Missouri Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

US Legal Forms - one of the largest collections of legal documents in the country - offers a vast selection of legal document templates that you can download or print.

By using the site, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent templates such as the Missouri Promissory Note related to the Sale and Purchase of a Mobile Home within minutes.

Once you are satisfied with the form, confirm your choice by clicking the Buy Now button.

Then, select your preferred payment plan and provide your credentials to create an account.

- If you have a monthly membership, sign in and download the Missouri Promissory Note related to the Sale and Purchase of a Mobile Home from the US Legal Forms catalog.

- The Download button will appear on each form you view.

- You have access to all previously saved forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple tips to help you get started.

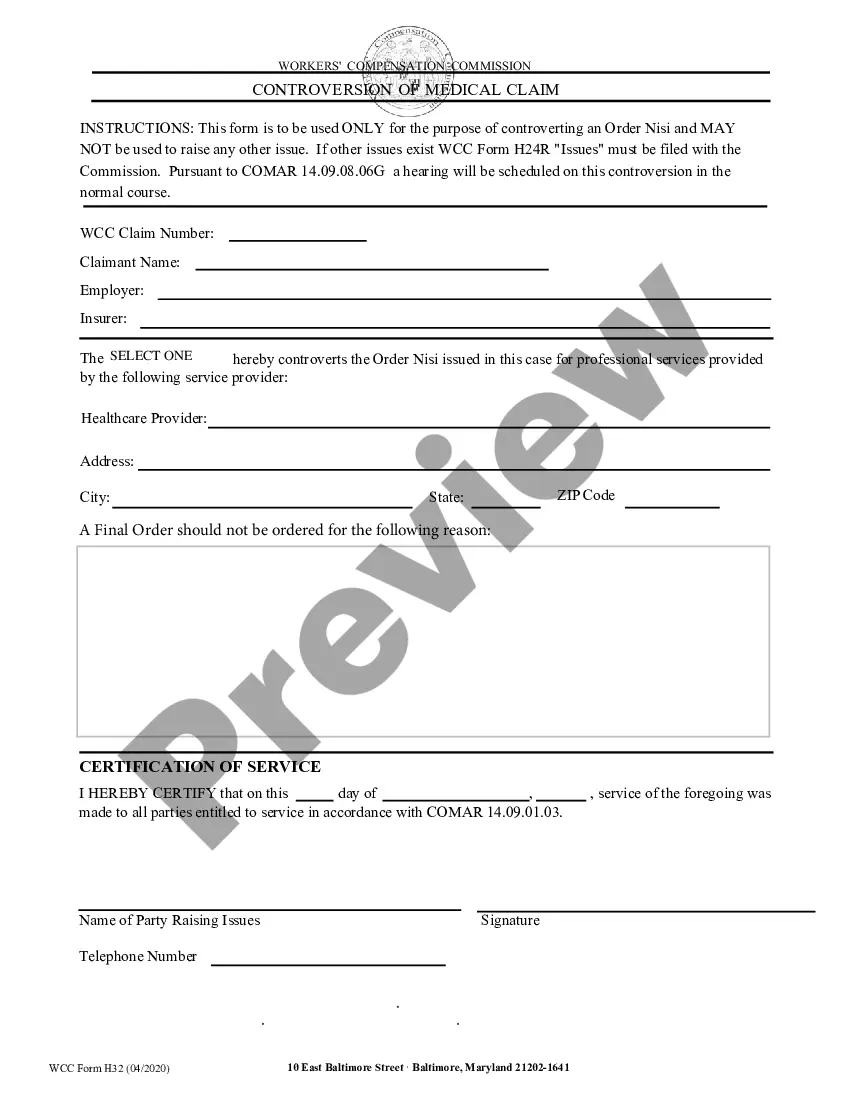

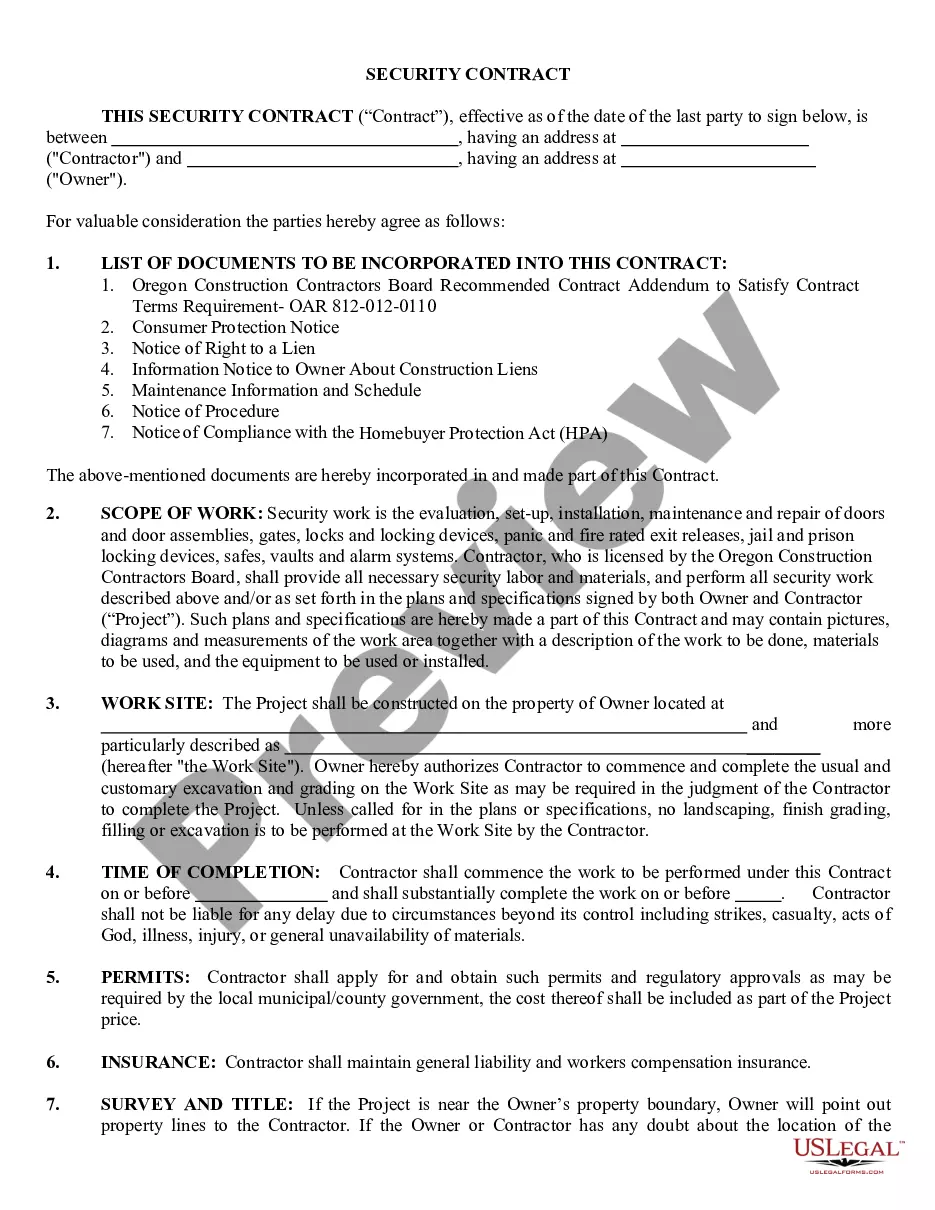

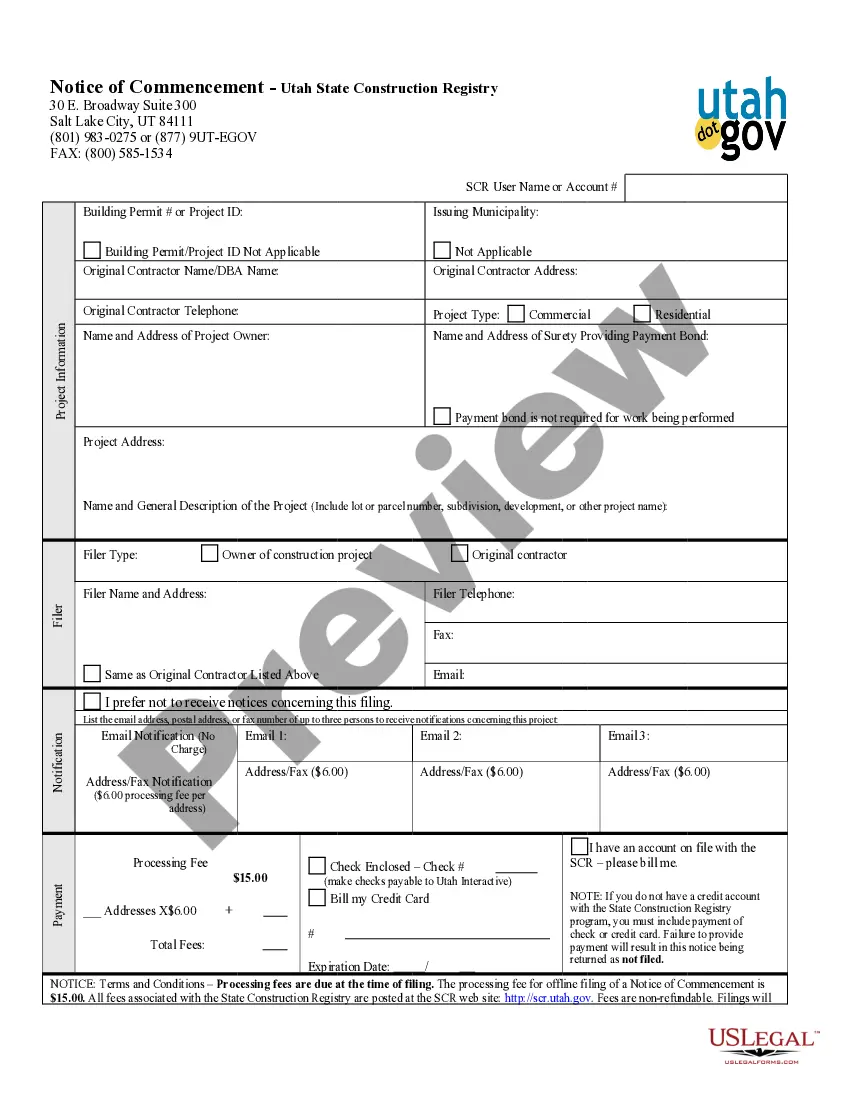

