Missouri Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

Are you presently in a scenario where you need documents for various organizational or personal objectives almost every day.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Missouri Security Agreement concerning Sale of Collateral by Debtor, which are designed to comply with state and federal regulations.

Once you find the suitable form, click Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Missouri Security Agreement concerning Sale of Collateral by Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

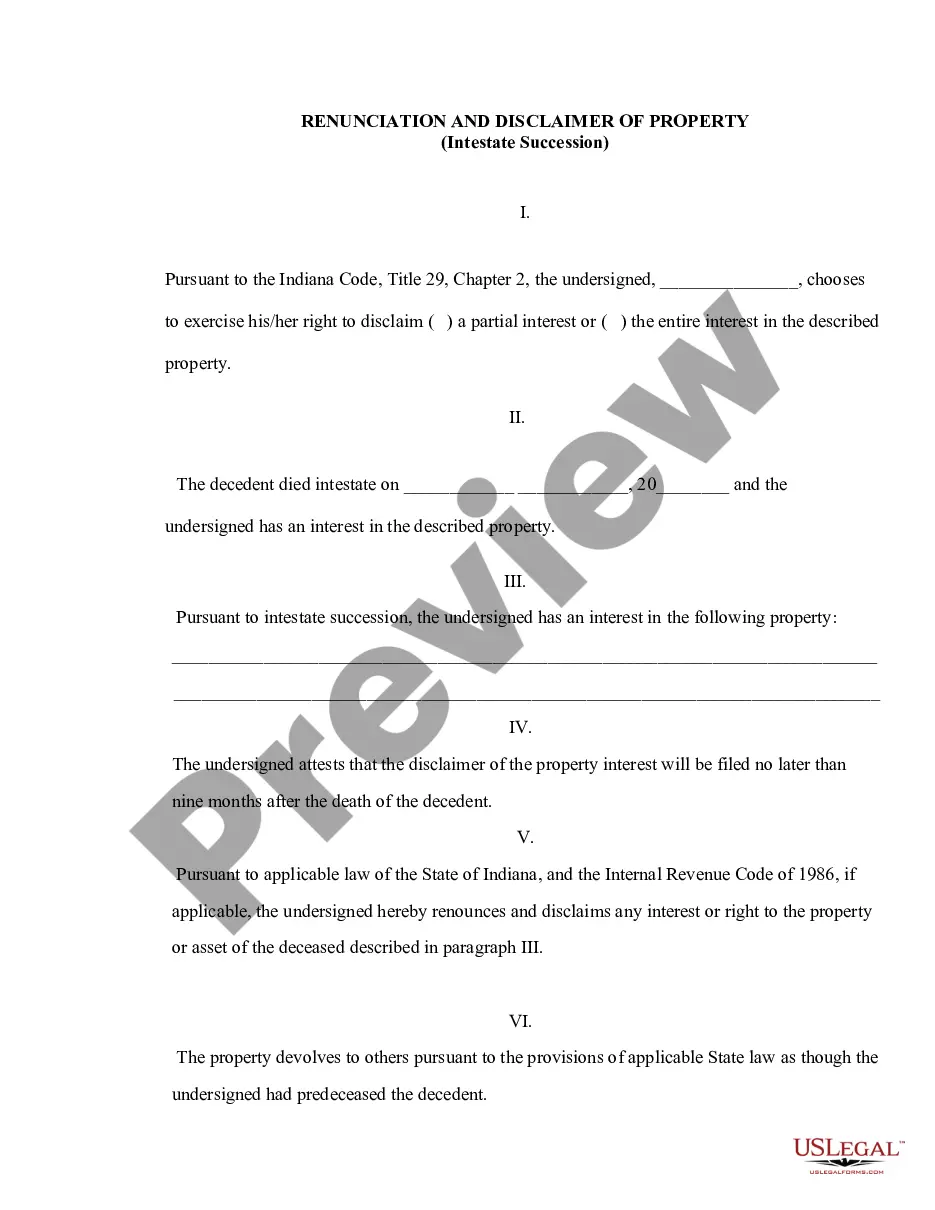

- Utilize the Review option to examine the form.

- Verify the details to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

To have an enforceable security interest, a creditor must meet three essential requirements: there must be a valid security agreement, the creditor must possess or have control of the collateral, and the interest must be legally perfected. These elements secure the creditor’s rights over the collateral in the case of default. Understanding these requirements is vital for drawing up a Missouri Security Agreement involving Sale of Collateral by Debtor.

A security agreement and a lien are related but not identical concepts. The security agreement establishes the obligation between the creditor and debtor regarding collateral, while a lien is the legal claim on the collateral itself. Essentially, a lien arises from a security agreement, as it grants the creditor rights to the collateral in case of default. These elements are critical in a Missouri Security Agreement involving Sale of Collateral by Debtor.

A security agreement outlines the terms between the debtor and creditor regarding the secured collateral. In contrast, a UCC filing serves as public notice of the security interest. While a security agreement is a private contract, the UCC filing provides additional protection to creditors by making their interest known to other parties. Both are essential in a Missouri Security Agreement involving Sale of Collateral by Debtor.

To make a security interest enforceable, the parties must comply with specific legal requirements outlined in the Missouri Security Agreement involving Sale of Collateral by Debtor. Typically, this involves attachment, which occurs when the lender gives value, the debtor has rights in the collateral, and there is an agreement. Additionally, perfection, often achieved by filing a financing statement, may be necessary to ensure the security interest holds against third parties. Navigating this process can be complex, but platforms like uslegalforms can provide guidance and templates to simplify it.

A security agreement is a contract that allows a lender to obtain a security interest in a debtor's property. In contrast, a lien is a legal right or interest that a lender has against a debtor's property, typically without requiring a formal contract. In a Missouri Security Agreement involving Sale of Collateral by Debtor, the security agreement establishes the relationship, while the lien represents the legal claim against the collateral in case of default. This distinction helps clarify the rights and responsibilities of both parties.

When collateral is sold, the proceeds typically go toward paying off the debt owed to the lender. However, it's crucial to follow the terms outlined in the Missouri Security Agreement involving Sale of Collateral by Debtor to ensure that the sale is legally recognized. Failing to do so may result in disputes or loss of the collateral without satisfying the debt. Understanding these implications can help protect you in financial transactions.

A collateral security agreement is a legal document that grants a lender a security interest in a debtor's asset. This agreement ensures that if the debtor fails to meet their obligations, the lender can claim the specified collateral to recover the owed amount. In the context of a Missouri Security Agreement involving Sale of Collateral by Debtor, this agreement outlines the terms under which a debtor can sell the pledged collateral while still protecting the lender's interests.

The standard for collateral description in a security agreement is that it must be specific enough to identify the assets clearly. For a Missouri Security Agreement involving Sale of Collateral by Debtor, this means using detailed descriptions that eliminate ambiguity and allow creditors to enforce their rights if needed. Clarity in description prevents disputes and ensures compliance with the law.

The right to take hold or sell a debtor's property as security or payment for a debt is known as a security interest. In a Missouri Security Agreement involving Sale of Collateral by Debtor, this right allows creditors to reclaim their funds if the debtor defaults on their obligations. Essentially, this provides a safety net for lenders, ensuring that they have a claim to specific assets.