Missouri Option to Purchase - Short Form

Description

How to fill out Option To Purchase - Short Form?

It is feasible to utilize time online exploring for the legitimate document format that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

You can download or print the Missouri Option to Purchase - Short Form from my service.

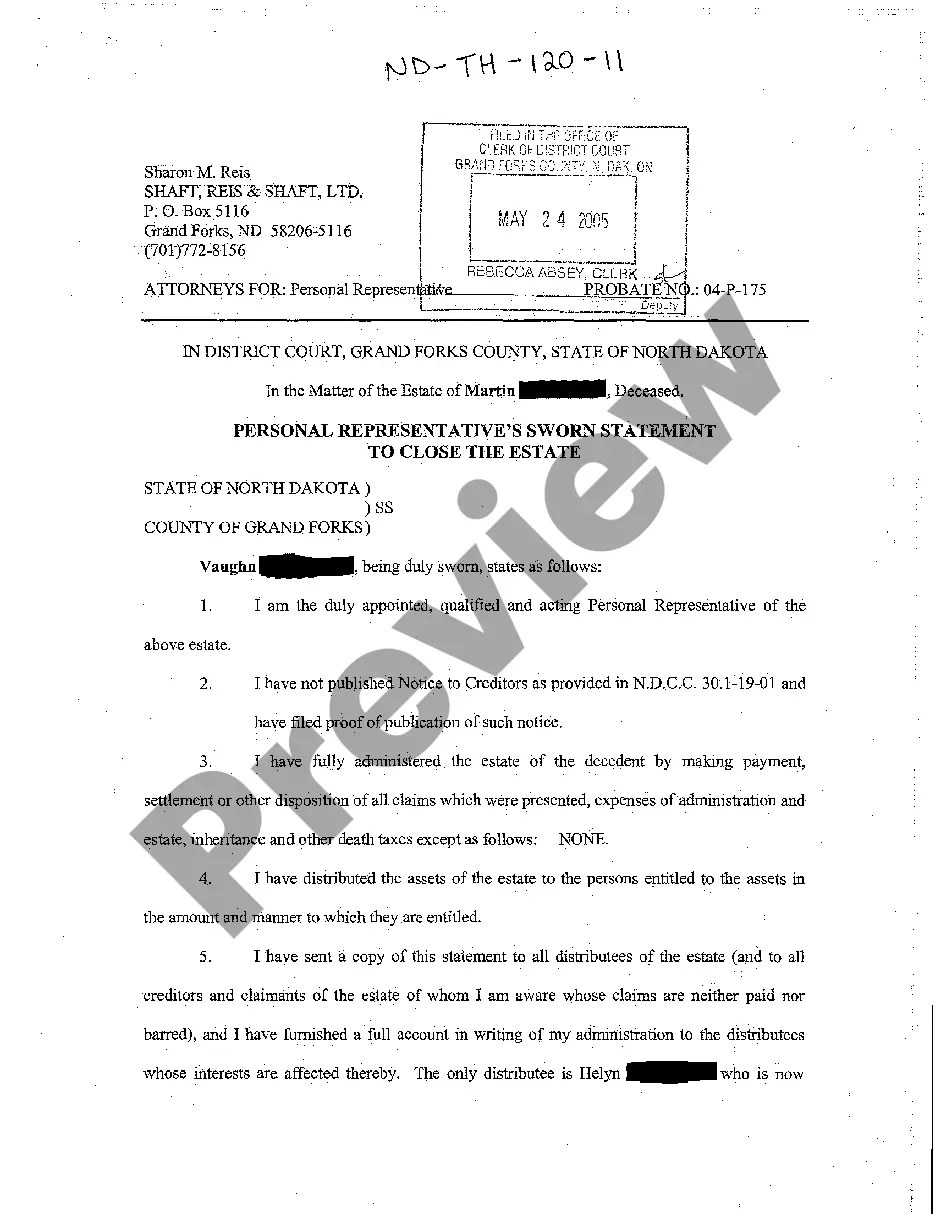

If available, use the Review button to view the document format as well.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can fill out, modify, print, or sign the Missouri Option to Purchase - Short Form.

- Every legal document format you acquire belongs to you indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for your state/town of choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

To request a tax-exempt letter in Missouri, you need to submit a specific application to the Missouri Department of Revenue. This letter confirms your tax-exempt status for applicable income. Uslegalforms can assist by providing the forms and instructions required to obtain this important documentation.

The Missouri withholding form, known as the MO W-4, enables employees to designate how much state tax is withheld from their earnings. Completing this form accurately can help you prevent under- or over-withholding. If you’re looking for a straightforward way to complete tax documents, uslegalforms offers a variety of resources.

Missouri does issue state tax forms, including the 1040 long and short forms. These forms are essential for individuals to report their income and determine their tax liabilities. To make the tax filing process easier, consider using uslegalforms which offers a variety of state-specific forms.

Yes, Missouri does implement state withholding regulations for employees. Employers are required to withhold state taxes from employee paychecks to ensure tax obligations are met. If you need clarification on how state withholding works, resources on uslegalforms can provide comprehensive answers.

Indeed, Missouri provides state withholding forms that employers must use to withhold state taxes from employee wages. The form helps ensure compliance with state tax laws. For guidance on filling out these documents correctly, uslegalforms can serve as a valuable resource.

Obtaining a no tax due letter in Missouri involves submitting a request form through the Missouri Department of Revenue. This demonstrates that you have no outstanding tax obligations. If you find the process confusing, uslegalforms can help you navigate it effectively by offering relevant document templates.

To request a letter of no tax due in Missouri, you must fill out a specific form through the Missouri Department of Revenue's online portal. This letter indicates that you have settled all your taxes. For a simplified approach, consider looking into uslegalforms which can provide the necessary forms and support for your request.

You can obtain a non-filing tax letter online by visiting the Missouri Department of Revenue’s website. By navigating to the appropriate section and providing requested details, you can request a letter that confirms your non-filing status. Utilizing uslegalforms can help you find the right forms and instructions to make the process easier.

To secure a tax clearance letter in Missouri, you must complete a specific application provided by the Missouri Department of Revenue. This letter confirms that you have no outstanding tax liabilities. For individuals seeking help with this process, uslegalforms offers simple forms and guidance to expedite your request.

To obtain your Missouri 1099 G, you can visit the official Missouri Department of Revenue website. There, you can access your tax documents by providing necessary personal information. If you need further assistance, consider using the uslegalforms platform to streamline your request and receive documents more efficiently.