Missouri Disputed Open Account Settlement

Description

How to fill out Disputed Open Account Settlement?

Are you currently in a position where you frequently need documents for either business or personal purposes almost every day.

There are numerous reputable document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Missouri Disputed Open Account Settlement, which can be drafted to satisfy federal and state regulations.

You can find all the document templates you have purchased in the My documents section.

You can acquire an additional copy of the Missouri Disputed Open Account Settlement at any time if needed. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Disputed Open Account Settlement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

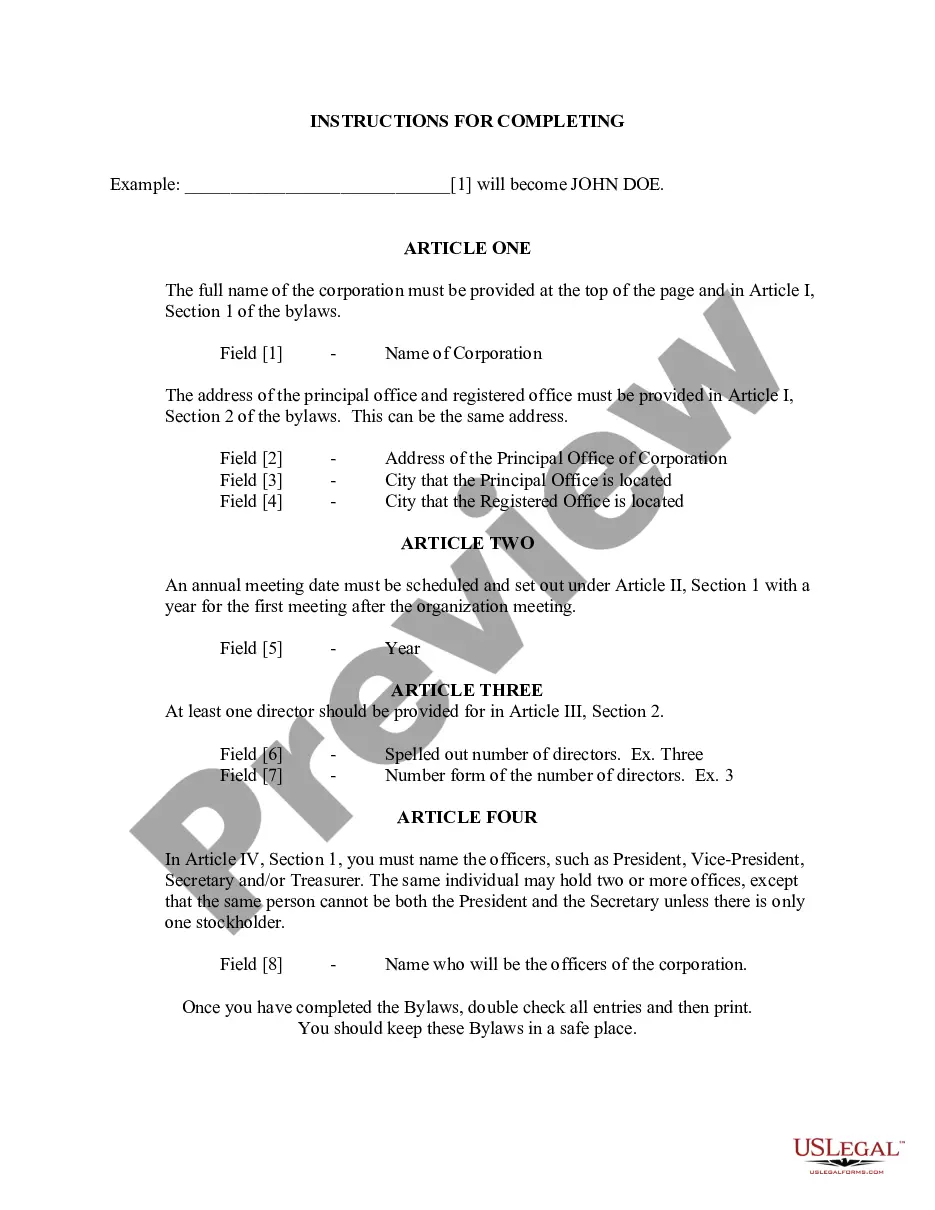

- Use the Preview option to review the form.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the right form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete your purchase using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

A Missouri lawsuit starts by filing a petition. A petition states the facts of a dispute, which are typically briefly described in chronological order in numbered paragraphs. The petition must state enough facts to show that the plaintiff has a viable cause of action against the defendant.

The FCBA protects consumers against inaccurate or unwarranted charges. Cardholders have protection against liability for fraudulent charges under FCBA if their credit card details have been compromised in a data breach or if they discover a thief has gained access to their credit details.

The Act requires creditors to give consumers 60 days to challenge certain disputed charges over $50 such as wrong amounts, inaccurate statements, undelivered or unacceptable goods, and transactions by unauthorized users.

If a person is authorized to use a card but makes unauthorized purchases with it, those charges are not covered by the Fair Credit Billing Act, and the cardholder is liable for them. Consumers can challenge the results of the lender's investigation within 10 days.

If your rights have been violated under the Fair Credit Billing Act, you are entitled to your actual damages, statutory damages up to $5,000, and possibly punitive damages if the creditor has a history of violating other consumers' rights in the same way.

The FCBA applies only to billing errors on ?open-end? accounts, like credit cards and revolving charge accounts. It does not apply to debit card transactions or disputes involving installment contracts with a fixed schedule of payments, like those used to buy cars or furniture.