Missouri Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

Selecting the optimal legal document template can be challenging. Indeed, numerous formats are accessible online, but how do you find the legal form you need? Leverage the US Legal Forms website. This platform provides a vast array of templates, including the Missouri Consulting Agreement - with Former Shareholder, suitable for both business and personal purposes.

All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Missouri Consulting Agreement - with Former Shareholder. Use your account to navigate through the legal forms you have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

Complete, edit, print, and sign the obtained Missouri Consulting Agreement - with Former Shareholder. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize this service to acquire properly crafted paperwork that complies with state regulations.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have chosen the correct form for your area/county. You can preview the document using the Preview option and read the description to confirm it suits your needs.

- If the form does not meet your requirements, utilize the Search field to locate the appropriate document.

- Once you are certain the form is suitable, click the Purchase now button to obtain the document.

- Select the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template onto your device.

Form popularity

FAQ

Yes, you can create your own operating agreement for your LLC. This document allows you to customize the rules and guidelines for your business as you see fit. Many choose to use templates from platforms like US Legal Forms that offer Missouri-specific options, including those related to a Missouri Consulting Agreement - with Former Shareholder, to ensure that all important details are covered.

Yes, an LLC can technically operate without an operating agreement, but this can lead to confusion and disputes among members. Without clear guidelines for governance, managing day-to-day operations may become challenging. Consider drafting an operating agreement, especially if you have a Missouri Consulting Agreement - with Former Shareholder, to ensure smooth operation and defined roles among members.

You can create a shareholders agreement by drafting a document that outlines the rights and responsibilities of shareholders in your company. Common practices include consulting legal professionals to ensure your agreement complies with applicable laws. Using a platform like US Legal Forms can simplify this process, allowing you to find templates tailored to your needs, including a Missouri Consulting Agreement - with Former Shareholder.

An LLC, or Limited Liability Company, is a business structure that protects its owners from personal liability. An operating agreement, on the other hand, is a document that details the internal workings of the LLC, including management structure and profit distribution. To manage a Missouri Consulting Agreement - with Former Shareholder effectively, the operating agreement is crucial as it defines how both parties will interact and fulfill their responsibilities.

In Missouri, while an LLC is not legally required to create an operating agreement, having one is highly recommended. An operating agreement serves as a blueprint for your LLC's operations and management. It outlines the roles and responsibilities of members, which can help prevent disputes. If you have a Missouri Consulting Agreement - with Former Shareholder, including an operating agreement can clarify expectations for all parties involved.

