Missouri Sample Letter for Advertising Rates

Description

How to fill out Sample Letter For Advertising Rates?

Selecting the appropriate legitimate document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you discover the legitimate form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Missouri Sample Letter for Advertising Rates, that can be utilized for both business and personal purposes.

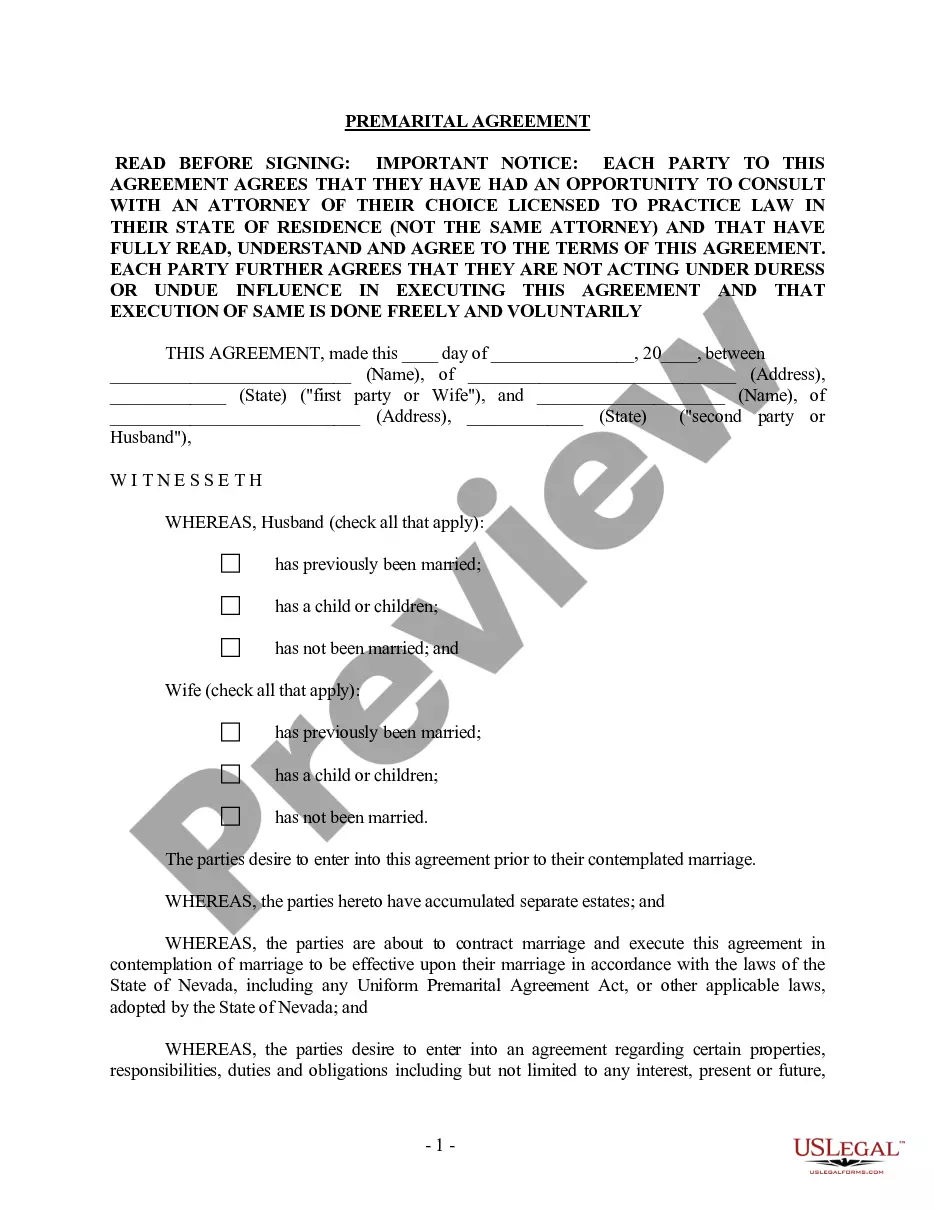

You can view the form using the Preview option and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Missouri Sample Letter for Advertising Rates.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account and get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

Certain types of income are not subject to taxation in Missouri, including social security benefits and certain pension plans. Being aware of these exemptions can help you manage your finances more effectively. As you navigate your business's finances, a Missouri Sample Letter for Advertising Rates can help clarify your income sources and any taxable implications.

Yes, you can obtain a Missouri tax waiver online by visiting the Missouri Department of Revenue's website. It is essential to follow the online application process carefully, as it requires specific information about your tax status. A Missouri Sample Letter for Advertising Rates can guide you on what information to include and how to present your case. Make sure to check back for any updates regarding your submission.

A no tax due letter can be requested from the Missouri Department of Revenue if you have no outstanding tax liabilities. Simply submit your request along with any necessary verification documents to support your claim. Utilizing a Missouri Sample Letter for Advertising Rates may help structure your communication effectively. Stay organized with your records to facilitate a smooth request process.

Obtaining a Missouri tax exempt letter involves submitting an application to the Missouri Department of Revenue. You will need to provide proof of your tax-exempt status, which can include relevant documents or letters. Using a Missouri Sample Letter for Advertising Rates can simplify this process, ensuring precise documentation for your request. Make sure to follow up with the department after submitting your application.

In Missouri, advertising services are generally subject to sales tax. However, certain advertising services may be exempt based on the nature of the service or the business type. To clarify your specific case, consider getting a Missouri Sample Letter for Advertising Rates, which can provide detailed information related to tax applicability in your situation. Consulting a tax professional can also be beneficial.

To become exempt from Missouri withholding, you need to meet specific criteria defined by the state. Generally, if you expect to earn under a certain threshold or have no tax liability, you may qualify. You can use a Missouri Sample Letter for Advertising Rates to help document your situation effectively. Make sure to submit the necessary forms to your employer along with any relevant documentation.