Missouri Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

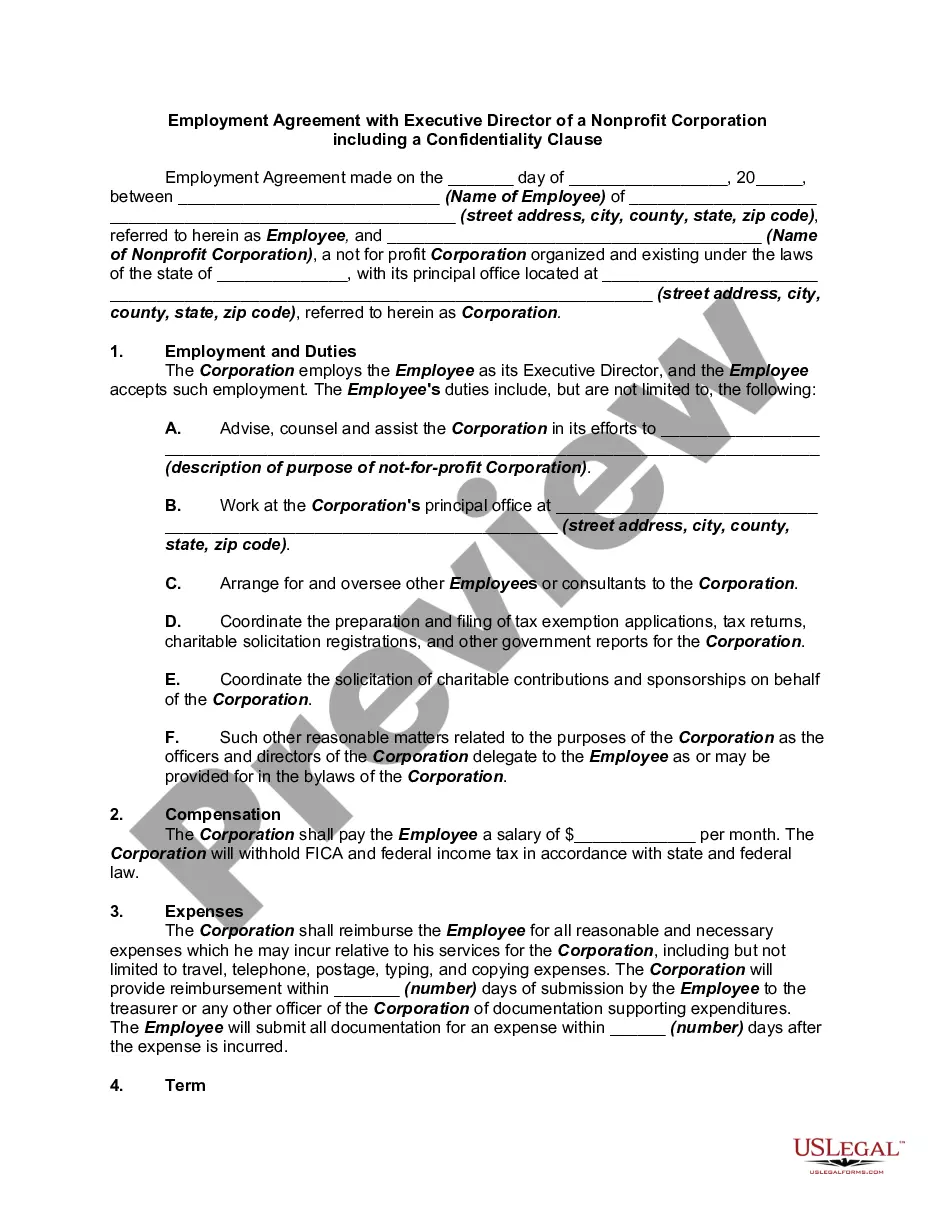

You might spend numerous hours online looking for the legal document format that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that can be evaluated by experts.

You can download or print the Missouri Deferred Compensation Agreement - Short Form from our services.

If available, take advantage of the Review option to look through the document template too.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Next, you can fill out, modify, print, or sign the Missouri Deferred Compensation Agreement - Short Form.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased template, navigate to the My documents tab and click on the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

The Internal Revenue Service (IRS) limits how much you can contribute to a 457 plan and a Roth IRA account. Both accounts come with tax advantages. The 457 plan gives you an up-front tax break, while the Roth IRA provides tax-free income during retirement.

If your employer offers a match on the 401(k), it behooves you to contribute at least up until the match. Even if you expect to retire early, paying a 10% early withdrawal penalty on a 100% free match is still a good deal. Otherwise, those with plans for an early retirement ought to favor the 457.

There are two main types of nonqualified deferred compensation plans from which small business owners may choose: supplemental executive retirement plans (SERPs) and deferred savings plans. These two options share several common characteristics, but there are also important differences between the two.

457 plans are IRS-sanctioned, tax-advantaged employee retirement plans. They are offered by state, local government, and some nonprofit employers. Participants are allowed to contribute up to 100% of their salary, provided it does not exceed the applicable dollar limit for the year.

Deferred compensation plans come in two types qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

What is a deferred compensation plan? A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

The deferred compensation plan (DCP) is a voluntary program that allows participants to set aside eligible cash in a tax deferred vehicle for retirement or other life event purposes. This DCP allows you to elect to receive certain income in a future year that would otherwise be paid to you in the upcoming year.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

The main distinguishing factor between 457 and 401(k) is how the retirement plan is offered. 457 plans are common in government entities such as state governments, as well as non-profit organizations. In contrast, 401(k)s are offered by private companies to their employees.