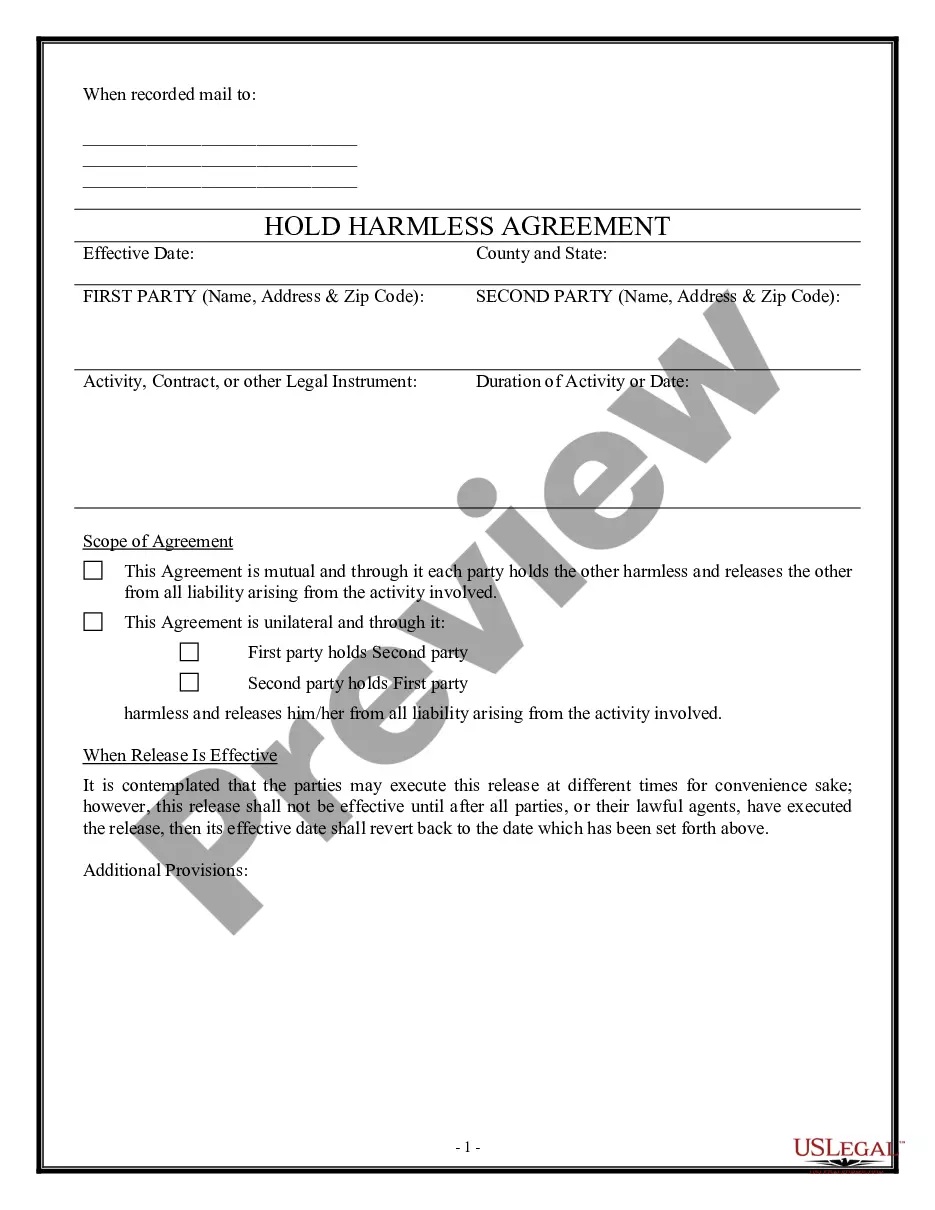

To change a shareholder agreement, all shareholders must usually agree to the amendments. After reaching a consensus, document the changes clearly, and ensure all parties sign the updated agreement. When altering a Missouri Consulting Agreement - with Former Shareholder, it is essential to address how changes may affect the consulting terms agreed upon previously.

Writing a shareholder agreement involves gathering input from all shareholders to understand their needs and expectations. Draft the agreement, focusing on critical components like the business goals, each shareholder's contributions, and exit strategies. You can enhance this process by using resources from USLegalForms, especially when drafting a Missouri Consulting Agreement - with Former Shareholder.

To write a shareholder agreement, start by outlining the purpose and the key elements that need to be included, such as governance rules, share transfer conditions, and dispute resolution processes. It's also wise to consult with legal professionals to ensure that the agreement meets all legal requirements. Utilizing a platform like USLegalForms can simplify this process for creating a Missouri Consulting Agreement - with Former Shareholder.

