A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Missouri Notice of Default and Election to Sell - Intent To Foreclose

Description

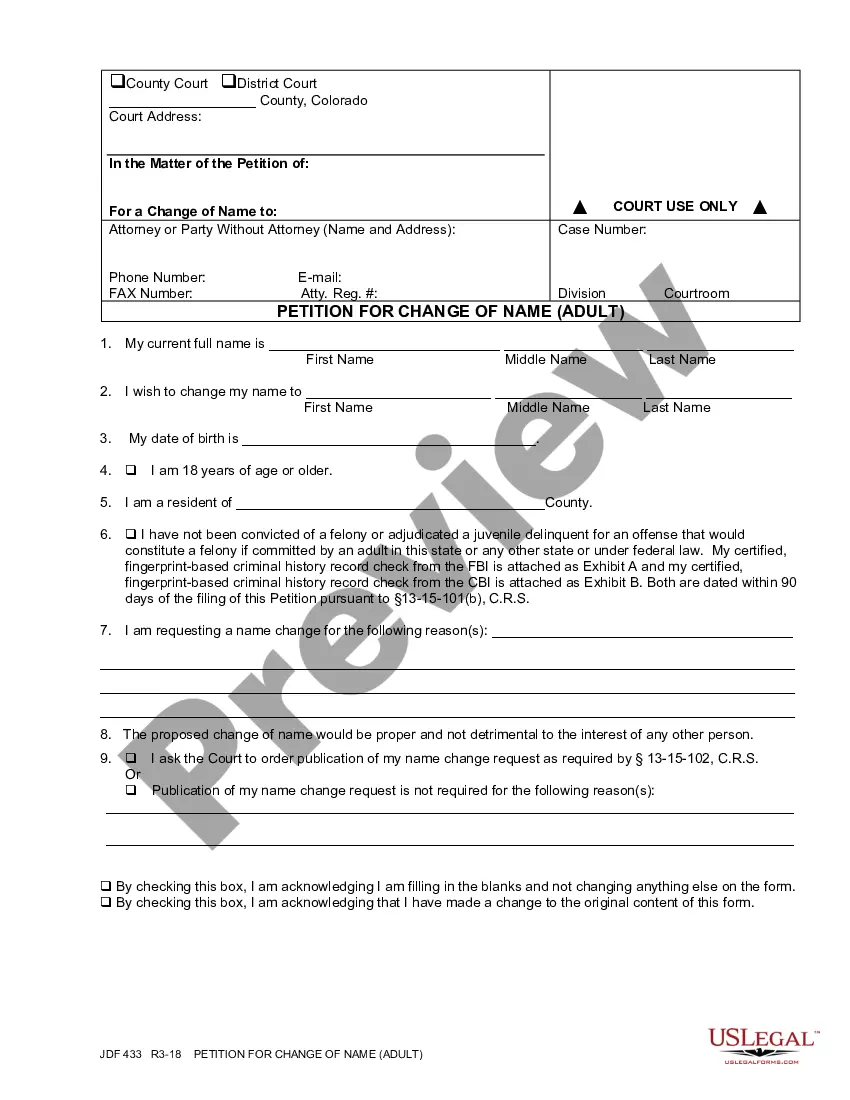

How to fill out Notice Of Default And Election To Sell - Intent To Foreclose?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can find thousands of templates for business and personal use, categorized by types, states, or keywords.

You can access the most recent templates such as the Missouri Notice of Default and Election to Sell - Intent To Foreclose in just a few minutes.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan of your choice and provide your credentials to sign up for an account.

- If you already have a subscription, Log In and download the Missouri Notice of Default and Election to Sell - Intent To Foreclose from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can find all previously downloaded templates in the My documents tab of your account.

- To start using US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your specific region/county.

- Click the Review button to assess the contents of the form.

Form popularity

FAQ

To file a notice of default in Missouri, you must prepare a written document that indicates you have failed to meet your mortgage obligations. This document serves as your Missouri Notice of Default and Election to Sell - Intent To Foreclose. You need to officially file it with the county recorder’s office where the property is located. Consider using a platform like uslegalforms to ensure you complete this process correctly and efficiently.

The foreclosure process in Missouri begins when a homeowner defaults on their mortgage payments. The lender must provide a Missouri Notice of Default and Election to Sell - Intent To Foreclose, which informs the homeowner of the default status. After this notice, the lender can initiate a public auction to sell the property, usually after a waiting period. It's crucial to understand this process, as it impacts your rights and options.

Writing a notice of default requires clarity and precision. Begin by stating the debtor's name, the property address, and the specifics of the mortgage agreement. Include information about the default, such as missed payments and the total amount due. To ensure you comply with legal requirements for the Missouri Notice of Default and Election to Sell - Intent To Foreclose, consider utilizing templates from U.S. Legal Forms for accuracy.

A notice of default indicates that you have missed mortgage payments, but it does not mean that foreclosure is imminent. This notice serves as a warning and gives you a chance to remedy the situation. It is essential to act quickly to resolve any issues before the process escalates to foreclosure. Learn more about managing a Missouri Notice of Default and Election to Sell - Intent To Foreclose through resources available on platforms like U.S. Legal Forms.

The notice of intention to foreclose informs you that your lender intends to initiate foreclosure proceedings. This notice typically includes details about your mortgage account and the amount owed. Understanding this notice is key in addressing your financial situation effectively. If you receive a notice related to the Missouri Notice of Default and Election to Sell - Intent To Foreclose, take action promptly to explore your options.

Responding to a foreclosure notice is crucial to protect your rights. Start by reviewing the notice thoroughly to understand the terms and deadlines. Consider contacting the lender to discuss possible repayment options or alternatives to foreclosure. If needed, consult legal resources or services like U.S. Legal Forms for guidance on navigating the Missouri Notice of Default and Election to Sell - Intent To Foreclose.

Once you default on your mortgage loan, the lender can demand that you repay the entire outstanding balance, called "accelerating the debt." If you don't repay the full loan amount or cure the default, the lender can foreclose.

For non-agricultural property, the sale of property takes place 110 to 125 calendar days after the NED is recorded. For agricultural property, the sale takes place 215 to 230 days after recording.

Once a default notice has been issued, the debt can be passed or sold to a debt collector. You may then start receiving letters and phone calls from the debt collector to chase up on the debt, and payments would need to be made to the debt collector rather than the original creditor.

The public trustee must set the foreclosure sale no less than 45 days and no more than 60 days from the date of recording of the Notice of Election and Demand. During that period of time, the property is advertised for sale in a newspaper of general circulation for four consecutive weeks.