Missouri Oil, Gas and Mineral Deed - Individual to Two Individuals

Description

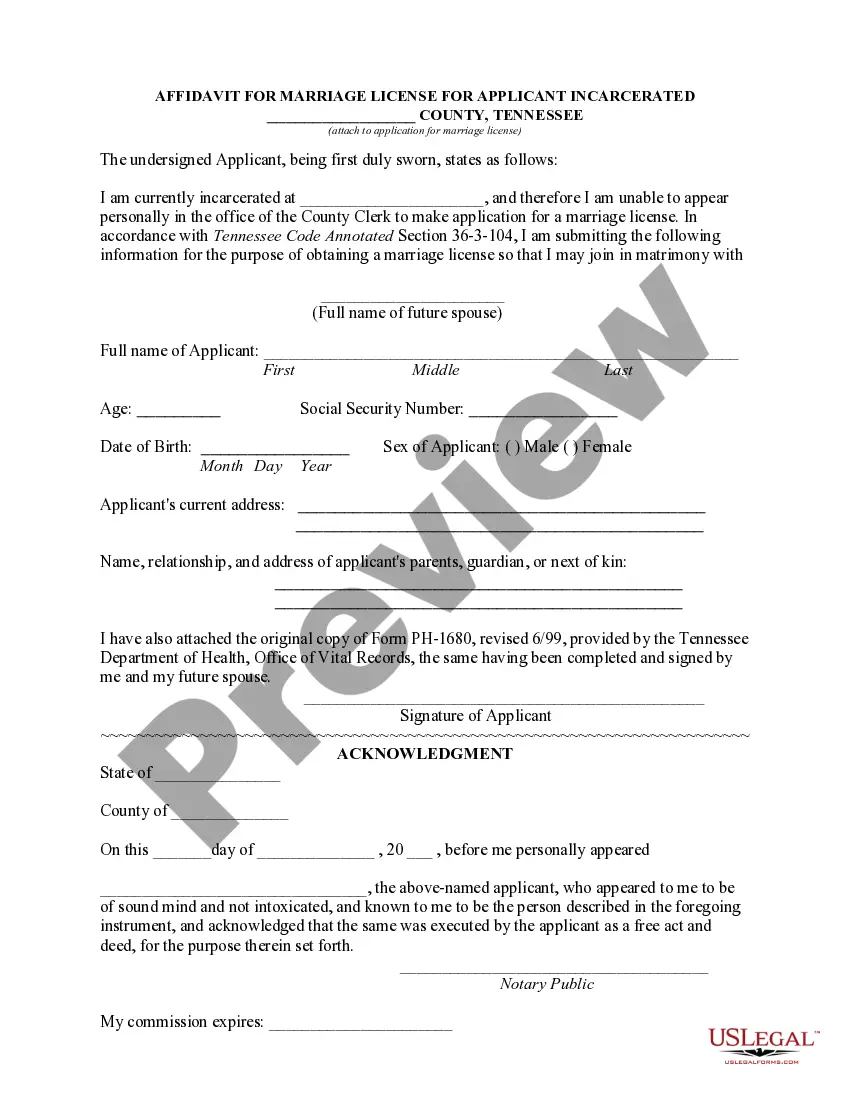

How to fill out Oil, Gas And Mineral Deed - Individual To Two Individuals?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print. By utilizing the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Missouri Oil, Gas and Mineral Deed - Individual to Two Individuals in just a few seconds. If you already have a subscription, Log In to download the Missouri Oil, Gas and Mineral Deed - Individual to Two Individuals from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the appropriate form for your city/state. Click on the Preview button to review the contents of the form. Read the form description to make sure you have chosen the correct document. If the form does not meet your needs, use the Search field at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, select the payment plan you prefer and provide your details to register for the account.

- Complete the payment. Use a Visa or Mastercard or PayPal account to finalize the payment.

- Select the format and download the form onto your device.

- Make edits. Fill out, modify, and print and sign the downloaded Missouri Oil, Gas and Mineral Deed - Individual to Two Individuals.

- Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Missouri Oil, Gas and Mineral Deed - Individual to Two Individuals with US Legal Forms, the most extensive collection of legal document templates.

- Utilize a vast array of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else. Once mineral rights have been sold, the original owner retains only the rights to the land surface, while the second party may exploit the underground resources in any way they choose.

Missouri's statutes give the owner of the property rights to the minerals below the surface in the absence of a contract to the contrary. They also prescribe the duties of property owners and miner's.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.

Is the oil that is being removed from under the neighbors' land limited to what is under that property only? A)Yes, mineral rights can be sold separately from the land itself. Traditionally, ownership rights of real property are described as a barrel of legal rights.