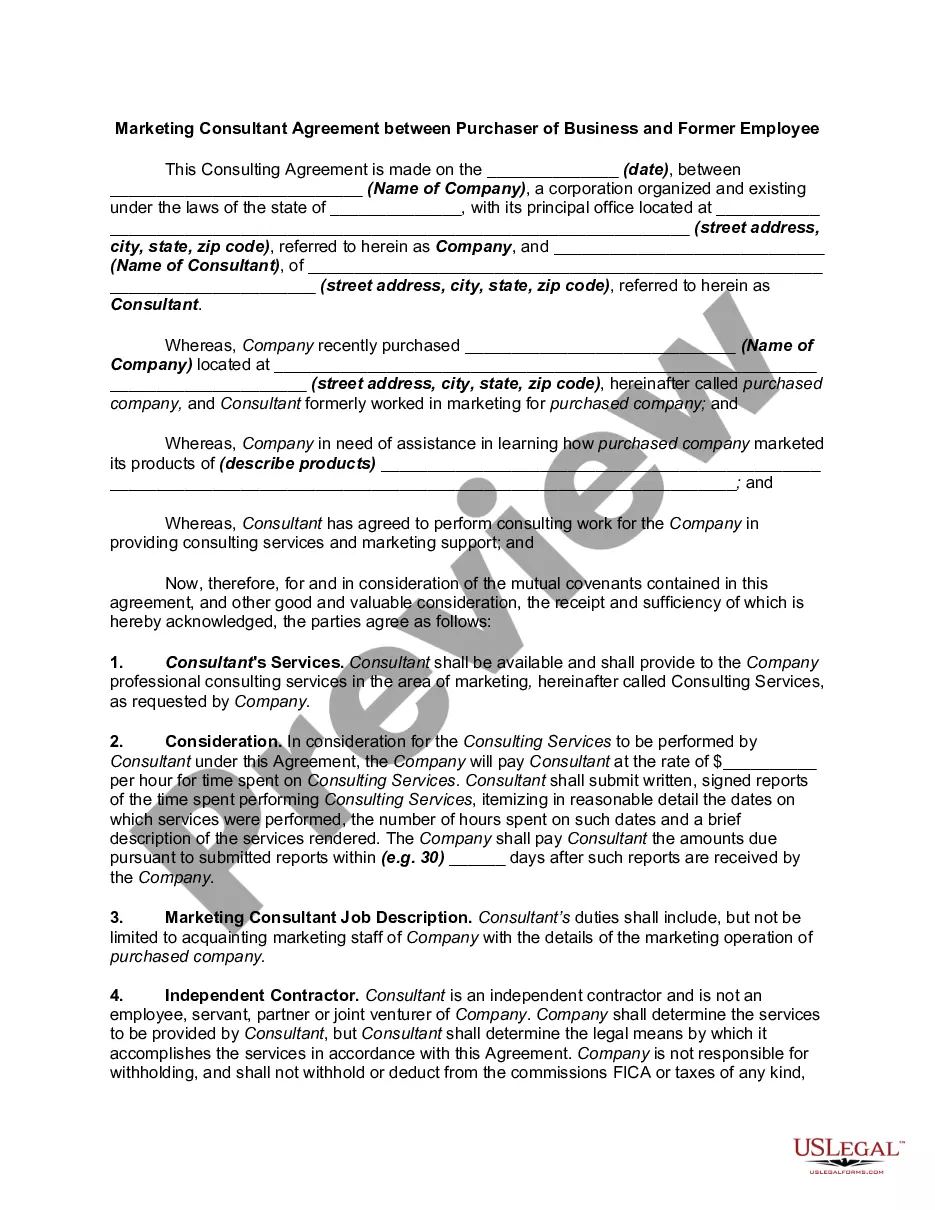

A consulting agreement specifically refers to a contract where one party provides expert services to another, focusing on advice and recommendations. In contrast, a contract is a broader term that includes various types of agreements, not limited solely to consulting. When discussing a Missouri Consulting Agreement - with Former Shareholder, the focus is on the terms under which former shareholders can provide consultancy services.

A comprehensive shareholders agreement typically includes details such as the rights and duties of each shareholder, the procedures for transferring shares, and dispute resolution mechanisms. It may also specify how profits are distributed and the management structure of the company. In the context of a Missouri Consulting Agreement - with Former Shareholder, it is crucial to detail obligations related to post-termination consulting roles.