- Ensure you have selected the correct form for your area/state. Click on the Preview button to review the content of the form. Check the form details to confirm you have selected the right one.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

Form popularity

FAQ

To obtain a copy of your promissory note, start by contacting the lender or the person to whom you made the promise. They are typically required to maintain a record of the agreement. If you used a formal service like USLegalForms, simply log in to your account where you can download copies of your documents easily. Keeping your documents organized and accessible can save you time and effort.

Texas Mobile Home PaperworkSale, transfer and current ownership of a manufactured home.Whether a home is titled as personal or real property.The home's physical location.Outstanding liens.

Bank or Credit Union If you own the land, financing a manufactured home is fairly similar to financing a traditional home. You'll need a credit score in the mid-600s, a down payment of 10%-to-20% (as low as 3.5% with an FHA loan), and income that is roughly one-third the mortgage.

Closing fees include: $395 closing fee, 6% Florida sales tax, a flat rate county tax (usually $25 to $75), and estimated title transfer recording fee: single wide- $275, double wide- $375, triple wide- $475. Any remaining collected funds unused in the title transfer recording will be refunded to the buyer.

A mobile home is to be considered real property only when the owner of the mobile home is also the owner of the land on which the mobile home is situated and said mobile home is permanently affixed thereto.

The bill is signed by both the buyer and the seller in a company of a notary witness. The reason is to have the document notarized, and once it has been, you will then stand as the owner since the bill is a legal binder.

How long does it take to relevel a mobile home? It should take no longer than three to six hours to put the mobile home back to its original position. But it generally depends on the size of your home and the difficulty of the leveling job.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.

A Promissory note is a contract, which means that it is legally binding. However, it must include certain conditions to ensure it is enforceable.

For currently occupied homes, the average closing is around 30 days after the contract signing. Closing dates are flexible; your agent will assist you with that as part of the negotiation process.