Missouri Demand Bond

Description

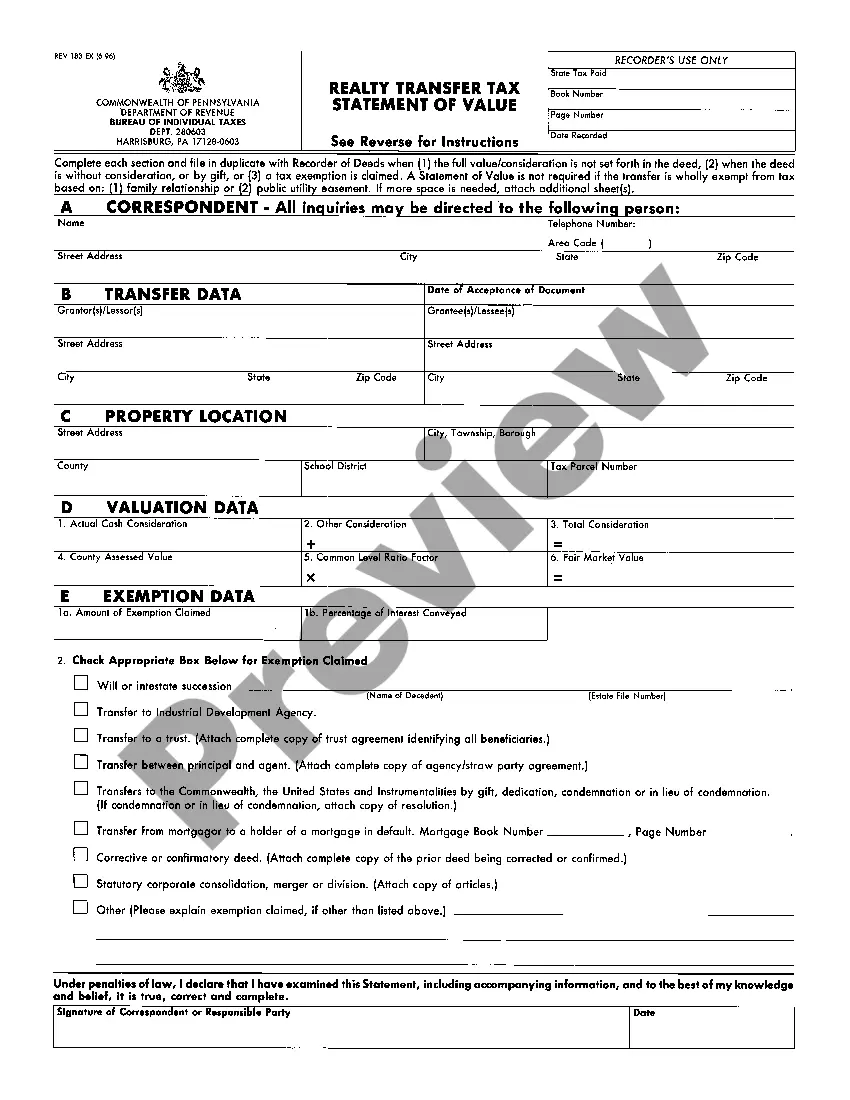

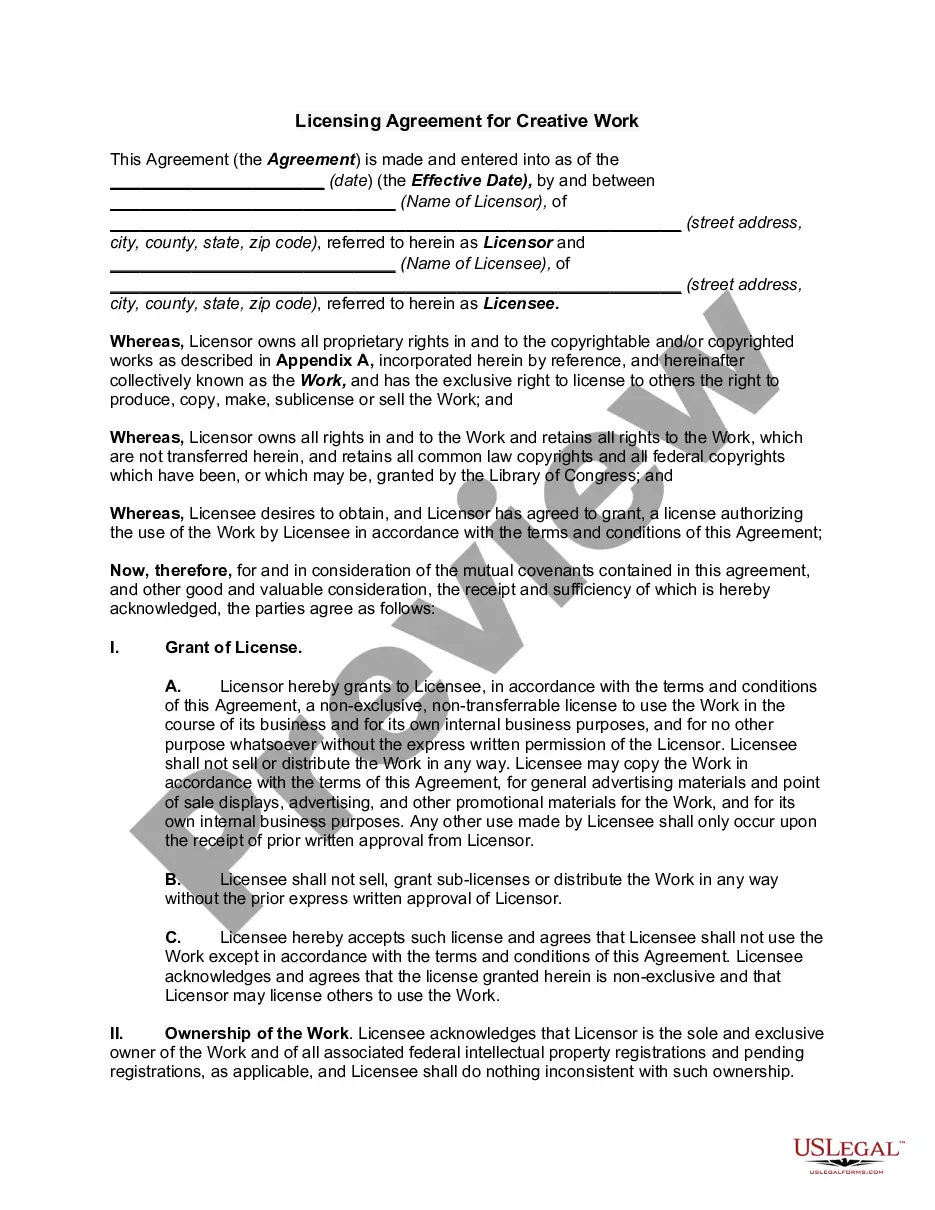

How to fill out Demand Bond?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can easily download or print the Missouri Demand Bond from our service.

If available, utilize the Preview option to review the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and criteria. Once you have found the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your information, and register for your account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Missouri Demand Bond. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, edit, print, or sign the Missouri Demand Bond.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click on the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

The difficulty of obtaining a surety bond, such as a Missouri Demand Bond, varies based on your financial history and the specifics of your project. Generally, if you meet the surety company's requirements and provide the necessary documentation, the process should be straightforward. However, if you face hurdles, seeking assistance from US Legal Forms can provide additional resources and support to help you navigate the application process.

Typically, a credit score of 650 or higher is preferred when applying for a surety bond, including a Missouri Demand Bond. A higher score can improve your chances of approval and may lead to better rates. If your credit score is below this threshold, you may still qualify, but additional information may be required. Consider consulting US Legal Forms for strategies to enhance your application.

Acquiring a bonded title in Missouri may seem daunting, but it is manageable with the right information. A Missouri Demand Bond is often required to secure a bonded title, which ensures the protection of future owners. You will need to provide proof of ownership and certain documentation to initiate the process. Using resources from US Legal Forms can simplify your experience and provide necessary guidance.

