Missouri Unrestricted Charitable Contribution of Cash

Description

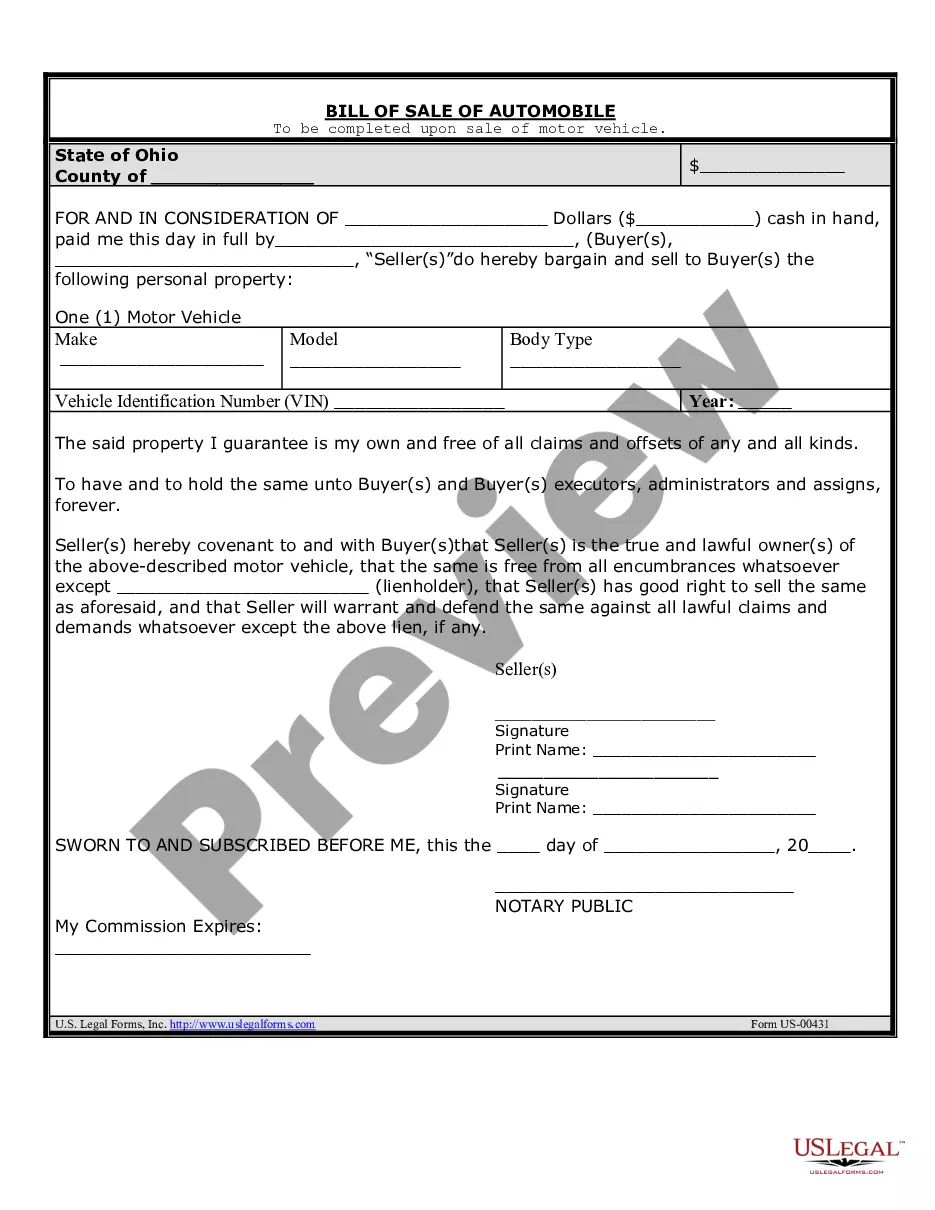

How to fill out Unrestricted Charitable Contribution Of Cash?

US Legal Forms - among the greatest libraries of legitimate kinds in the United States - gives an array of legitimate record templates you can obtain or produce. Using the web site, you can find a large number of kinds for enterprise and individual reasons, sorted by classes, suggests, or keywords.You will discover the latest versions of kinds like the Missouri Unrestricted Charitable Contribution of Cash within minutes.

If you currently have a monthly subscription, log in and obtain Missouri Unrestricted Charitable Contribution of Cash from your US Legal Forms catalogue. The Acquire button can look on each and every form you look at. You have access to all formerly delivered electronically kinds within the My Forms tab of your respective bank account.

If you would like use US Legal Forms for the first time, allow me to share easy recommendations to help you get started out:

- Make sure you have picked the proper form to your city/state. Go through the Preview button to review the form`s content material. See the form information to actually have selected the right form.

- If the form does not fit your needs, use the Research discipline towards the top of the screen to discover the one who does.

- If you are happy with the form, affirm your selection by visiting the Get now button. Then, select the pricing plan you prefer and supply your accreditations to sign up to have an bank account.

- Process the transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Choose the formatting and obtain the form on your system.

- Make modifications. Complete, change and produce and sign the delivered electronically Missouri Unrestricted Charitable Contribution of Cash.

Each design you included in your money lacks an expiry time and it is the one you have eternally. So, if you want to obtain or produce an additional duplicate, just go to the My Forms segment and click around the form you will need.

Gain access to the Missouri Unrestricted Charitable Contribution of Cash with US Legal Forms, probably the most substantial catalogue of legitimate record templates. Use a large number of specialist and condition-specific templates that meet up with your business or individual requirements and needs.

Form popularity

FAQ

Accessed . 6.Internal Revenue Service. Expanded tax benefits help individuals and businesses give to charity during 2021; deductions up to $600 available for cash donations by non-itemizers.

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your federal AGI.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

The new threshold is 60 percent of AGI for cash contributions held for over a year, and 30 percent of AGI for non-cash assets. The good news is that the standard deduction is now higher to account for inflation, rising to $12,950 for people who file individually and $25,900 for married couples who file joint returns.

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

The new threshold is 60 percent of AGI for cash contributions held for over a year, and 30 percent of AGI for non-cash assets. The good news is that the standard deduction is now higher to account for inflation, rising to $12,950 for people who file individually and $25,900 for married couples who file joint returns.

To be clear, you can claim work expenses up to $300 without receipts IN TOTAL (not each item), with basic substantiation. This means that if you have no receipts for work-related purchases, you can still claim up to $300 worth on your tax return.

Missouri taxpayers can receive a tax credit for up to 50% of their donations with a maximum credit of $2,500 per taxpayer, per year.