Missouri Notice of Termination of Agency from Principal to the General Public or a Specific Person

Description

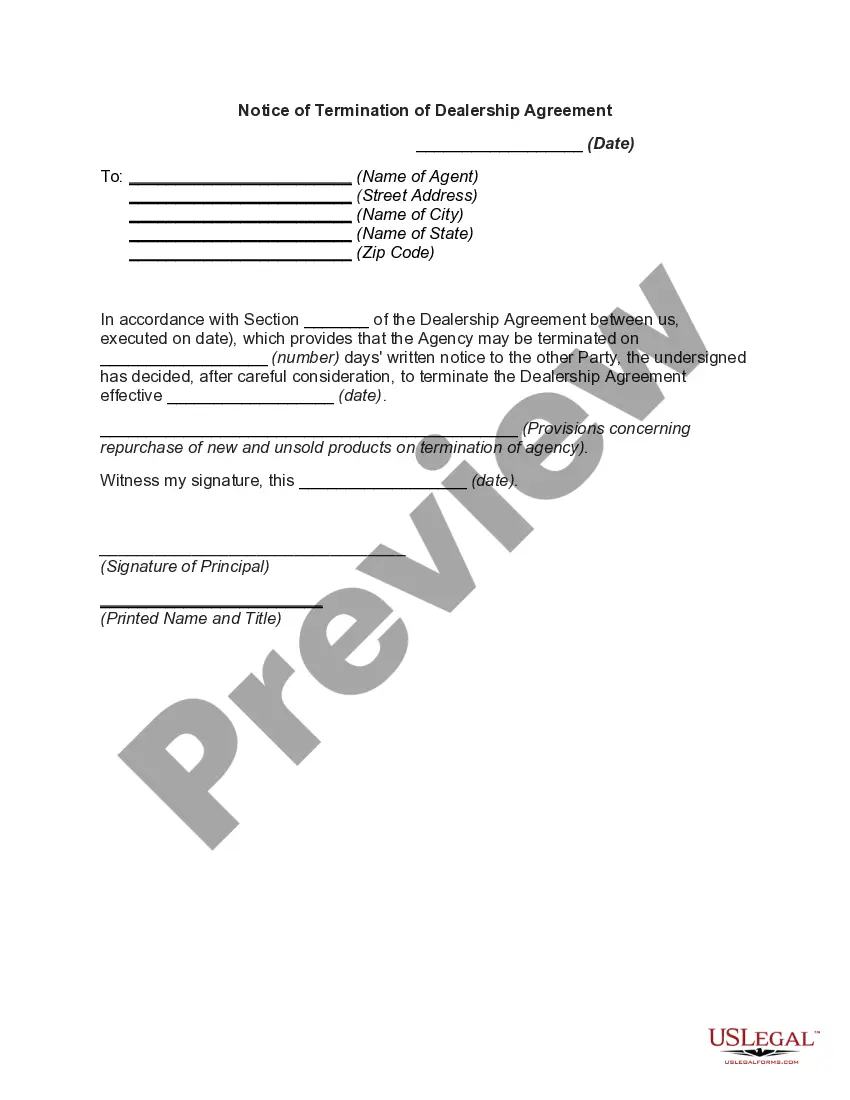

How to fill out Notice Of Termination Of Agency From Principal To The General Public Or A Specific Person?

If you require to complete, download, or print legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the website's easy and straightforward search to find the documents you need.

Various templates for commercial and personal applications are organized by categories and regions, or keywords.

Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Use US Legal Forms to obtain the Missouri Notice of Termination of Agency from Principal to the General Public or a Specific Person with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to receive the Missouri Notice of Termination of Agency from Principal to the General Public or a Specific Person.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Don't forget to read the summary.

Form popularity

FAQ

To dissolve an LLC in Missouri, LLCs have to file an Article of Dissolution. The filing fee is $25.

Here's what's included in articles of organization:Name and address of the registered agent.Name and address of the company registrar.Principal place of doing business.Name of the company.Doing Business As (DBA) designations.Purpose of your business.Type of business structure.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

You will need to know the following information to complete each Article:Entity Name.Business Purpose.Registered Agent Name and Registered Office Address.Governing Authority Type.Duration.Names and Addresses of Organizers.Series LLC Information (if applicable)Effective Date.

The Missouri Secretary of State charges $50 to file the Articles of Organization online and $105 for paper filings. Online Filers must also pay an additional $1.25. You can reserve your LLC name with the Missouri Secretary of State for $7.

To resign, the Missouri registered agent must submit the original and two copies of a Statement of Resignation of Registered Agent with $10 to the Missouri Secretary of State, Corporations Division by mail or in-person.

Closing Correctly Is Important Officially dissolving an LLC is important. If you don't, you can be held personally liable for the unpaid debts and taxes of the LLC. A few additional fees you should look for; Many states also levy a fee against LLCs each year.

To dissolve your LLC in Missouri, you must first complete (and provide by mail, fax or in person) either a Notice of Abandonment of Merger or Consolidation of Limited Liability Company (Form LLC-2) or a Notice of Winding Up (LLC-13) form, disclosing that a dissolution is in process.

In Missouri, you must first file a Notice of Winding Up to inform the state that you are in the process of ending your business. Then, once you wind up your LLC, you must file the Articles of Termination. Both forms are $25. Missouri requires business owners to submit their Articles of Termination" by mail or online.