In Missouri, the duration you can be held without a bond largely depends on the circumstances surrounding your case. Generally, the court may impose a bond requirement soon after your arrest or during court proceedings. A Missouri Demand Bond can facilitate your release, ensuring compliance with legal obligations. It is advisable to consult with a legal expert to understand your specific situation.

Obtaining a surety bond, such as a Missouri Demand Bond, can vary in difficulty based on your specific situation. The process typically involves providing documentation, such as financial statements and project details, to the surety company. If you have a solid financial background and good credit, you may find the process smoother. However, if you encounter challenges, platforms like US Legal Forms can help guide you through the requirements.

A signed $10,000 surety bond is a legal agreement that guarantees payment of a specific amount if a party fails to meet its obligations. In the context of a Missouri Demand Bond, this bond serves as a financial assurance for compliance with legal requirements. This means that if you do not fulfill your duties, the bond provides a safety net for the affected parties. Using platforms like US Legal Forms can simplify the process of obtaining a signed surety bond.

A judge shall set bail in a single monetary amount, which shall be fully secured by the defendant in a method of the defendant's choosing. Finally, attorneys shall not be permitted to recover, nor courts allowed to enforce, any lien or claim on bail proceeds deposited with the court.

A surety bond is a contractual agreement between three parties: a principal, an obligee and a surety company. The obligee is the party that requires the principal to obtain a surety bond as a condition of conducting business, and the principal is the party that actually would purchase the surety bond.

Missouri notary bonds cost $50 for the state-required 4-year term and include $10,000 of errors and omissions insurance coverage.

These rates are between 1%-4% of the total amount of your bond. In other words, the cost of your Missouri surety bond will be between 1% and 4% of the amount of the bond. There are further factors that contribute to and influence the cost of your bond.