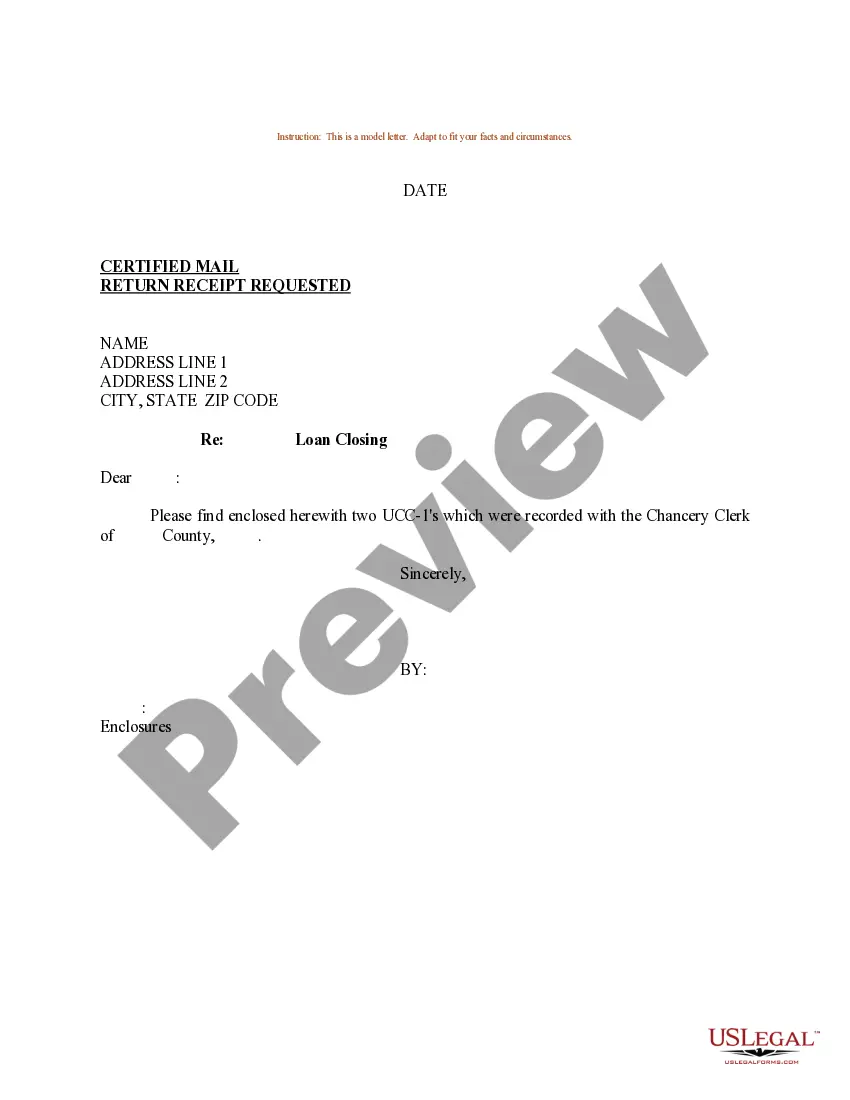

Missouri Sample Letter Transmitting UCC-1 Forms for a Loan Closing

Description

How to fill out Sample Letter Transmitting UCC-1 Forms For A Loan Closing?

You can devote considerable time on the internet searching for the valid document format that meets the state and national requirements you desire.

US Legal Forms offers numerous valid templates that have been reviewed by professionals.

You can obtain or print the Missouri Sample Letter Transmitting UCC-1 Forms for a Loan Closing from the services.

If you wish to discover another version of the form, use the Search field to find the format that meets your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can fill out, edit, print, or sign the Missouri Sample Letter Transmitting UCC-1 Forms for a Loan Closing.

- Each valid document format you purchase is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and then click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for your state/city of choice. Check the form summary to confirm you have chosen the right form.

- If available, utilize the Preview button to review the document format as well.

Form popularity

FAQ

In Missouri, a UCC-1 filing is typically valid for five years from the date of filing. After this period, you may need to renew the filing to maintain your secured interest. If you are unsure how to manage this, the resources available on the US Legal Forms platform can assist you with ongoing compliance.

You must file your UCC-1 statement in the appropriate state office, usually the Secretary of State, where the debtor is located. For Missouri, you can file your UCC-1 form either online or by sending it to the state's office by mail. If you need guidance, US Legal Forms can assist you in accessing the right resources for filing your forms.

Article 9 of the Uniform Commercial Code governs secured transactions. It provides a mechanism whereby a secured creditor can perfect its security interest in the debtor's assets by filing a UCC-1 financing statement. In theory, anyone can file a UCC-1 against anyone else.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

How to complete a UCC1 (Step by Step)Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address.Secured Party Information. Organization or individual's name. Mailing address.Collateral Information. Description of collateral.

3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.

By Mail: send the completed form with the processing fee of $40 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

This might be a piece of equipment, a vehicle, property, or even a blanket lien naming all your assets. A UCC-1 protects a lender's interests for five years (unless the lender refiles) and will typically be included on your business credit reports.

1 financing statement contains three important pieces of information: Parts 1 and 2 contain the personal and contact information of the borrower. Part 3 contains the personal and contact information of the secured partyotherwise known as the creditor. Part 4 describes the collateral covered in the UCC lien.