Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Nevada Special Rules for Designated Settlement Funds IRS Code 468B

Description

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

Choosing the best authorized papers web template can be quite a have a problem. Of course, there are a lot of themes accessible on the Internet, but how do you obtain the authorized form you will need? Use the US Legal Forms site. The services offers 1000s of themes, like the Nevada Special Rules for Designated Settlement Funds IRS Code 468B, which you can use for enterprise and private needs. All the kinds are examined by professionals and satisfy state and federal demands.

Should you be presently listed, log in to your profile and then click the Download button to find the Nevada Special Rules for Designated Settlement Funds IRS Code 468B. Use your profile to search with the authorized kinds you may have ordered previously. Visit the My Forms tab of the profile and obtain yet another duplicate from the papers you will need.

Should you be a whole new consumer of US Legal Forms, allow me to share easy instructions that you should adhere to:

- Very first, make certain you have selected the right form for the town/area. You are able to look over the shape while using Preview button and browse the shape description to guarantee it will be the right one for you.

- If the form is not going to satisfy your expectations, take advantage of the Seach discipline to get the right form.

- When you are certain the shape is proper, click on the Get now button to find the form.

- Opt for the costs strategy you need and enter the necessary information. Design your profile and pay for your order making use of your PayPal profile or credit card.

- Opt for the submit structure and down load the authorized papers web template to your system.

- Full, revise and print out and sign the received Nevada Special Rules for Designated Settlement Funds IRS Code 468B.

US Legal Forms is definitely the biggest catalogue of authorized kinds that you can discover a variety of papers themes. Use the service to down load appropriately-made paperwork that adhere to express demands.

Form popularity

FAQ

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

If you receive a settlement in California that is considered taxable income, you will need to report it on your tax return. You will typically receive a Form 1099-MISC, which reports the amount of taxable income you received during the year.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

A Qualified Settlement Fund (QSF), also referred to as a 468B Trust, is an exceptionally useful settlement tool that allows time to properly resolve mass tort litigation and other cases involving multiple claimants.

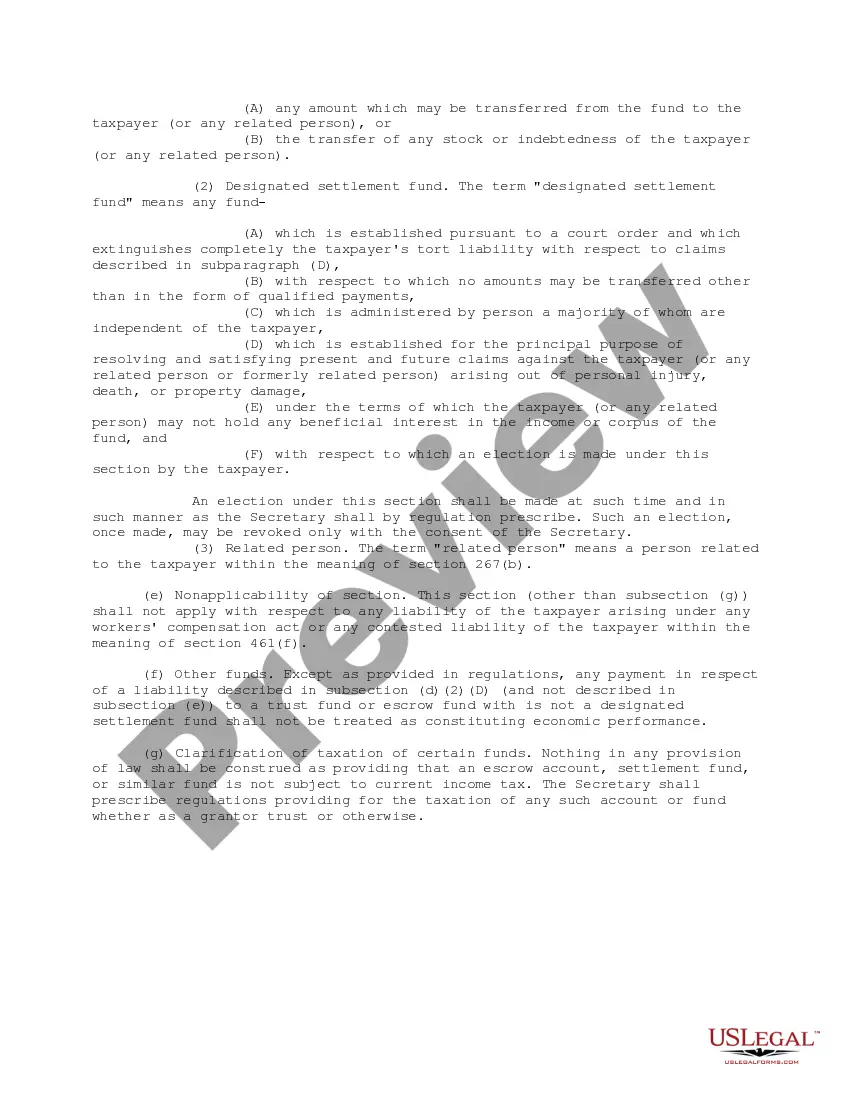

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

§ 1.468B-2 Taxation of qualified settlement funds and related administrative requirements. (a) In general. A qualified settlement fund is a United States person and is subject to tax on its modified gross income for any taxable year at a rate equal to the maximum rate in effect for that taxable year under section 1(e).