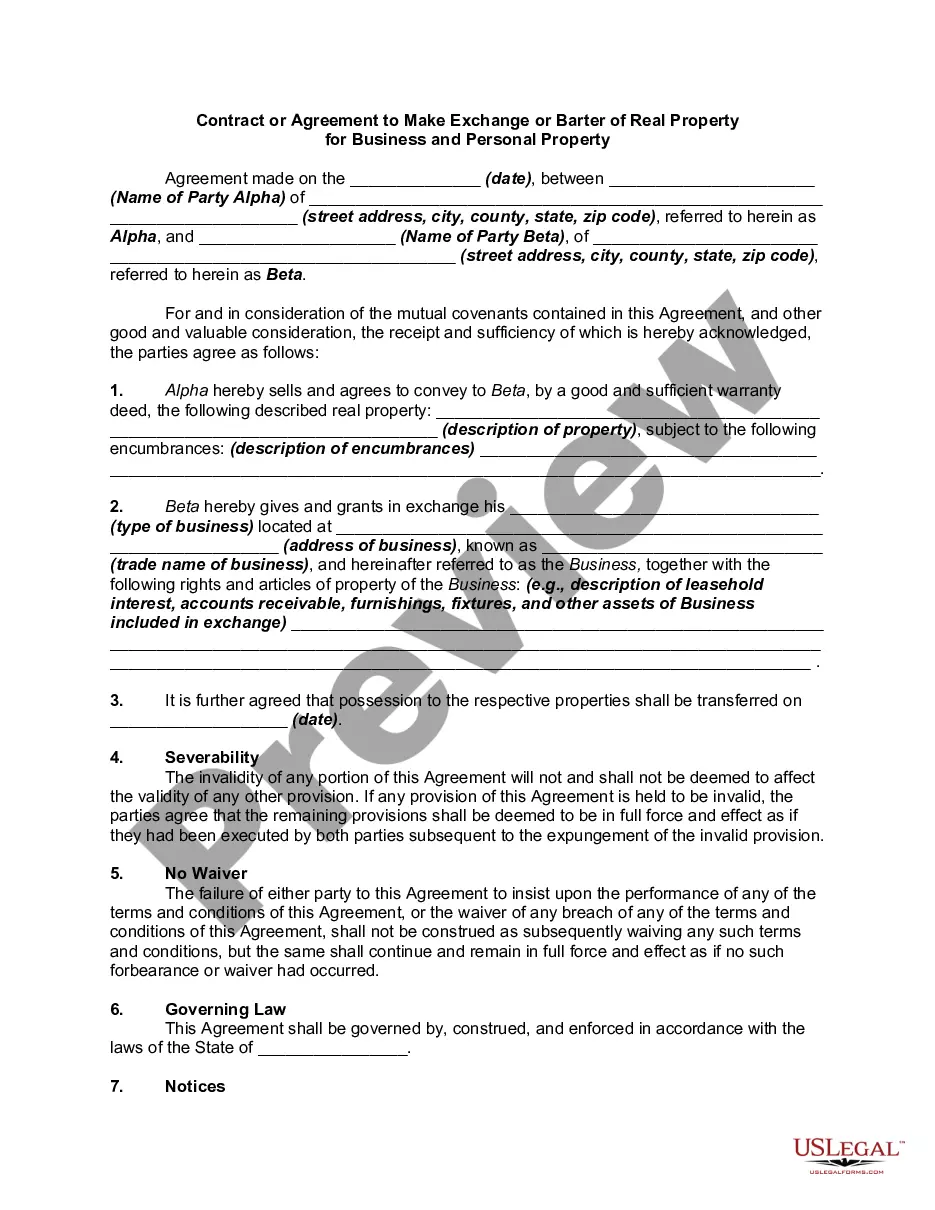

- Step 2. Use the Preview solution to examine the form`s articles. Do not forget about to read through the description.

- Step 3. Should you be not satisfied together with the type, take advantage of the Research area towards the top of the display screen to get other models of the authorized type template.

- Step 4. Once you have found the shape you need, click the Buy now key. Choose the rates plan you prefer and include your qualifications to sign up for an profile.

- Step 5. Approach the deal. You should use your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Pick the structure of the authorized type and download it on your device.

- Step 7. Total, edit and produce or indicator the Missouri Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Each authorized record template you purchase is your own for a long time. You may have acces to every type you saved within your acccount. Click the My Forms portion and decide on a type to produce or download once more.

Contend and download, and produce the Missouri Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms. There are many specialist and status-distinct kinds you can use for the business or specific demands.

Form popularity

FAQ

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

Missouri requires any nonprofit organization to have at least three directors. A president, secretary and treasurer have to be on the board for incorporation.

Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

Non-profit organizations must provide a completed application and supporting documents to be considered for exemption from property taxes for each property owned. Note: Business personal property is tax-exempt only when it is owned by the tax-exempt entity.

Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the ...